Bybit India: What You Need to Know About Crypto Trading in India

When you use Bybit India, a global crypto exchange widely used by Indian traders despite local regulatory gray areas. Also known as Bybit platform in India, it offers spot trading, derivatives, and staking—but its availability here isn’t about legality, it’s about accessibility. India doesn’t ban crypto, but it makes it expensive and confusing to use. The government taxes every trade at 30%, plus 1% TDS on every transaction, and treats crypto like gambling, not an asset class. That’s why many Indian traders turn to platforms like Bybit: they’re not blocked, they just operate outside the formal banking system.

Bybit India isn’t a separate entity—it’s just Indian users accessing the global Bybit platform. That means no Indian regulatory license, no local customer support in Hindi or Tamil, and no direct INR deposits. You need to use P2P or third-party gateways to fund your account, which adds risk. And while Bybit doesn’t verify your location, Indian authorities can still track your wallet activity through banks and tax filings. The real question isn’t whether you can trade on Bybit—it’s whether you’re prepared for the tax fallout, the lack of legal recourse, and the constant threat of sudden policy shifts.

Related entities like non-custodial wallet India, wallets like Ledger or Trust Wallet where users hold their own keys without exchange control are critical here. If you’re using Bybit, you’re trusting someone else with your crypto. But if you withdraw to a non-custodial wallet, you’re entering a different legal gray zone—India’s 2025 rules don’t ban these wallets, but they make them hard to use. You’ll pay heavy taxes on every transfer, and banks may freeze accounts linked to crypto activity. Then there’s crypto tax India, the 30% flat tax on gains plus 1% TDS that applies whether you trade on Bybit, CoinSwitch, or a P2P app. It’s not progressive, it’s not fair, and it’s not optional.

What you’ll find in the posts below isn’t a list of how to bypass rules—it’s a clear-eyed look at what’s really happening. From why Bybit remains popular despite the risks, to how Indian traders are using decentralized tools to stay in control, to the real cost of trading under today’s tax regime. You’ll see why some exchanges are dying, why others are thriving, and how the next big move in Indian crypto might not come from regulators—but from users who refuse to play by broken rules.

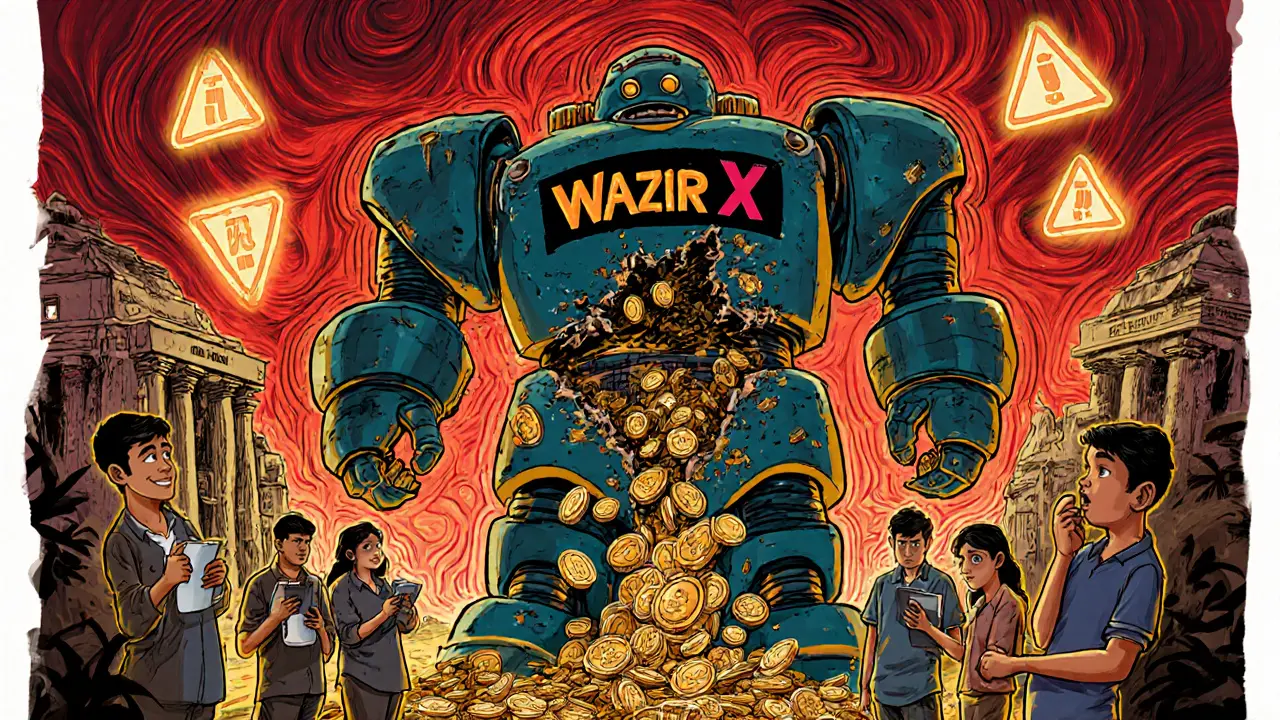

Crypto Exchanges to Avoid if You Are Indian in 2025

Avoid these crypto exchanges if you're in India-WazirX, Binance, and Bybit have faced major penalties, hacks, or banking blocks. Learn which platforms are safer and how to protect your funds under India’s evolving crypto rules.