MiCA Compliance: What It Means for Crypto Businesses and Users in 2025

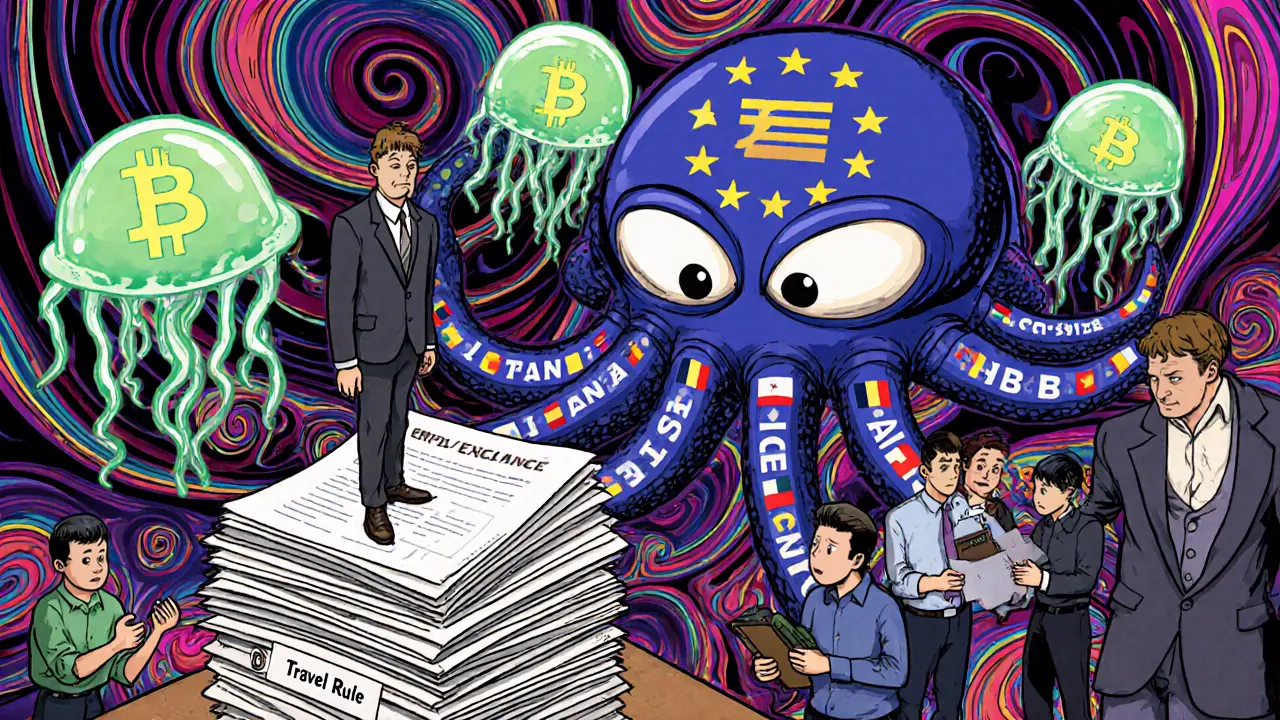

When you hear MiCA compliance, the Markets in Crypto-Assets Regulation that standardizes crypto rules across the European Union. Also known as EU crypto regulation, it forces exchanges, wallet providers, and token issuers to prove they’re secure, transparent, and accountable. This isn’t just paperwork—it’s a full overhaul of how crypto companies operate in Europe. If you’re trading, staking, or issuing tokens in the EU, MiCA compliance isn’t optional. It’s the new baseline.

Think of MiCA compliance, the Markets in Crypto-Assets Regulation that standardizes crypto rules across the European Union. Also known as EU crypto regulation, it forces exchanges, wallet providers, and token issuers to prove they’re secure, transparent, and accountable as the foundation. Above it, you’ve got other rules like OFAC cryptocurrency sanctions, U.S. government rules that block transactions with sanctioned wallets and entities and real-world asset tokenization, the process of turning property, bonds, or gold into blockchain-based tokens. MiCA doesn’t replace these—it layers on top. A crypto exchange in Germany must follow MiCA’s disclosure rules, screen wallets for OFAC hits, and if it offers tokenized real estate, it needs extra licensing. These aren’t separate systems. They’re tangled together.

And it’s not just big firms. If you’re running a small DeFi project or launching a new token, MiCA’s rules on whitepapers, reserve audits, and investor protections apply to you too. You can’t just say "it’s decentralized" and walk away. The EU wants names, addresses, and proof. That’s why you’re seeing projects move out of Europe—or shut down. Meanwhile, countries like Qatar and India are tightening their own rules, making MiCA one of the few clear frameworks left in a messy global landscape.

What you’ll find below are real examples of how MiCA compliance shows up in practice: in crypto bans, in exchange reviews, in token failures, and in the quiet shift from unregulated airdrops to licensed offerings. Some posts show companies struggling to keep up. Others reveal how compliance gaps lead to scams. None of them are theoretical. They’re all happening right now, in 2025, and they’re shaping where you can safely trade, invest, or build.

AML Requirements for Crypto Businesses in the EU: What You Need to Know in 2025

EU crypto businesses must comply with strict AML rules under MiCA and AMLR. Learn the 2025 requirements, Travel Rule, licensing costs, and what’s coming in 2027.