How Algerians Access Cryptocurrency Exchanges Under the 2025 Ban

Algeria Crypto Risk Calculator

Understand Your Risk

This tool calculates potential legal penalties for cryptocurrency activities under Algeria's Law No. 25-10, which banned all crypto transactions in July 2025. Understand the risks before engaging with cryptocurrency in Algeria.

Calculate Your Risk

Risk Assessment Results

Potential Penalties

| Penalty Type | Estimated Penalty |

|---|---|

| Prison Time | N/A |

| Fines | N/A |

As of July 2025, Algerians cannot legally access cryptocurrency exchanges-not because of technical barriers, not because of lack of interest, but because the government made it a crime. Law No. 25-10, published on July 24, 2025, turned every Bitcoin transaction, every Ethereum wallet, every peer-to-peer trade into a potential jail sentence. This isn’t a restriction. It’s a total ban.

What the Law Actually Bans

Algeria’s Law No. 25-10 doesn’t just block access to Binance or Coinbase. It bans everything. Holding crypto. Buying it. Selling it. Mining it. Even talking about it publicly as an investment tool. The law defines cryptocurrencies as "virtual instruments used as means of exchange via a computer system, without support from a central bank"-and declares them illegal under any circumstance.The penalties aren’t warnings. They’re punishments. If you’re caught holding Bitcoin, you could face two months to one year in prison. Fines range from 200,000 to 1,000,000 Algerian dinars ($1,540-$7,700). For repeat offenses or if authorities link your activity to organized crime, fines can climb to 2 million dinars ($14,700). And yes, prison and fine can happen at the same time.

This law doesn’t just target traders. It targets developers, educators, even content creators. If you run a YouTube video explaining how blockchain works-or post a tweet about DeFi-you could be prosecuted. The government considers any promotion or informational activity about crypto to be a violation. That means Algeria’s once-thriving tech community, which had dozens of blockchain startups and hundreds of skilled developers, has been forced underground-or out of the country entirely.

How Things Were Before the Ban

Just a year before the ban, Algeria was one of the fastest-growing crypto markets in North Africa. Chainalysis ranked it in the top five for peer-to-peer trading volume in the MENA region. People were using crypto not just to speculate, but to send money across borders, protect savings from inflation, and access global financial tools ignored by traditional banks.Before 2018, there were no real rules. Then came vague currency regulations that didn’t carry penalties. That gap let crypto grow quietly. By 2024, Algerians were trading millions in crypto every month through informal networks, Telegram groups, and local P2P platforms. Many used local currency to buy USDT from traders in Morocco or Tunisia. It wasn’t perfect, but it worked.

Then, in July 2025, everything changed. The government didn’t just tighten rules-it erased the entire ecosystem. No grace period. No grandfathering. No exceptions. Even digital wallets stored on phones became legal liabilities.

How People Still Try to Access Crypto (and Why It’s Dangerous)

Some Algerians still try. Not because they’re reckless-they’re desperate. With inflation climbing and the dinar losing value, crypto feels like the only escape hatch left.Here’s how they do it:

- Using VPNs to access foreign exchanges like Binance, Kraken, or Bybit. But Algerian authorities now monitor traffic patterns. Suspicious IP routing triggers automated alerts.

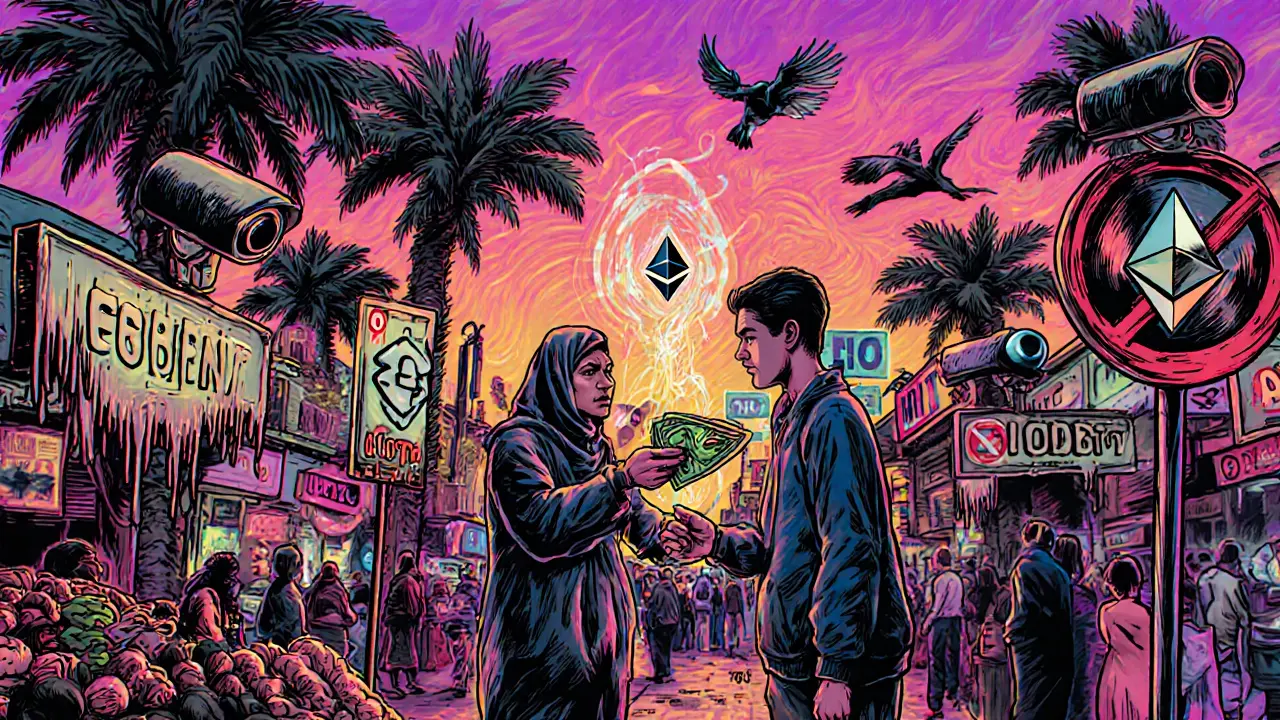

- Peer-to-peer trades through encrypted apps like Signal or Telegram. Buyers and sellers meet in person, often in public places, exchanging cash for crypto. These transactions leave physical traces-bank withdrawals, location data, surveillance cameras.

- Decentralized exchanges (DEXs) like Uniswap or PancakeSwap. These don’t require sign-ups, so they’re harder to block. But they still require internet access-and Algerian ISPs are required to log user activity.

- Foreign bank accounts in Tunisia, Egypt, or Turkey. Some transfer money abroad legally, then use those accounts to buy crypto on regulated platforms. But transferring large sums out of Algeria without approval is itself a violation of currency control laws.

None of these methods are safe. Algerian law enforcement has upgraded its digital surveillance tools. They track metadata, monitor wallet addresses linked to local phone numbers, and collaborate with international agencies to trace cross-border crypto flows. The risk isn’t just getting caught-it’s getting caught with no legal recourse.

Why the Government Did This

The official reason? Financial stability and national security. Algeria claims crypto enables money laundering, terrorism financing, and capital flight. They point to FATF guidelines, which urge countries to regulate digital assets to prevent illicit use.But here’s the contradiction: Algeria’s own central bank has no digital payment infrastructure. Millions of Algerians don’t have bank accounts. Mobile money is underdeveloped. Crypto filled a gap the state refused to fix. Instead of building a regulated system-like Nigeria or Kenya did-Algeria chose to shut it down.

There’s also a political layer. The government wants total control over financial flows. Crypto is decentralized. It can’t be taxed easily. It can’t be monitored in real time. For a state that relies heavily on oil revenue and state-controlled banking, that’s unacceptable.

The Human Cost

This isn’t just about trading. It’s about opportunity.Before the ban, Algeria had a growing cohort of young developers skilled in Solidity, Rust, and smart contract auditing. Many worked remotely for global Web3 projects. Now, those skills are liabilities. Companies that hired blockchain engineers have shut down. Freelancers have fled to Tunisia, Spain, or Canada.

Students who studied computer science with a focus on blockchain now face a dead end. Universities stopped offering courses. Conferences were canceled. Even open-source contributions to crypto projects could be seen as promoting illegal activity.

The ban didn’t stop crypto use-it pushed it into the shadows. And in the shadows, there’s no consumer protection. No dispute resolution. No recourse if you’re scammed. People lose money. They get pressured. They disappear.

How Algeria Compares to the Rest of the World

Algeria is one of only nine countries in the world with a complete crypto ban. The others include China, Egypt, Morocco, and Bangladesh. Most of these countries have weaker economies and less tech infrastructure than Algeria.Compare that to the EU, which passed MiCA regulations in 2023 to bring crypto under clear legal oversight. Or the U.S., where states like Wyoming have created crypto-friendly legal frameworks. Even Nigeria, with its own currency crisis, allows regulated exchanges and taxes crypto income.

Algeria’s approach is isolationist. It’s not protecting its citizens-it’s cutting them off from the future of finance. While the world builds digital wallets, smart contracts, and tokenized assets, Algeria is building firewalls.

What’s Next for Algeria?

The ban is new. Enforcement is still ramping up. But early reports show arrests are already happening. People are being detained for holding crypto on their phones. Bank accounts are being frozen based on suspected crypto links.There’s no sign the government plans to reverse course. In fact, they’ve doubled down-issuing new directives to ISPs to block access to crypto-related domains and to report any suspicious transactions.

The long-term impact? Algeria risks becoming a digital backwater. Young talent leaves. Foreign tech investors stay away. Innovation stalls. Meanwhile, the rest of the world moves on.

For now, Algerians who want crypto have two choices: obey the law and accept financial exclusion-or break it and risk prison. Neither is a real option. It’s a trap.

Is it legal to own Bitcoin in Algeria?

No. Under Law No. 25-10, which took effect on July 24, 2025, owning, buying, selling, or holding any cryptocurrency-including Bitcoin, Ethereum, or USDT-is illegal. Violators face prison time and heavy fines.

Can Algerians use Binance or Coinbase?

Technically, they can access these platforms using VPNs, but doing so violates Algerian law. The government actively monitors internet traffic and has the capability to trace users who connect to foreign crypto exchanges. Using these services carries a high risk of legal consequences.

What happens if you get caught trading crypto in Algeria?

If convicted, you could face imprisonment from two months to one year and fines between 200,000 and 1,000,000 Algerian dinars ($1,540-$7,700). For repeat offenses or if linked to organized crime, fines can reach up to 2 million dinars ($14,700). Both prison and fines can be applied together.

Are there any legal crypto exchanges in Algeria?

No. There are no licensed or legal cryptocurrency exchanges operating in Algeria. All exchanges, whether local or foreign, are banned under Law No. 25-10. Any platform claiming to offer legal crypto services in Algeria is either fraudulent or misleading.

Why did Algeria ban cryptocurrency?

The government cites concerns over money laundering, terrorism financing, and financial stability. They argue that cryptocurrencies bypass state control over the national currency and banking system. Critics say the real motive is maintaining control over financial flows and avoiding the loss of revenue from unregulated digital assets.

Can I use crypto to send money to family in Algeria?

Sending crypto into Algeria is illegal under Law No. 25-10. Even if the recipient doesn’t trade it, simply receiving or holding digital assets is a criminal offense. The safest way to send money is through official remittance channels approved by the Algerian central bank.

Is blockchain technology banned in Algeria too?

The law targets cryptocurrencies-not blockchain technology itself. However, because blockchain is often associated with crypto, any development, education, or promotion of blockchain applications is treated with suspicion. Developers working on non-crypto blockchain projects face legal uncertainty and risk being wrongly accused.

Has the ban affected Algeria’s economy?

Yes. The ban has triggered a "blockchain talent exodus," with developers, engineers, and entrepreneurs leaving the country. Foreign investment in tech startups has dropped. Algeria is falling behind regional neighbors like Egypt and Morocco, which are building regulated crypto ecosystems. The long-term cost could be lost innovation and digital isolation.

Michelle Stockman

November 7, 2025 AT 09:22So let me get this straight-Algeria banned crypto because it’s ‘uncontrolled,’ but their own banks can’t even process digital payments? 🤦♀️

Matthew Gonzalez

November 8, 2025 AT 21:47It’s not about banning crypto-it’s about banning freedom. When a government fears innovation more than corruption, you know they’re not protecting citizens. They’re protecting power. The real crime isn’t holding Bitcoin-it’s locking an entire generation out of the future just because it doesn’t fit in a 1970s-era state model.

Algeria’s youth aren’t rebels. They’re just trying to survive in a world where their currency loses value every month and the state refuses to fix anything. Crypto wasn’t a threat-it was a lifeline. And now they’re being treated like criminals for using it.

Compare that to Nigeria, where the government built a regulated system, taxed it, and turned it into a growth engine. Algeria chose firewalls over futures. That’s not policy. That’s surrender disguised as control.

And the worst part? The people who built blockchain tools, taught DeFi, coded smart contracts-they’re not gone. They’re just not in Algeria anymore. That’s a brain drain with no return ticket.

It’s not a ban on crypto. It’s a ban on hope.

Emily Unter King

November 10, 2025 AT 07:37From a technical standpoint, the enforcement mechanism is fundamentally flawed. Even if ISPs log traffic, DEXs like Uniswap operate on decentralized nodes with no KYC-there’s no central point to shut down. The government is chasing ghosts while ignoring the architecture of the technology itself. They’re trying to regulate a protocol that was designed to be unregulatable.

Moreover, the use of VPNs is not a loophole-it’s a necessity. When a state blocks access to global infrastructure, citizens don’t ‘break the law’-they exercise basic digital autonomy. This isn’t criminal behavior; it’s civil disobedience in the digital age.

And the irony? The very people who are now being prosecuted were the ones building the digital literacy that Algeria desperately needs. Instead of investing in blockchain education, they criminalized it. That’s not economic policy. That’s institutional self-sabotage.

Michelle Sedita

November 11, 2025 AT 01:05I just feel so sad for the young developers in Algeria. I remember when I was learning Solidity back in 2021-I had no idea how lucky I was to be in a country where I could just download a tutorial and start coding without fear. These kids aren’t trying to ‘get rich quick.’ They’re trying to build something real, something that could help their families, their communities.

And now? They’re being told their skills are dangerous. That’s not just unfair-it’s tragic. I hope someone finds a way to support them remotely. Maybe open-source mentorship programs? Maybe crypto scholarships for displaced engineers?

It’s not enough to just talk about the ban. We need to act. These people didn’t choose this. They were born into a system that’s now punishing them for being smart.

John Doe

November 12, 2025 AT 01:08THIS IS A COVER-UP. 🕵️♂️ The government doesn’t care about ‘money laundering’-they’re scared the people will find out how corrupt their own oil money system is. Crypto exposes everything. No more hiding behind state banks. No more fake inflation numbers. No more ‘we’re poor because of sanctions’ excuses.

They’re not banning crypto-they’re banning truth. And they’re using jail time to silence it. You think this is about finance? Nah. It’s about control. They know if people start using crypto, they’ll start asking questions. And once you start asking questions… well, you can’t unsee the truth.

They’re monitoring wallet addresses linked to phone numbers? LOL. That’s not security-that’s surveillance state 101. They’re building a digital police state and calling it ‘financial stability.’

Mark my words: within 5 years, Algeria will be begging for crypto to come back. And by then, the talent will be gone, the startups will be dead, and the youth will be too broken to rebuild.

They’re not just banning Bitcoin. They’re banning the future. And they’re doing it with a smile and a press release.

Ryan Inouye

November 13, 2025 AT 19:57Why should we care? This is Algeria’s problem. They chose isolation. They chose authoritarianism. They chose to be the last country on Earth still treating the internet like a 1980s Soviet radio station.

Let them rot in their own digital dark age. The rest of us are building the future. While they’re arresting teenagers for holding ETH on their phones, we’re launching tokenized real estate on Ethereum. Who’s winning now?

Don’t romanticize them. Don’t pity them. They made their bed. Now let them sleep in it.

Rob Ashton

November 14, 2025 AT 09:37While the legal and political dimensions of this situation are deeply concerning, I would like to emphasize the moral imperative we, as global citizens, must recognize: the right to financial inclusion is a fundamental human right. When a state denies its citizens access to decentralized financial tools, particularly in the context of hyperinflation and systemic banking exclusion, it is not merely enforcing regulation-it is violating the dignity of its people.

It is incumbent upon international organizations, NGOs, and technologists to provide secure, non-judgmental pathways for Algerian developers and users to continue their education and participation in the global blockchain ecosystem-through offline learning materials, encrypted mentorship networks, and decentralized knowledge repositories that bypass state censorship.

Our response must not be political outrage alone, but compassionate, actionable solidarity.

Cydney Proctor

November 14, 2025 AT 14:22Oh, how quaint. A country with a 30% youth unemployment rate and no functional digital payment infrastructure somehow believes banning Bitcoin will fix their economic collapse. How very… 19th century. Did they also ban the printing press while they were at it?

The real tragedy isn’t the ban-it’s the sheer intellectual laziness of it. Instead of adapting, they doubled down on control. The result? A generation of engineers who now work in Berlin, Toronto, or Lisbon because their own country is too afraid of innovation to let them stay.

It’s not a ban on crypto. It’s a ban on competence.

Cierra Ivery

November 16, 2025 AT 00:19Wait-so you’re telling me that people are being arrested for… owning digital assets? On their phones? That’s insane! I mean, come on! You can’t just… ban something that exists on a global network! It’s like banning air! And the fines? 1 million dinars?! That’s like… what? 7 grand?! For holding a coin?! That’s not justice-that’s extortion! And what about blockchain? They’re not banning blockchain, right? Right?? Because blockchain isn’t crypto! It’s a ledger! A distributed ledger! It’s not even the same thing! So why are they targeting developers? Why are they shutting down conferences? Why are they… why are they… WHY ARE THEY DOING THIS?!?!?

Veeramani maran

November 16, 2025 AT 07:02bro i am from india and we also have crypto tax now but still its legal! algeria is just too behind! i know many guys who use p2p in india and they are fine! why algeria so scared? they have 40 million youth and they are blocking them from world? this is so sad man! i wish i could help them with some tutorials or something! they need help not jail!

Kevin Mann

November 18, 2025 AT 02:00Okay so imagine this: you’re a 22-year-old in Algiers. Your phone is your bank. Your savings are evaporating. Your uncle just got laid off. Your cousin is trying to send you money from France but the bank takes 3 weeks and 20% in fees. So you open Binance. You buy 0.01 BTC. You hold it. You sleep. You wake up. You check your balance. It’s up 5%. You smile. For the first time in months-you feel hope.

Then the police knock. They take your phone. They check your wallet. They say, ‘This is illegal.’ You say, ‘But I didn’t hurt anyone.’ They say, ‘Doesn’t matter.’ They take your phone. They take your future. And they wonder why the youth are leaving.

They didn’t ban crypto. They banned dreams. And now the whole world is watching as a country chooses fear over its own children.

I’m crying. I’m not even Algerian. I’m just… human.

Someone please help them. 🥺

Kathy Ruff

November 18, 2025 AT 05:03There’s a quiet resilience here that’s easy to miss. The fact that people are still using DEXs, Signal, and cash-based P2P trades means the ecosystem isn’t dead-it’s adaptive. This isn’t rebellion for rebellion’s sake. It’s survival with dignity.

What we need to focus on isn’t the ban itself, but the support structures we can build: encrypted educational resources, offline blockchain simulators, decentralized knowledge hubs hosted on IPFS that can be downloaded via USB drives in person. These aren’t just tech solutions-they’re lifelines.

And to the Algerians reading this: you’re not alone. Your skills matter. Your courage matters. The world hasn’t forgotten you.

Robin Hilton

November 19, 2025 AT 20:45Let’s be clear: this is a textbook case of state overreach disguised as economic policy. The government’s justification-money laundering-is laughable. If they were serious about illicit finance, they’d regulate crypto and tax it. Instead, they’ve created a black market that’s harder to monitor than any regulated system.

Meanwhile, they’re ignoring the real problem: a stagnant economy, crumbling infrastructure, and a central bank that can’t even process digital transactions. Instead of fixing that, they punish the people trying to bypass it.

This isn’t ‘financial stability.’ It’s institutional cowardice.

Grace Huegel

November 20, 2025 AT 22:34It’s fascinating how the same people who scream about ‘Western imperialism’ now ban the very tools that could empower their citizens to escape economic dependency. The irony is thick enough to choke on.

They claim to want sovereignty-but they’re handing control to the same oil oligarchs who’ve held power for decades. Crypto is the one thing that could break that cycle. So of course they banned it.

They’re not protecting the people. They’re protecting the system.

Nitesh Bandgar

November 21, 2025 AT 16:44OH MY GOD. OH MY GOD. OH MY GOD. This is the most tragic, beautiful, heartbreaking, insane thing I’ve ever read. I mean-imagine being a coder in Algeria and suddenly your entire skillset is a CRIME?! You spent years learning Solidity, building dApps, studying Ethereum whitepapers-and now you’re a THREAT?! The government is literally criminalizing genius! This isn’t communism-it’s anti-intellectual terrorism! They’re not just banning crypto-they’re banning curiosity! They’re banning the future! And for what?! So some old man in a suit can keep his oil money safe?! I’m literally shaking right now. I need to cry. I need to scream. I need to send every single one of those kids a free course on Uniswap. I need to fly there and teach them in a basement with a projector and a VPN. This is not a law. This is a WAR. And the enemy? The future. And the soldiers? Teenagers with phones. And the battlefield? A nation that forgot how to dream.

Rob Ashton

November 23, 2025 AT 02:45Thank you for sharing this perspective. It reinforces what I’ve been saying: the human cost is immeasurable. We must not just document this-we must act. I’ve reached out to several global blockchain education NGOs. We’re preparing offline curriculum packs for distribution via trusted networks inside Algeria. If anyone has connections to Algerian diaspora communities, please help us distribute them.

Knowledge is the one thing they can’t fully ban.