Ethereum ETF: What It Is, Why It Matters, and What’s Really Happening

When you hear Ethereum ETF, an exchange-traded fund that tracks the price of Ethereum without requiring you to hold the actual cryptocurrency. Also known as a spot Ethereum ETF, it lets you buy and sell Ethereum exposure through a traditional brokerage account, just like stocks. This isn’t just another crypto buzzword—it’s a major shift in how regular people can get into Ethereum without dealing with wallets, seed phrases, or exchange hacks.

Before Ethereum ETFs, you had to pick a crypto exchange, verify your identity, deposit funds, and then buy ETH directly. Now, if your broker offers it, you can click a button and own Ethereum through a fund that’s regulated by the SEC. That’s a big deal. It means institutions are starting to take Ethereum seriously—not just as a speculative asset, but as something that belongs in retirement portfolios and mutual funds. The same thing happened with Bitcoin ETFs in early 2024, and Ethereum is following right behind. But Ethereum isn’t Bitcoin. It’s the backbone of DeFi, NFTs, and smart contracts. An Ethereum ETF doesn’t just track price—it’s a vote of confidence in the entire ecosystem that runs on it.

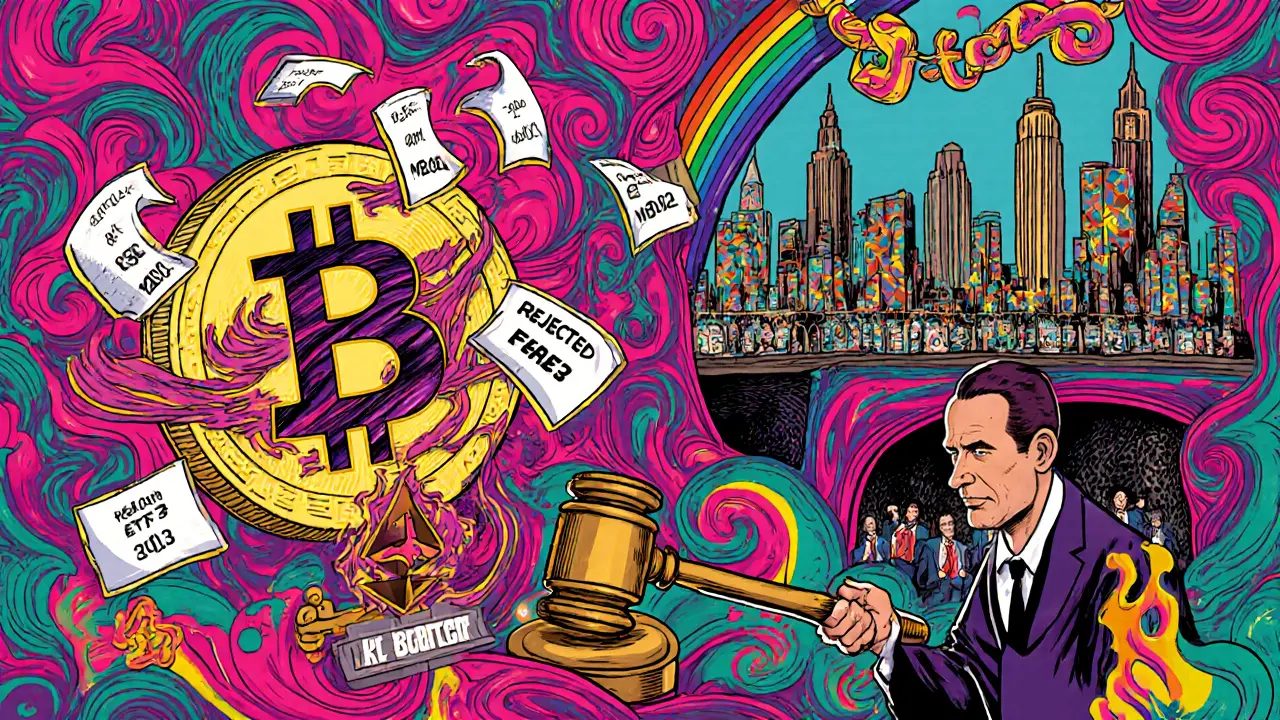

That’s why regulators are moving slowly. The SEC has approved Bitcoin spot ETFs but hasn’t greenlit Ethereum ones yet. Why? Because Ethereum’s structure is more complex. Is it a security? A commodity? A platform? The answer isn’t clear-cut. Some experts argue that since Ethereum transitioned to proof-of-stake, it’s no longer mined like Bitcoin, making it more like a service than a currency. Others say its native token still functions as a utility. The confusion is real, and it’s holding back approval. But with BlackRock, Fidelity, and Grayscale all filing applications, the pressure is building. If one gets approved, others will follow fast.

Meanwhile, investors are already finding workarounds. Some use Ethereum futures ETFs, which track contracts—not the actual coin. Others buy tokenized Ethereum on regulated platforms like Coinbase or Bitstamp. But neither of those is the same as a true spot Ethereum ETF. The real thing gives you direct exposure, lower fees, and full transparency. It’s the kind of product that could bring millions of new users into crypto—not the tech-savvy crowd, but your parents, your coworkers, your accountant.

What you’ll find in the posts below isn’t hype. It’s hard facts. You’ll see how crypto regulation shapes what’s allowed in places like the EU and Qatar. You’ll learn why some tokens are dead on arrival, while others like RWA tokenization are exploding. You’ll get real reviews of exchanges, warnings about scams, and breakdowns of on-chain data that actually matter. This isn’t a list of random crypto news. It’s a collection of pieces that help you understand the bigger picture—where Ethereum fits, what’s changing, and what you need to watch next.

Bitcoin and Ethereum ETF Approvals in the US: What Changed and What It Means for Investors

Bitcoin and Ethereum ETFs are now a reality in the U.S., transforming how investors access crypto. With SEC approvals in 2024 and in-kind trading added in 2025, these products offer regulated, tax-efficient exposure to digital assets. Here's what you need to know about fees, performance, and what's next.