Crypto Business Compliance: Rules, Risks, and Real-World Requirements in 2025

When you run a crypto business, crypto business compliance, the set of legal and operational rules that crypto companies must follow to operate legally. Also known as crypto regulatory adherence, it's not about paperwork—it's about staying open for business. If you’re handling crypto transactions, running an exchange, or even offering airdrops, you’re already in the crosshairs of global regulators. No one’s asking if you’re ‘nice’ or ‘innovative.’ They’re asking: Did you screen wallets? Did you report suspicious activity? Did you know your users are on the OFAC list?

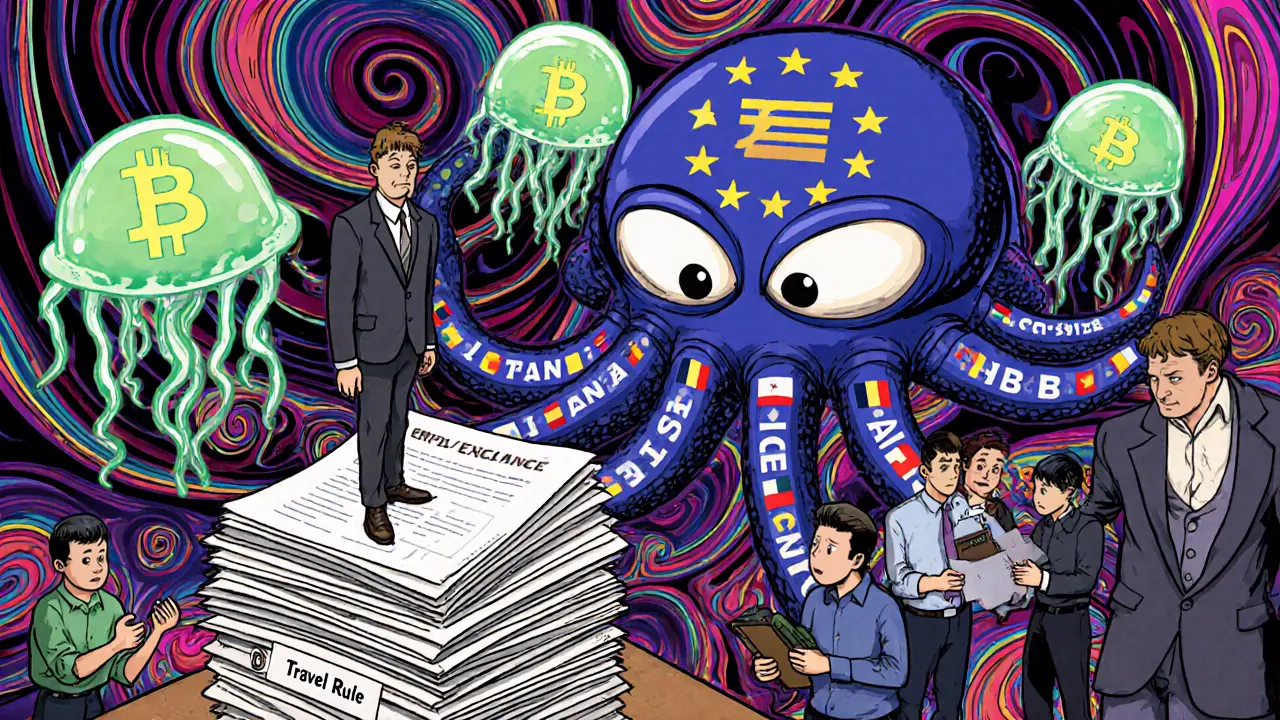

OFAC cryptocurrency sanctions, U.S. government restrictions that block transactions with specific crypto wallets and entities aren’t theoretical. In 2024, over $10 billion in fraud from Myanmar-based operations triggered new OFAC actions. If your platform lets someone with a sanctioned wallet send you BTC, you’re liable—even if you didn’t know their name. Tools like Chainalysis or TRM Labs aren’t luxury software; they’re survival gear. And it’s not just the U.S. MiCA regulation, the European Union’s comprehensive crypto market framework that came into force in 2024 now requires all crypto firms operating in Europe to register, disclose tokenomics, and enforce KYC. Miss one requirement? Your business gets blocked across 27 countries.

Compliance isn’t just about avoiding fines. It’s about trust. If you’re in India, you can’t ignore the FIU’s strict reporting rules—even if you think you’re just a small DEX. If you’re in Qatar, you can’t offer Bitcoin trading, but you can tokenize real estate—so long as you follow the 2024 digital asset guidelines. Mexico’s FinTech Law doesn’t ban users, but it forces exchanges to prove their identity verification systems work. And if you’re running a tokenized asset platform like those tied to BlackRock’s BUIDL or RWA tokenization, you’re under even tighter scrutiny because institutional money is watching.

You don’t need a legal team to start, but you do need to know where the lines are. The posts below show you exactly how compliance plays out in real cases: which exchanges got shut down, which airdrops were scams hiding from regulators, which wallets got frozen, and how businesses are adapting—sometimes successfully, sometimes not. There’s no sugarcoating here. Some projects died because they ignored compliance. Others survived because they built it in from day one. What you’re about to read isn’t theory. It’s what actually happened.

AML Requirements for Crypto Businesses in the EU: What You Need to Know in 2025

EU crypto businesses must comply with strict AML rules under MiCA and AMLR. Learn the 2025 requirements, Travel Rule, licensing costs, and what’s coming in 2027.