Binance India: What’s Really Happening with Crypto Trading in India

When people talk about Binance India, the Indian arm of the world’s largest crypto exchange that stopped direct rupee trading in 2022 but still serves users through peer-to-peer and global accounts. Also known as Binance P2P India, it’s not banned—it’s just operating under heavy restrictions that make everyday trading feel like a maze. Many think Binance left India, but it didn’t. It just stopped fiat on-ramps. Millions still use it through peer-to-peer trades, offshore wallets, and third-party payment methods. The real story isn’t about Binance shutting down—it’s about how Indian regulators made it harder to use crypto without outright banning it.

Behind Binance India’s quiet shift is a broader battle over non-custodial wallet India, wallets like Ledger or MetaMask that let users control their own keys without relying on exchanges. Also known as self-custody wallets, they’re not illegal, but the government’s 30% tax on crypto gains and 1% TDS on every transaction make using them feel like a risk. If you hold crypto in a non-custodial wallet, you’re on your own to track taxes, report trades, and prove ownership—no exchange is there to help. This isn’t a ban. It’s a slow chokehold. Meanwhile, Indian crypto tax, a 30% flat tax on all crypto profits with no deductions for losses, plus 1% TDS on every trade. Also known as crypto income tax India, it’s one of the strictest in the world and forces even small traders into compliance mode. You can’t avoid it. Every trade, every swap, every P2P buy—tax authorities now track it. The system doesn’t care if you’re holding for years or day-trading. If you profit, you pay.

What’s left for Indian crypto users? Binance still works—but only if you’re willing to jump through hoops. You can buy Bitcoin via P2P using UPI, but you’ll pay higher premiums. You can withdraw to a wallet, but you’ll need to prove you paid taxes. And if you try to use a local exchange? Many are either shut down or too risky to trust. The real winners? Those who understand the rules, keep good records, and use tools that don’t rely on Indian banking channels. The next few years won’t be about whether crypto is legal in India. It’s about how smart you are at navigating a system designed to make it expensive and complicated.

Below, you’ll find deep dives into exactly how Indian crypto rules impact your wallet, what alternatives actually work in 2025, and why Binance India isn’t dead—it’s just playing a different game.

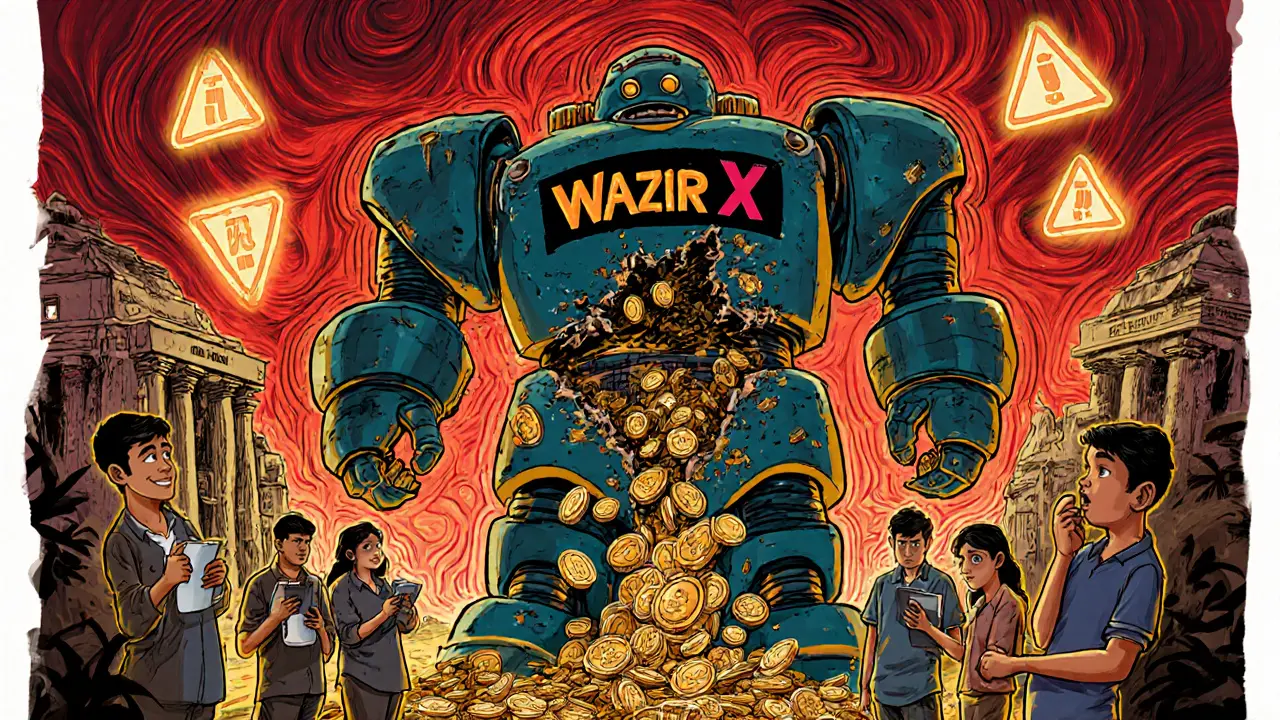

Crypto Exchanges to Avoid if You Are Indian in 2025

Avoid these crypto exchanges if you're in India-WazirX, Binance, and Bybit have faced major penalties, hacks, or banking blocks. Learn which platforms are safer and how to protect your funds under India’s evolving crypto rules.