FIU Compliance: What Crypto Businesses Must Do to Stay Legal

When you run a crypto business, FIU compliance, the requirement to report suspicious activity to a Financial Intelligence Unit. It's not a suggestion—it's the law in over 170 countries. If you're handling crypto transactions, especially with users in the EU, US, or UK, you're already under its scope. Ignoring it doesn't make it go away. It just makes you a target for fines, license revocation, or worse.

AML, anti-money laundering rules and OFAC sanctions, U.S. government lists of blocked individuals and entities are the two big engines behind FIU compliance. You can’t have one without the other. If your platform lets someone transfer crypto to a wallet on the OFAC SDN list, you’ve just violated FIU reporting rules—even if you didn’t know it was blocked. That’s why tools like blockchain analytics and wallet screening aren’t nice-to-haves. They’re your first line of defense.

It’s not just about big exchanges. Even small DeFi platforms, crypto ATMs, and wallet providers are being targeted. The EU’s AMLR and MiCA rules now require all crypto service providers to register with national FIUs. In the U.S., FinCEN treats crypto businesses as money transmitters, meaning you must file SARs (Suspicious Activity Reports) just like banks. Miss a report? You could be looking at $100,000+ in penalties. And it’s not just fines—your team could face criminal charges.

What you’ll find in these posts isn’t theory. It’s real-world breakdowns of how companies got caught, what regulators actually look for, and how to build compliance that actually works. You’ll see how Qatar bans crypto but allows tokenized assets, how Mexico’s FinTech Law forces exchanges to verify users, and why a fake airdrop can trigger an OFAC investigation. These aren’t hypotheticals. They’re cases that happened—and they’re happening right now.

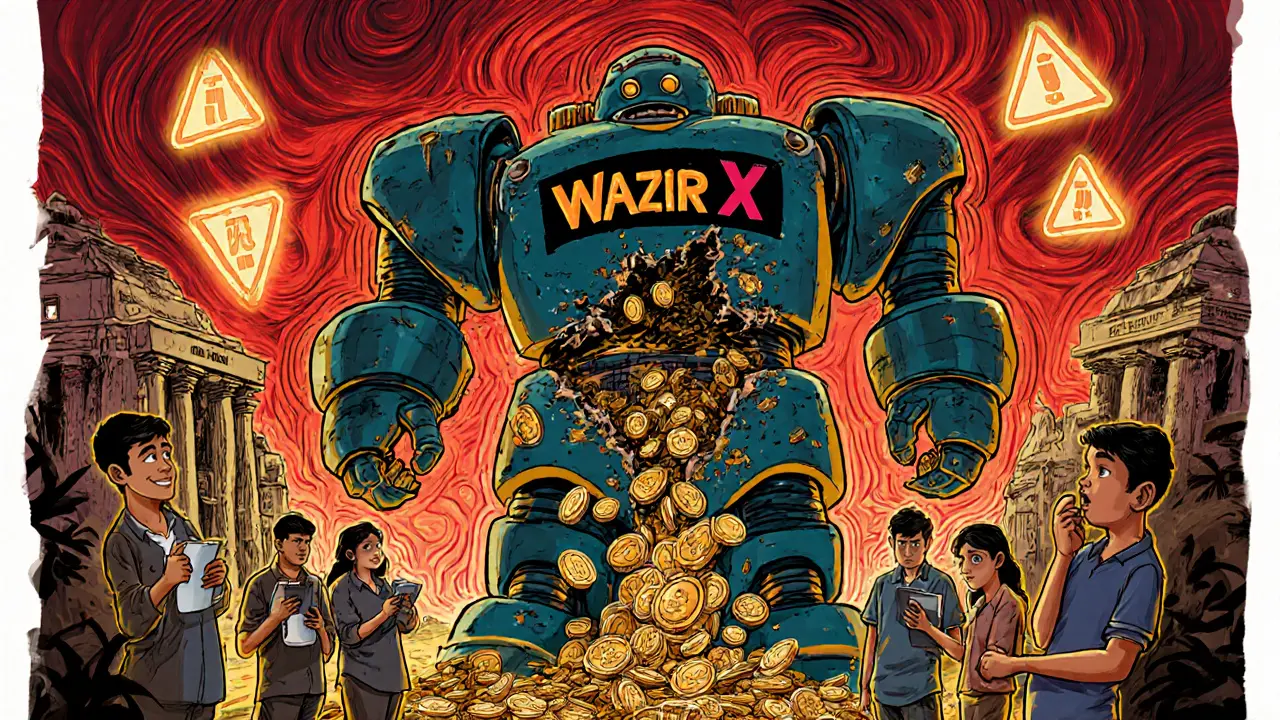

Crypto Exchanges to Avoid if You Are Indian in 2025

Avoid these crypto exchanges if you're in India-WazirX, Binance, and Bybit have faced major penalties, hacks, or banking blocks. Learn which platforms are safer and how to protect your funds under India’s evolving crypto rules.