AML Crypto EU: What You Need to Know About Anti-Money Laundering Rules for Crypto in Europe

When you hear AML crypto EU, Anti-Money Laundering rules applied to cryptocurrency transactions within the European Union. Also known as crypto KYC rules, it's not just paperwork—it's the legal backbone that keeps exchanges, wallets, and DeFi platforms from becoming open doors for fraud and crime. If you're running a crypto business in Europe, or even just holding assets through a regulated exchange, these rules affect you directly. The EU didn't wait for crypto to settle down—instead, it built rules that force transparency, traceability, and accountability from day one.

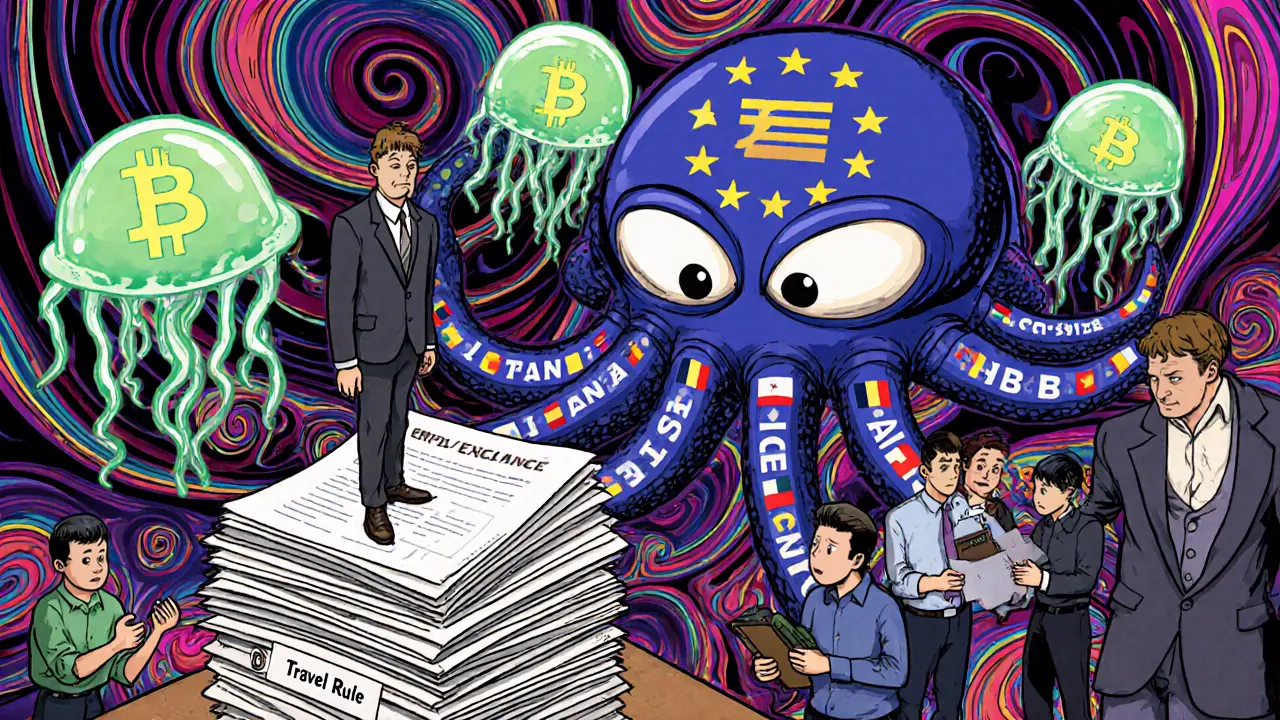

At the heart of this is MiCA regulation, the Markets in Crypto-Assets framework that standardizes crypto rules across all 27 EU member states. MiCA doesn't just say "don't launder money"—it demands that every crypto service provider verifies who their users are, monitors transactions in real time, and reports anything suspicious. It applies to everything: exchanges, stablecoins, wallet providers, even NFT marketplaces if they're trading for fiat or other crypto. And it’s not optional. Fines can hit millions, and licenses can vanish overnight. Then there’s OFAC crypto sanctions, U.S. government lists of blocked wallets and entities that no compliant business, even in Europe, can interact with. If your user’s wallet is on that list, you’re legally required to freeze it—even if they’re just a regular person who bought crypto on Binance. The U.S. doesn’t control Europe, but its sanctions ripple through every major platform because no one wants to lose access to the dollar system.

These rules aren’t just for big firms. Even small DeFi projects or independent wallet services need to know what’s expected. You can’t ignore transaction monitoring just because you’re "decentralized." The EU sees crypto as part of the financial system now—not a wild frontier. That’s why posts in this collection cover everything from how exchanges screen wallets to why some platforms are shutting down in Europe because they can’t meet the cost of compliance. You’ll find real examples: how one exchange got fined for missing a single wallet flag, how tokenized assets are being treated under MiCA, and why some crypto projects simply vanished because they refused to play by the rules.

What you’ll find here isn’t theory. It’s what’s actually happening on the ground in 2025: the tools crypto businesses use, the mistakes they make, and the legal traps that catch even smart operators. Whether you’re a trader, a developer, or just trying to understand why your exchange asked for another ID scan, this collection gives you the facts without the fluff.

AML Requirements for Crypto Businesses in the EU: What You Need to Know in 2025

EU crypto businesses must comply with strict AML rules under MiCA and AMLR. Learn the 2025 requirements, Travel Rule, licensing costs, and what’s coming in 2027.