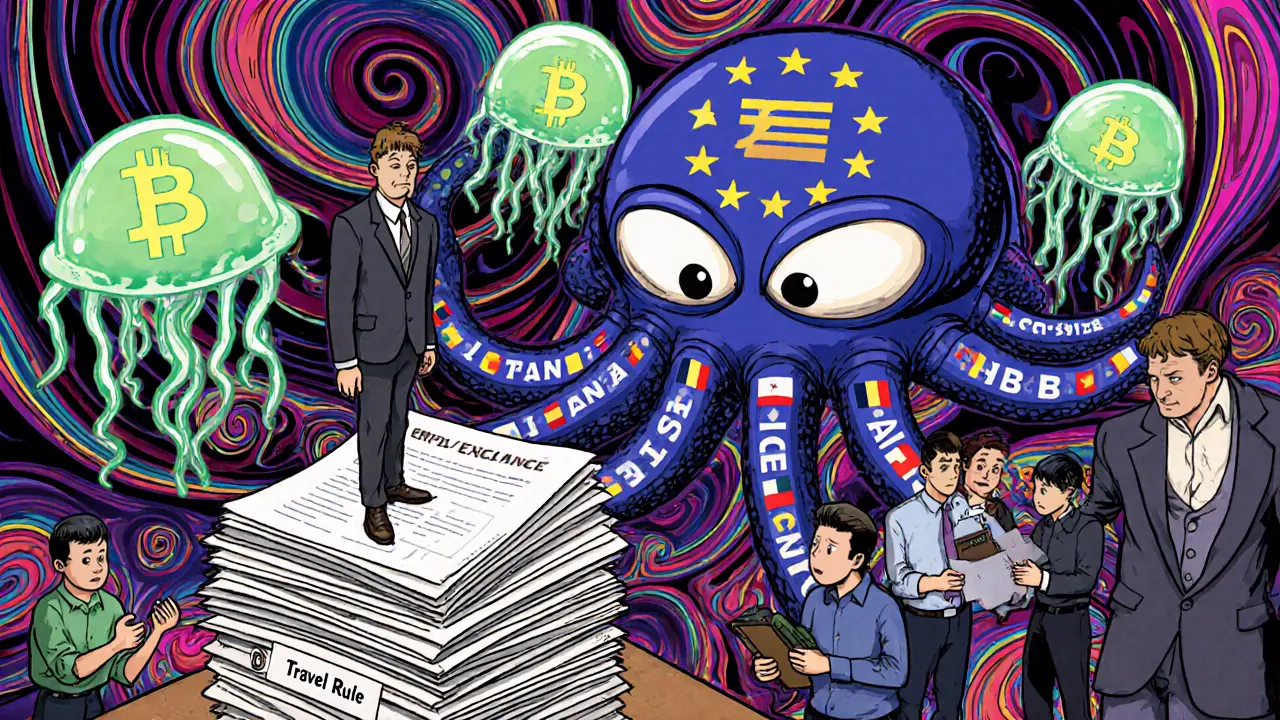

Travel Rule EU: What It Means for Crypto Users and Exchanges in 2025

When you send crypto across borders in the European Union, the Travel Rule EU, a regulatory requirement that forces crypto service providers to share sender and receiver details on transactions over €1,000. Also known as FATF Recommendation 16, it’s no longer optional—it’s enforced under the MiCA regulation, the EU’s comprehensive framework for crypto assets that came fully into effect in 2024. This isn’t about tracking your personal wallet transfers—it’s about making sure exchanges, custodians, and other VASPs, Virtual Asset Service Providers like Binance, Kraken, or any regulated EU-based platform. collect and pass on identifying data for every transfer above €1,000.

Think of it like banking: when you wire euros, the bank sends your name, account, and address to the recipient’s bank. The Travel Rule EU does the same for crypto. If you’re using a non-custodial wallet and send €1,500 to an exchange, that exchange must verify your identity before accepting the funds. If you’re trading on a regulated EU platform, you’ve already given them your ID—they now have to share that info with the other side. This blocks anonymous transfers at scale and pushes scams, money laundering, and ransomware payments into the open. It’s not perfect—some users bypass it with mixers or peer-to-peer trades—but for anyone using a licensed exchange, compliance is non-negotiable. The rule also links directly to crypto AML, anti-money laundering systems that require transaction monitoring and reporting. Without it, MiCA’s goal of bringing crypto into the mainstream financial system wouldn’t hold up.

What does this mean for you? If you’re a regular user, you might notice extra verification steps when sending crypto to an exchange or another user. If you run a business, you need software that automatically captures and transmits names, wallet addresses, and IDs for every qualifying transaction. There’s no gray area: non-compliant platforms risk losing their license in the EU. The rule doesn’t ban crypto—it just makes it harder to hide. And that’s the point. The posts below show how this rule connects to real-world cases: how it affects exchanges, how it clashes with privacy-focused coins, and how it’s being rolled out across different EU countries. You’ll find deep dives on enforcement, compliance tools, and what happens when a platform gets it wrong. This isn’t theory—it’s the new operating system for crypto in Europe.

AML Requirements for Crypto Businesses in the EU: What You Need to Know in 2025

EU crypto businesses must comply with strict AML rules under MiCA and AMLR. Learn the 2025 requirements, Travel Rule, licensing costs, and what’s coming in 2027.