Elk Finance (Avalanche) Crypto Exchange Review: Cross-Chain Swaps Done Right?

Cross-Chain Swap Fee Calculator

Calculate Your Cross-Chain Swap

Get estimated fees and slippage for swapping tokens across 15+ blockchains using Elk Finance's routing engine.

Estimated Swap Details

Important Note: On Avalanche, Elk Finance has limited liquidity. Your swap may experience high slippage or fail due to insufficient liquidity paths. Check volume data for your specific tokens before proceeding.

Most crypto users know the pain: you want to move ETH to Solana, but instead of one click, you’re stuck bridging, waiting 10 minutes, then swapping again on another chain. It’s messy. Elk Finance promises to fix that - all in one transaction. But does it actually work in 2025? And is it worth using on Avalanche?

What Elk Finance Actually Does

Elk Finance isn’t another Uniswap clone. It’s a cross-chain router. Think of it like a GPS for your crypto. Instead of manually bridging tokens between chains, you pick a token on one network - say, Ethereum - and pick where you want it to go - say, Avalanche - and Elk Finance finds the cheapest, fastest path. It splits your swap into multiple hops if needed, using liquidity pools on each chain to get you there.

It works on 15+ blockchains, including Ethereum, BSC, Solana, Polygon, and yes - Avalanche. The whole thing runs on smart contracts deployed on each chain. No middleman. No custodial risk. You keep your keys. That’s the DeFi promise.

Behind the scenes, it uses a routing engine that checks liquidity across vaults on different chains. If the direct path from ETH to WAVAX is thin, it might route ETH → USDC on Ethereum → USDC on Avalanche → WAVAX. All in one click. That’s the big sell.

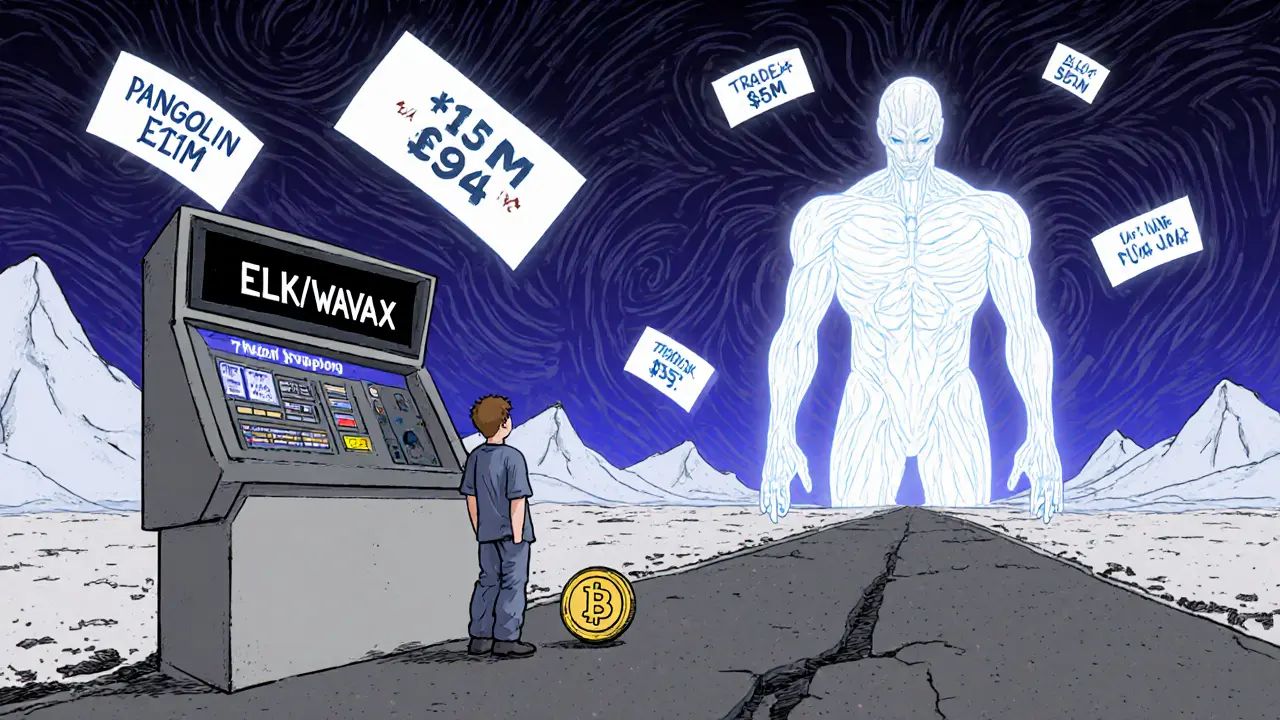

Elk Finance on Avalanche: The Real Numbers

Let’s cut through the marketing. On Avalanche, Elk Finance only supports 4 coins and 6 trading pairs. The most active one? ELK/WAVAX - which had $594 in volume over 24 hours as of October 2025. Total volume across all pairs on Avalanche? Just $886. That’s down 62% from the week before.

Compare that to Pangolin, Avalanche’s top DEX, which moves over $22 million daily. Or even Trader Joe, which hits $15 million. Elk Finance on Avalanche is a ghost town.

Why? Because liquidity is thin. If you want to swap something like USDT to AVAX, Elk Finance might not have enough depth. You’ll get slippage. Or worse - your trade fails because the routing engine can’t find a path. Users on Reddit say they’ve had swaps fail during network spikes. That’s not just inconvenient - it’s risky.

But here’s the twist: if you’re swapping ELK itself, or moving between major chains like Ethereum and Solana, it’s smoother. That’s where the routing engine shines. The problem isn’t the tech - it’s adoption.

The ELK Token: Utility or Hype?

Elk Finance has its own token: ELK. It’s not just a speculative asset. It’s the backbone of the protocol.

Stake ELK and you get up to 50% fee rebates on swaps. Liquidity providers earn rewards. There’s also a USD-pegged stablecoin (not yet live as of late 2025) meant to boost liquidity pools. And the team allocated 30 million ELK to a community vault - meaning future incentives are locked in.

But here’s the catch: only 15% of protocol revenue goes to buybacks, according to TradingBeasts. That’s low. Most top DeFi protocols like Uniswap or Curve use buybacks to reduce supply and support price. Elk Finance doesn’t. That makes ELK’s value proposition shaky.

Price-wise, ELK trades around $0.031 as of November 2025. Predictions are mixed. Some say it’ll hit $0.035 by 2031. Others say it’s flatlining. The token has no real utility beyond fee discounts. If nobody’s swapping, nobody’s staking. And if nobody’s staking, the token loses its reason to exist.

How It Compares to XY FINANCE and Others

Elk Finance isn’t alone. XY FINANCE does almost the same thing - but with 10+ chains and $12.7 million in daily volume. It’s bigger, more liquid, and has more trading pairs.

Both support MetaMask, WalletConnect, and Avalanche. Both have no KYC. Both are non-custodial. So why choose Elk?

Elk claims to support 15+ chains versus XY’s 10+. That sounds better - until you check the data. On Avalanche, XY FINANCE has 12 trading pairs and $3.1 million in daily volume. Elk has 6 pairs and $886. That’s not an edge. That’s a gap.

THORSwap and Multichain are also bigger players in cross-chain routing. They’ve been around longer. They have more users. Elk Finance is still trying to catch up.

Who Should Use Elk Finance?

It’s not for beginners. If you don’t know what a liquidity pool is, or how gas fees work on Avalanche, you’ll get lost. Onboarding takes 15-20 minutes just to make your first swap.

It’s not for traders looking for deep liquidity. If you’re swapping $5,000 of USDC to AVAX, you’ll get crushed by slippage.

But if you’re a DeFi power user who:

- Regularly moves assets between Ethereum, Solana, and Avalanche

- Owns ELK and wants to earn fee rebates

- Does small swaps under $500

- Values privacy and hates centralized bridges

Then Elk Finance might save you time. One click instead of three steps? That’s a win.

And if you’re bullish on cross-chain DeFi? Elk Finance is betting big on it. The team recently integrated with Avalanche’s subnet architecture to improve routing speed. Their roadmap includes Arbitrum, Optimism, and zkSync by 2026. That’s smart.

The Downsides: What No One Tells You

Elk Finance has no mobile app. You need a browser and a wallet. That’s fine for desktop users, but a dealbreaker for mobile-first traders.

No margin trading. No limit orders. No stop-losses. It’s purely AMM-based. That’s fine if you’re doing simple swaps - but not if you’re trading actively.

Customer support is live 24/7, but good luck getting help when your swap fails. There are no tutorials on how to troubleshoot routing errors. The documentation is basic. You’re on your own.

And the traffic? Alexa rank #294,805. Only 8,685 monthly visits. That’s tiny. For comparison, Uniswap gets 40 million. Even PancakeSwap gets 12 million. Elk Finance is a niche tool - not a mainstream platform.

Final Verdict: Is Elk Finance Worth It?

Elk Finance isn’t broken. The tech works. The routing engine is clever. The vision - one-click cross-chain swaps - is the future of DeFi.

But right now, it’s a prototype with no users.

If you’re a small-scale, cross-chain power user who owns ELK and wants to cut down bridge steps? Use it. It’s free. No fees. Just gas. And you might save time.

If you’re looking for reliability, volume, or a place to trade anything beyond ELK and WAVAX? Look elsewhere. Pangolin, Trader Joe, or even XY FINANCE will give you better prices and fewer headaches.

Elk Finance is like a high-tech electric scooter in a city with no bike lanes. The tech is cool. But unless more people use it, the lanes won’t be built. And without lanes, you’re just risking a fall.

It’s not dead. It’s just early. And in crypto, early doesn’t always mean better.

Can I use Elk Finance on my phone?

No. Elk Finance has no mobile app. You can only use it through a web browser with a wallet like MetaMask or WalletConnect. If you’re on mobile, you’ll need to open your wallet in a browser and navigate to the Elk Finance site. It works, but it’s clunky compared to native apps like PancakeSwap or Trader Joe.

Is Elk Finance safe to use?

Yes - but only if you understand DeFi risks. Elk Finance is non-custodial, meaning you control your keys. There’s no KYC. But like all smart contracts, it can have bugs. The code has been audited, but audits don’t guarantee safety. Always start with small amounts. Never send funds you can’t afford to lose. And double-check the contract address before connecting your wallet.

Why is trading volume so low on Avalanche?

Because few people are using it. Elk Finance is still new and unknown. Most Avalanche users stick to Pangolin or Trader Joe because they have more liquidity, more tokens, and better UIs. Elk Finance hasn’t convinced enough users to move their assets over. Without volume, the routing engine can’t find good paths - which makes swaps slower or fail - which scares off more users. It’s a chicken-and-egg problem.

Should I stake ELK tokens?

Only if you’re already using Elk Finance regularly. Staking ELK gives you up to 50% fee rebates - but if you’re not swapping often, you won’t earn enough to cover the risk. ELK’s price is volatile, and the token has limited utility beyond fee discounts. There’s no strong buyback mechanism or revenue sharing. Don’t stake for speculation. Stake only if you’re active on the platform and want to cut costs.

Can I swap any token on Elk Finance?

No. You can only swap tokens that have liquidity pools on the chains you’re using. On Avalanche, there are only 4 coins supported: ELK, WAVAX, USDC, and USDT. If you want to swap, say, AAVE to SOL, you need to first bridge AAVE to Ethereum or Solana, then use Elk Finance there. It doesn’t support every token - only the ones with enough liquidity to make routing possible.

What’s the difference between Elk Finance and a bridge like Wormhole?

A bridge moves your token from one chain to another - you get the same token on the other side. Elk Finance swaps your token for another token across chains. For example: you send ETH and get WAVAX back - not wrapped ETH. It’s a swap, not a transfer. That means you’re not locked into a wrapped asset. You get native tokens. That’s better for long-term holding and DeFi use.

Angie McRoberts

November 6, 2025 AT 08:19Chris Hollis

November 7, 2025 AT 03:37Natalie Nanee

November 7, 2025 AT 06:26Allison Doumith

November 8, 2025 AT 05:58Becca Robins

November 8, 2025 AT 10:29Alexa Huffman

November 10, 2025 AT 05:06Sunidhi Arakere

November 11, 2025 AT 13:33Scot Henry

November 12, 2025 AT 20:35Noah Roelofsn

November 14, 2025 AT 09:57Arjun Ullas

November 15, 2025 AT 11:03Steven Lam

November 16, 2025 AT 10:11Vivian Efthimiopoulou

November 17, 2025 AT 07:55Diana Smarandache

November 18, 2025 AT 20:27