Crypto AML Regulations: What You Must Know to Stay Compliant in 2025

When it comes to crypto AML regulations, rules designed to stop money laundering and illicit finance using digital assets. Also known as anti-money laundering rules for cryptocurrency, these regulations now shape everything from wallet usage to exchange access. If you’re trading, staking, or holding crypto, ignoring these rules isn’t an option—it’s a legal risk.

These rules don’t just target big exchanges. They reach into your wallet. The OFAC sanctions, U.S. government lists of blocked individuals and crypto addresses tied to crime are actively scanning blockchain activity. If you interact with a wallet on that list—even by accident—you could freeze your funds or trigger a regulatory review. That’s why tools like blockchain analytics and wallet screening aren’t just for companies anymore; they’re becoming essential for anyone serious about staying safe.

And it’s not just the U.S. Countries like Qatar ban crypto outright but allow tokenized real estate. Mexico’s FinTech Law forces exchanges to report transactions but leaves individuals in a gray zone. India’s rules make non-custodial wallets hard to use with heavy taxes and unclear reporting. The crypto compliance, the process of following legal requirements to avoid fines or shutdowns you see in exchanges like Saros Finance or DeGate? That’s the result of these regulations forcing platforms to build KYC, transaction monitoring, and sanctions screening into their core systems.

Real-world asset tokenization—like BlackRock’s BUIDL or tokenized gold—is now under the same AML microscope. If you’re investing in tokenized property or bonds, regulators treat it like traditional finance. That means your identity, source of funds, and transaction history are being tracked. Even meme coins like JANRO or EKTA aren’t exempt—low liquidity and no team don’t make you invisible to regulators.

Scams from Myanmar networks, fake airdrops like HyperGraph HGT, and dead tokens like ELCASH all feed into why these rules exist. Governments aren’t trying to kill crypto—they’re trying to cut off the criminal flow. And if you’re using an exchange like WazirX or Koinde with no clear compliance history, you’re already on the radar.

You don’t need to be a lawyer to navigate this. But you do need to know: which countries ban what, which wallets are flagged, and which platforms actually follow the rules. Below, you’ll find clear breakdowns of crypto bans, real-world asset rules, OFAC compliance steps, and exchanges that are safe—or not—to use in 2025. No fluff. Just what you need to protect your assets and stay out of trouble.

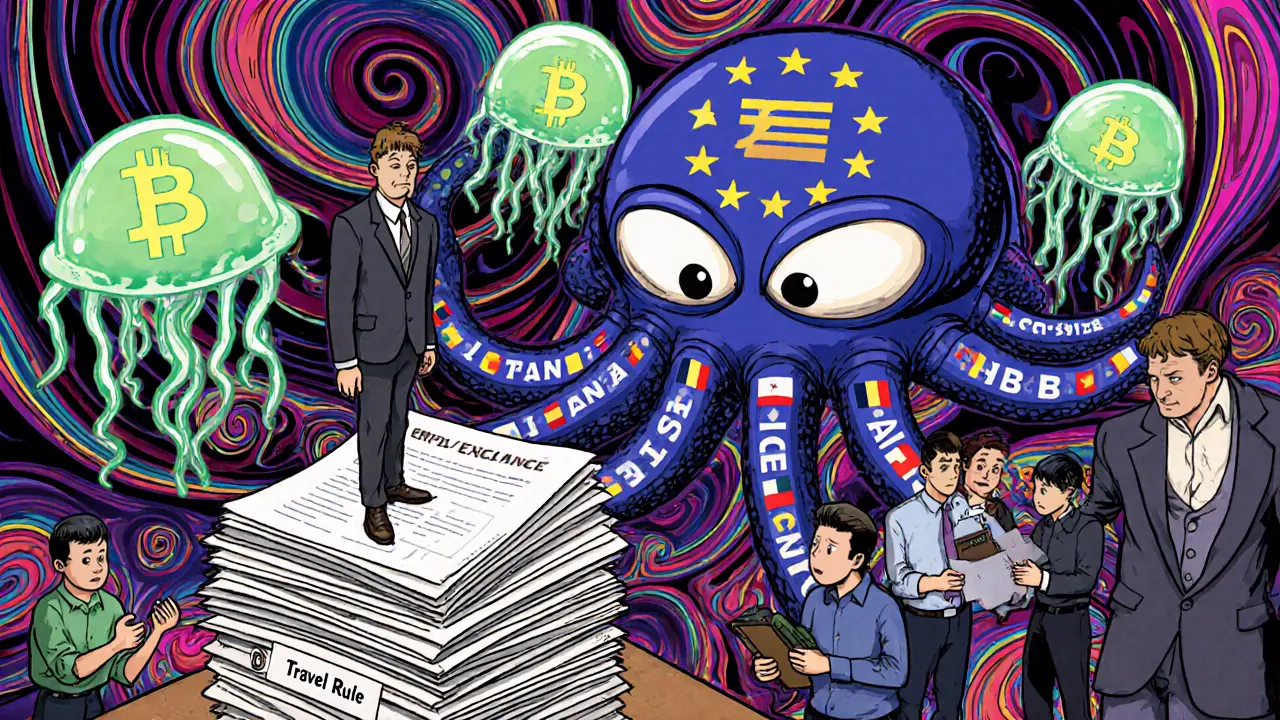

AML Requirements for Crypto Businesses in the EU: What You Need to Know in 2025

EU crypto businesses must comply with strict AML rules under MiCA and AMLR. Learn the 2025 requirements, Travel Rule, licensing costs, and what’s coming in 2027.