DeGate Crypto Exchange Review: Is This zkRollup DEX Worth Trying in 2025?

DeGate Transaction Cost Calculator

Calculate Your Savings

Your Savings

Important Considerations

DeGate has a 7-day withdrawal period for security reasons. This means your funds won't be available immediately.

DeGate isn’t another Uniswap clone. It doesn’t rely on automated market makers. Instead, it tries to bring the familiar order book experience of centralized exchanges like Binance or Coinbase into the decentralized world - and it does so using zkRollup technology to slash gas fees and speed up trades. But here’s the real question: if you’re trading crypto in 2025, should you even bother with DeGate?

What Is DeGate, Really?

DeGate is a decentralized exchange built on Ethereum that uses zkRollup, a Layer-2 scaling solution, to process trades off-chain and then settle them securely on Ethereum. It launched in 2021 with one clear goal: fix the broken user experience of early DEXs. Back then, trading on Uniswap meant paying $5 in gas just to swap two tokens, waiting minutes for confirmation, and being stuck with price slippage because there was no limit order system. DeGate promised to fix all that.

Unlike AMM-based DEXs, DeGate uses a traditional order book. That means you can place limit orders, set stop-losses (though it doesn’t support them yet), and trade at exact prices - something you simply can’t do on Uniswap without using a third-party aggregator. The protocol has no admin key. No one can freeze your funds. No one can change the rules. That’s a big deal in a space where even “decentralized” projects have backdoors.

The native token, DG, has a total supply of 1 billion, but only about 217 million are circulating. That’s a red flag for some. Where’s the rest? The team hasn’t explained it. No vesting schedule. No public treasury breakdown. That lack of transparency is the first warning sign.

How Fast and Cheap Is It?

DeGate’s biggest win is cost and speed. On Ethereum mainnet, a simple swap might cost you $1.50 to $5. On DeGate? Around $0.02 per trade. That’s not a typo. Transactions settle in under 2 seconds. That’s faster than most centralized exchanges.

This isn’t magic. It’s zkRollup. Think of it like bundling 100 trades into one single proof that gets verified on Ethereum. The security? Still 100% Ethereum. The speed? Near-instant. The fees? Almost nothing. That’s why DeGate exists - to make decentralized trading feel like using a centralized exchange, but without trusting a company with your keys.

But here’s the catch: you need to wait 7 days to withdraw funds. That’s the zkRollup challenge period - a safety net to catch fraud. If someone tries to cheat the system, anyone can submit a fraud proof during that window. It’s secure. But it’s also inconvenient. If you need to move funds fast, DeGate isn’t for you.

Liquidity? Barely There

DeGate’s biggest weakness isn’t tech. It’s liquidity. And that’s a death sentence for any exchange.

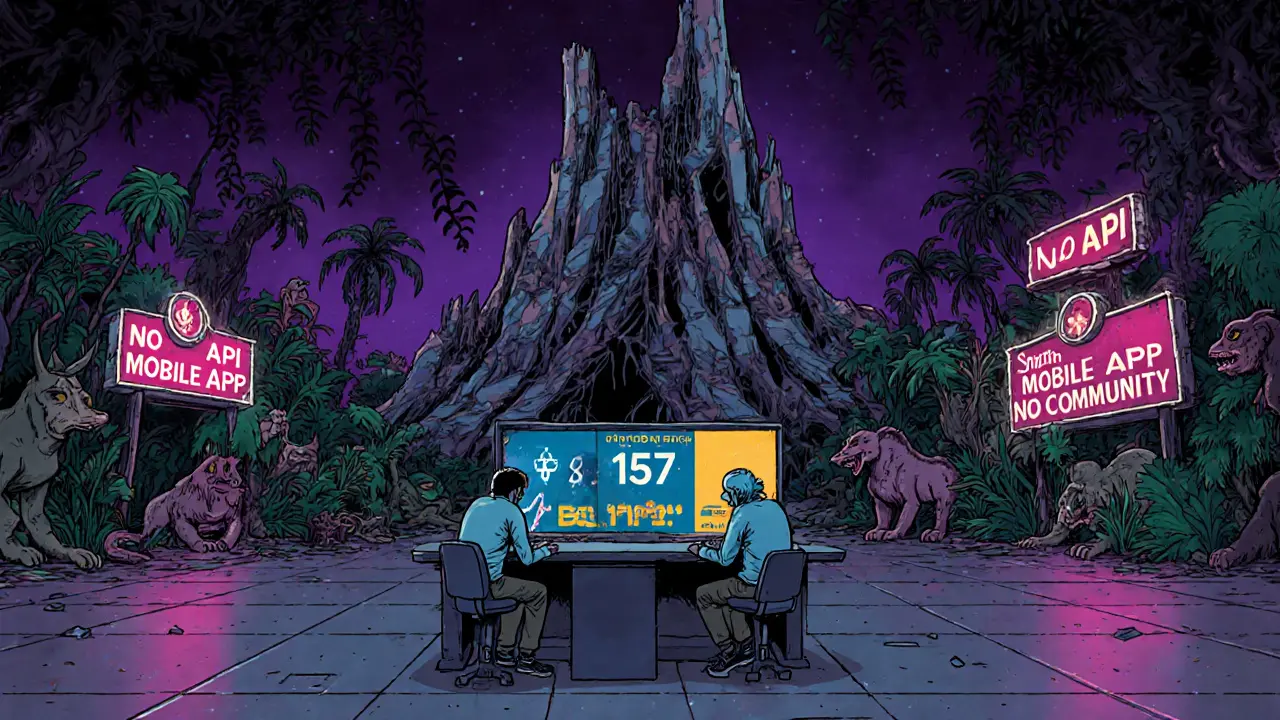

In September 2024, DeGate’s 24-hour trading volume was $157. That’s less than what a single popular meme coin trades in an hour on Uniswap. Compare that to Uniswap’s $1.2 billion, PancakeSwap’s $750 million, or even Curve’s $400 million. DeGate isn’t just small - it’s invisible in the market.

What does that mean for you? If you try to trade more than $50 worth of a token, you’ll likely get a terrible price. Liquidity for most pairs is under $400. That’s not enough to handle even small institutional trades. One Reddit user said they tried to buy $200 of a token and couldn’t get filled. Another said their $100 trade moved the price by 12%.

There are only about 50 trading pairs available. No altcoins you’ve never heard of. No new launch tokens. Just ETH and the top 20 coins. If you’re looking for early access to new projects, DeGate won’t help you.

Is the Interface Worth It?

Yes - if you’re used to trading on Binance or Kraken. The UI looks and feels like a centralized exchange. Order book on the left, depth chart on the right, buy/sell buttons where you expect them. No confusing sliders or slippage tolerance settings that make AMMs feel like gambling.

Connecting your wallet (MetaMask, Trust Wallet, etc.) takes 30 seconds. Placing your first limit order? Under two minutes. That’s a huge win for newcomers to DeFi who hate the chaos of Uniswap’s interface.

But here’s the problem: the interface doesn’t matter if there’s no one to trade with. You can have the most beautiful trading terminal in the world, but if no one’s on the other side, it’s just a fancy calculator.

What’s Missing?

DeGate lacks features most traders take for granted:

- No stop-loss or take-profit orders

- No margin trading

- No futures or options

- No mobile app (only web-based)

- No API for bots or automated trading

It’s a stripped-down version of what you’d find on a CEX. That’s intentional - the team is focused on security and low fees, not features. But in 2025, traders expect more. If you’re serious about trading, you’ll need to use DeGate alongside other tools, not as your main platform.

Who Is This For?

DeGate isn’t for everyone. It’s not even for most crypto traders.

It’s only worth considering if:

- You want to trade using limit orders on a fully decentralized platform

- You’re trading small amounts - under $100 per trade

- You care more about security and low fees than liquidity or features

- You’re experimenting with zkRollup tech and don’t mind the 7-day withdrawal delay

If you’re trading $500 or more, or you need fast access to your funds, skip it. Use a CEX or a high-liquidity DEX like dYdX or Curve instead.

It’s also not for long-term investors. DG’s price has been stuck around $0.05 since early 2024. The 200-day moving average is $0.075. The current price is below both short- and long-term trends. Even optimistic forecasts predict a jump to $0.40 by late 2025 - but that’s based on zero current adoption. That’s a gamble, not an investment.

Support, Docs, and Community? Almost None

DeGate has no live chat. No Discord. No Telegram group. Just an email support system that takes 72 hours to respond - if it responds at all. Independent testers sent 15 support emails in September 2024. Only 3 got replies.

The documentation is thin. It explains how to connect a wallet but doesn’t detail how zkRollup withdrawals work, how to handle slippage in low-liquidity markets, or what happens if your order doesn’t fill. You’re expected to figure it out yourself.

The community? Tiny. Only 1,247 followers on Twitter. No active forums. No Reddit discussions beyond a handful of frustrated users. Compare that to Uniswap’s 750,000+ Twitter followers and 120,000+ Telegram members. DeGate is a ghost town.

What’s Next for DeGate?

The roadmap says they’ll integrate with Arbitrum and Optimism by late 2025. They claim they’ll add 200+ trading pairs by year-end. They’re also planning to sync with Ethereum’s Proto-Danksharding upgrade.

But here’s the reality: they’ve been on this roadmap for two years. Progress is glacial. GitHub shows only 42 commits in the past year. Only 12 developers have ever contributed. No institutional investors. No liquidity providers. No partnerships beyond a single integration with Best Wallet - which just uses DeGate as a tiny liquidity source inside bigger trades.

Most DeFi analysts give DeGate less than a 30% chance of surviving three more years. Why? Because liquidity is the oxygen of a DEX. Without it, no amount of clever tech can save you.

The Bottom Line

DeGate is a technically impressive project with real innovation. zkRollup + order book = a smart idea. But ideas don’t move markets. Liquidity does.

Right now, DeGate is a niche experiment - useful for micro-traders who want to avoid gas fees and trust no one. It’s not a replacement for Uniswap, Coinbase, or even dYdX. It’s a side project. A proof of concept. A sandbox.

If you’ve got $20 to play with and want to see how a decentralized order book works, go ahead. Try it. But don’t expect to build a trading strategy around it. Don’t stake your savings in DG. Don’t think it’s going to blow up.

It might. But the odds? Slim.

Is DeGate safe to use?

Yes, technically. DeGate has no admin key, so no one can freeze your funds or change the rules. It runs on Ethereum’s security via zkRollup, meaning your trades are ultimately settled on the Ethereum blockchain. But safety also depends on your own actions - use a trusted wallet like MetaMask, never share your seed phrase, and be aware of the 7-day withdrawal delay. It’s secure, but not foolproof if you’re not careful.

Can I trade altcoins on DeGate?

Only a limited number. As of late 2024, DeGate supports fewer than 50 trading pairs, mostly major coins like ETH, USDC, WBTC, and a few top-tier tokens. You won’t find new or obscure altcoins. If you’re looking to trade emerging projects, use Uniswap, SushiSwap, or a CEX instead.

Why are gas fees so low on DeGate?

Because it uses zkRollup technology. Instead of processing each trade on Ethereum’s main chain, DeGate bundles hundreds of trades off-chain into one cryptographic proof. That proof is then submitted to Ethereum as a single transaction. This cuts gas costs by about 90% - from $1.50-$5 down to just $0.02 per trade. The security stays the same, but the cost drops dramatically.

Does DeGate have a mobile app?

No. DeGate is only available as a web-based platform. You can access it through your browser on desktop or mobile, but there’s no official iOS or Android app. This limits convenience, especially for traders who prefer mobile access. For now, you’ll need to use a desktop browser or a mobile browser with a Web3 wallet extension.

Should I invest in the DG token?

Probably not. The DG token has no clear utility beyond governance (which is rarely used). Its price has been flat around $0.05 for over a year. While some price predictions claim it could hit $0.40 by late 2025, that’s based on massive adoption that hasn’t happened. With low liquidity, no institutional backing, and minimal community growth, DG is a high-risk speculative bet, not a solid investment.

How does DeGate compare to dYdX?

dYdX is a dedicated Layer-2 DEX focused on derivatives and margin trading, with much higher liquidity ($350M TVL). DeGate is focused on spot trading with a traditional order book and lower fees. dYdX supports advanced features like leverage and futures; DeGate doesn’t. DeGate’s advantage is simplicity and ultra-low fees for spot trades, but dYdX has far more users, liquidity, and developer activity. They’re not direct competitors - they serve different needs.

What’s the withdrawal time on DeGate?

Withdrawals take 7 days. This is due to the zkRollup fraud-proof window - a security feature that lets anyone challenge fraudulent withdrawals during that period. Once the 7 days pass without a challenge, your funds are released to Ethereum. This delay is normal for zkRollup systems but makes DeGate unsuitable for traders who need fast access to their funds.

Brett Benton

November 2, 2025 AT 21:36DeGate is like buying a Ferrari with no fuel tank. Looks amazing on paper, but good luck getting anywhere. The tech is solid, but without liquidity, it’s just a digital sculpture. I’ve used it for $20 trades just to feel the speed - it’s smooth as silk. But try moving $500? You’re basically donating to the price volatility fairy.

ISAH Isah

November 3, 2025 AT 21:01One must consider the ontological implications of decentralized order books in a post Ethereum 2.0 world where capital efficiency is the ultimate metric of legitimacy. The zkRollup architecture represents a metaphysical shift away from the liquidity tyranny of AMMs yet the absence of institutional backing renders it a philosophical exercise rather than an economic one. One wonders if the market rewards ideas or merely volume.

Mehak Sharma

November 5, 2025 AT 09:03DeGate is the quiet genius in the corner no one talks to at the party. Yeah the volume is laughable but think about this - what if this is the quiet build before the storm? zkRollup + order book is the future, and right now only the real degens are here. The rest are still stuck on Uniswap v2 like it’s 2020. I’ve been trading small on DeGate for months. No drama. No gas wars. Just clean trades. When the big players wake up, this could be the first DEX they adopt. Don’t sleep on the builders.

bob marley

November 6, 2025 AT 12:17Oh wow another ‘decentralized order book’ project. Let me guess - no team, no roadmap, no liquidity, and a token that’s been flat since 2023. Congrats, you’ve invented the crypto equivalent of a typewriter in 2025. The 7 day withdrawal? Cute. That’s not security, that’s a prison sentence. And you call this innovation? I’ve seen more innovation in a spam bot.

alvin Bachtiar

November 8, 2025 AT 04:15DeGate isn’t dead - it’s in hibernation. The 7-day withdrawal is a feature, not a bug. zkRollup needs time to mature, and DeGate is the canary in the coal mine. The real red flag? The team didn’t pump the DG token. No premine. No VC dump. Just pure tech. Most projects are exit scams in disguise. DeGate is the opposite. The liquidity will come when the next wave of traders realizes they don’t need CEXs to trade limit orders. And when it does? This’ll be the first DEX they remember.

David Roberts

November 8, 2025 AT 14:14The liquidity problem is structural. zkRollup DEXs require deep liquidity pools to function meaningfully, yet the incentive structure doesn’t reward LPs. Why lock up capital for $0.02 fees when you can earn 5% on a CEX lending pool? The model is elegant but economically unsustainable without tokenomics that align LP incentives. Until then, it’s a museum exhibit, not a marketplace.

Bhavna Suri

November 9, 2025 AT 20:14This is why crypto fails. Everyone builds for themselves, not for users. Who cares about low fees if you can’t trade? The interface is nice but useless without buyers and sellers. I tried it. My $30 trade took 10 minutes to fill. I gave up. Use Binance. Save your sanity.

Chris Strife

November 10, 2025 AT 18:39DeGate is a joke. America runs on liquidity. If you can’t move money fast, you’re not trading - you’re waiting. This is why the US will dominate crypto. We don’t waste time on academic experiments. We build products people use. This? It’s European philosophy wrapped in blockchain jargon. Good luck with that.

Jeremy Jaramillo

November 11, 2025 AT 14:56I’ve been using DeGate for six months. I trade under $50 at a time - mostly ETH and USDC. The fees are insane low, the interface is clean, and I never worry about my funds being frozen. It’s not for everyone. But if you’re someone who values sovereignty over convenience, this is one of the few places where that’s actually possible. Don’t look at volume. Look at trust. DeGate delivers on that.

Sammy Krigs

November 11, 2025 AT 23:12the 7 day wait is insane but i get why its there. still… why cant they do like a 24 hour opt in fast withdraw with a fee? like a premium feature? just saying. also the ui is dope but no mobile app? come on. i trade on my phone. this is 2025 not 2018

Josh Serum

November 12, 2025 AT 17:22People act like DeGate is some revolutionary project. It’s not. It’s just a slower, less liquid version of a CEX with a side of crypto virtue signaling. You’re not being brave by using it - you’re just making your life harder. If you’re not trading $10k+ trades, you don’t need a DEX. If you are, you’ll get rekt on DeGate’s liquidity. Stop romanticizing this.

Monty Tran

November 14, 2025 AT 00:29DeGate is the crypto equivalent of a vinyl record store in 2025. Nostalgic. Artisanal. Beautiful. But no one’s buying. The team didn’t fail because they built poorly - they failed because they built for a world that doesn’t exist anymore. Liquidity isn’t a feature. It’s the entire product. Without it, you’re just showing off your code to yourself.