Bitcoin ETF: What It Is, How It Works, and Why It Matters

When you hear Bitcoin ETF, an exchange-traded fund that tracks the price of Bitcoin, allowing investors to buy and sell shares on traditional stock exchanges without holding actual Bitcoin. Also known as Bitcoin spot ETF, it’s the first real bridge between Wall Street and the crypto world. Before 2024, if you wanted Bitcoin exposure, you had to use a crypto exchange, manage a wallet, and worry about security. Now, you can buy a Bitcoin ETF through your Fidelity, Charles Schwab, or Robinhood account—just like you would Apple or Tesla stock.

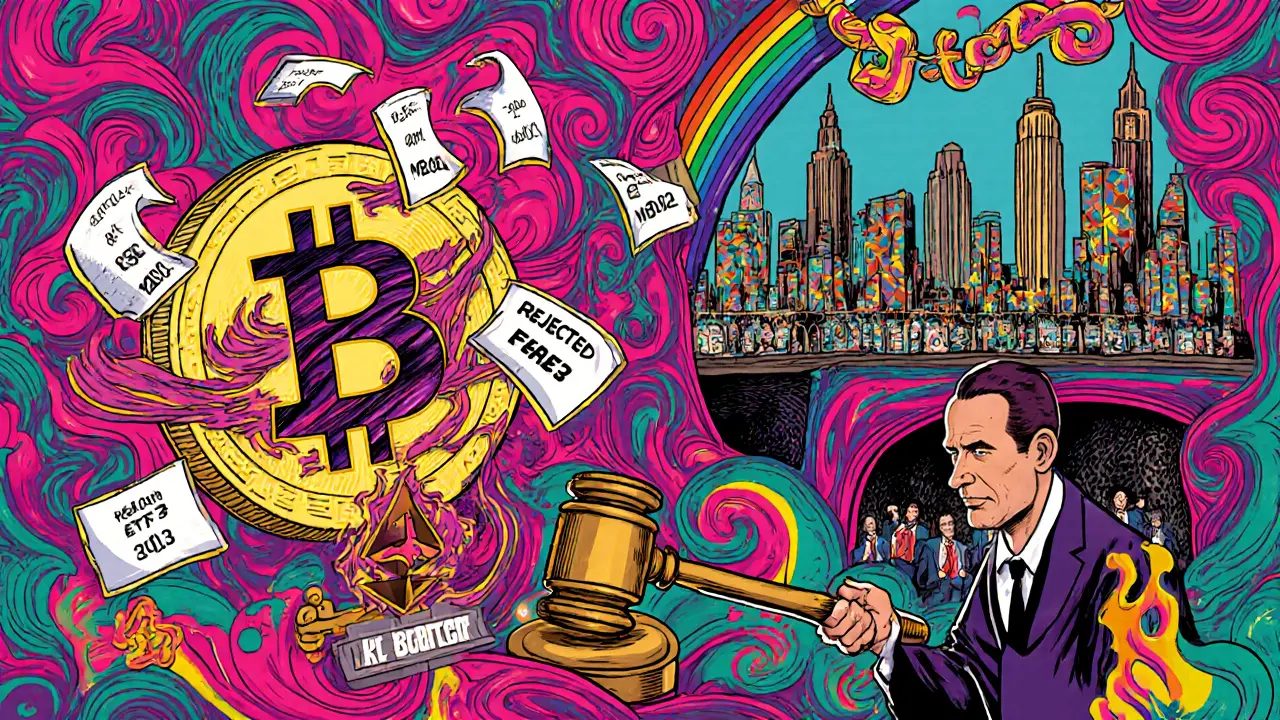

This shift didn’t happen by accident. It’s the result of years of pressure from big money—hedge funds, pension plans, and asset managers—who wanted clean, regulated access to Bitcoin. The SEC, the U.S. Securities and Exchange Commission, which regulates financial markets and approves or blocks investment products like ETFs finally gave the green light after years of rejections. Why? Because the market matured. Bitcoin’s price stability, custody solutions improved, and fraud dropped. The institutional crypto, large financial firms and corporations investing in digital assets through regulated channels didn’t just want to dabble—they wanted to allocate billions.

But here’s the catch: a Bitcoin ETF isn’t magic. It doesn’t change Bitcoin’s volatility. It doesn’t make it safer. It just makes it easier to buy. And that’s huge. Millions of people who never touched crypto before now have a simple way in. But it also means more eyes on Bitcoin—from regulators, from banks, from politicians. That’s why you’ll see posts here about Bitcoin ETF approval delays, how it affects other crypto assets, and why some countries are rushing to launch their own versions.

What you’ll find in this collection isn’t hype. It’s real analysis. Posts cover how ETFs influence Bitcoin’s price, why regulators are nervous about custody, how global markets are responding, and what happens when a major fund like BlackRock launches a Bitcoin ETF. You’ll also see how this ties into broader trends—like tokenized Treasuries, crypto regulation in the EU, and how countries like Qatar ban crypto but allow tokenized assets. This isn’t just about one product. It’s about how finance is changing, one ETF at a time.

Bitcoin and Ethereum ETF Approvals in the US: What Changed and What It Means for Investors

Bitcoin and Ethereum ETFs are now a reality in the U.S., transforming how investors access crypto. With SEC approvals in 2024 and in-kind trading added in 2025, these products offer regulated, tax-efficient exposure to digital assets. Here's what you need to know about fees, performance, and what's next.