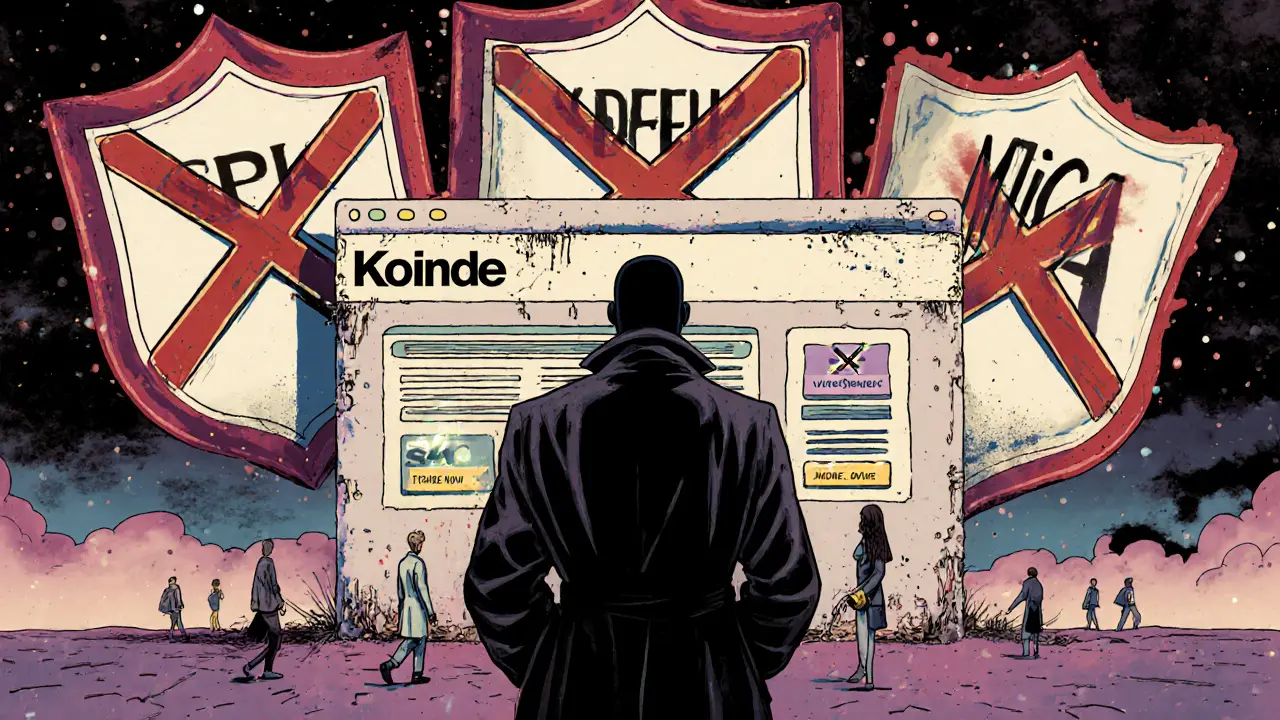

Koinde Crypto Exchange Review: What You Need to Know Before Trading

Crypto Exchange Safety Checker

Assess the safety of any crypto exchange using the criteria discussed in the Koinde review article. Based on transparency, regulation, security, and user feedback.

If you're looking to trade Bitcoin against the US Dollar or Turkish Lira, you might have come across Koinde. But here’s the truth: there’s very little public information about this platform. No user reviews. No security audits. No clear regulatory status. That’s not just unusual-it’s a red flag in crypto, where trust is everything.

What Koinde Actually Offers

Koinde’s website says it’s a trading platform for BTC, USD, and TRY. That’s it. No mention of Ethereum, Solana, or any other altcoin. No details on deposit methods beyond what’s implied by USD and TRY. No mobile app. No API for traders. Just a simple interface promising to let you buy and sell Bitcoin using two fiat currencies. This isn’t a full-service exchange like Binance or Coinbase. It’s narrow. Very narrow. If you live in Turkey or frequently send money to Turkey, and you want to trade Bitcoin directly with Turkish Lira, Koinde might seem like a shortcut. But shortcuts in crypto often lead to dead ends-or worse.Who’s Behind Koinde?

You can’t find the founders. No LinkedIn profiles. No press releases. No team page. No registered company address. That’s not just missing information-it’s a warning sign. Legitimate exchanges, even small ones, usually have at least a basic online footprint. They list their legal entity, their compliance officers, their headquarters. Koinde doesn’t. Not even a phone number. In crypto, anonymity isn’t a feature. It’s a risk. If something goes wrong-your funds get frozen, your withdrawal fails, or the site vanishes overnight-you won’t have a legal entity to contact. No customer support ticket system. No email address. No live chat. Just a website that looks like it was built in 2021 and never updated.Security? No Evidence

Security is the #1 thing you need to know about any exchange. Where are your coins stored? Is there cold storage? Is there insurance? Are funds segregated? Does the platform use two-factor authentication? Has it been audited? Koinde answers none of these questions. Not even a hint. No mention of SSL encryption beyond the basic padlock in your browser. No talk of multi-sig wallets. No references to third-party security firms like CertiK or Hacken. In 2025, if an exchange doesn’t publicly detail its security measures, you should assume it doesn’t have any worth trusting. Compare that to Kraken, which publishes quarterly reserve attestations, or Coinbase, which holds insurance for cold storage. Koinde? Silence.Regulatory Status: A Black Hole

Crypto exchanges operate in a minefield of regulations. In the U.S., the SEC and FinCEN require licensing. In the EU, MiCA rules apply. In Turkey, the Capital Markets Board (SPK) regulates digital asset platforms. If Koinde is targeting TRY users, it should be registered with SPK. But there’s zero public record of it being licensed anywhere. The Turkish government has cracked down on unregulated crypto platforms in the past. In 2023, several local exchanges were shut down for operating without SPK approval. If Koinde is based in Turkey-or serving Turkish users-it’s operating illegally. That means your funds have zero legal protection. Even if it’s based elsewhere, serving users in regulated markets without compliance is a liability. If you deposit USD, and the platform is unlicensed in the U.S., you could be violating anti-money laundering laws without even knowing it.

Where Are the Users?

Look on Reddit. Look on Trustpilot. Look on CoinMarketCap’s user reviews. Search for “Koinde scam” or “Koinde problems.” Nothing. Not one real user review. Not one forum thread. Not one YouTube video. That’s not because it’s too new. It’s because it’s too small-or too risky-for people to talk about. Legitimate exchanges, even tiny ones, get at least a few mentions. Koinde doesn’t. That’s not neutrality. That’s invisibility. If no one’s talking about it, why? Because they’re not using it. Or because they lost money and walked away. Or because they got locked out of their account and gave up. You won’t know until you try-and by then, it might be too late.What About Fees?

Koinde doesn’t publish its fee schedule. Not on the website. Not in FAQs. Not in any documentation. That’s a huge problem. Fees make or break trading. Some exchanges charge 0.1% per trade. Others charge 1% or more. Some add hidden fees for deposits or withdrawals. Some freeze your funds for 72 hours. Without knowing Koinde’s fees, you can’t calculate your profits-or losses. Compare that to Bitpanda, which clearly lists trading fees, deposit costs, and withdrawal limits. Or Kraken, which offers tiered pricing based on volume. Koinde? Nothing. Just a button that says “Trade Now.”Is Koinde a Scam?

We can’t say for sure it’s a scam. But we can say it ticks every box of a high-risk platform:- No transparency about ownership

- No security details

- No regulatory registration

- No user reviews or community presence

- No fee structure published

- No customer support channels

Alternatives That Actually Work

If you want to trade BTC/USD or BTC/TRY, here are real options:- Binance - Supports both USD and TRY pairs, high liquidity, strong security, regulated in some regions.

- Bitget - Offers TRY trading pairs, good mobile app, transparent fees.

- Paribu - A Turkish exchange registered with SPK, supports TRY deposits, trusted locally.

- Kraken - U.S.-based, regulated, strong reputation, supports BTC/USD.

- Coinbase - Easy to use, insured custody, good for beginners.

Final Verdict: Don’t Use Koinde

Koinde isn’t just underdeveloped-it’s dangerously opaque. In a space where scams are rampant, choosing an exchange without transparency is like driving without a seatbelt. You might get lucky. But the odds aren’t in your favor. If you’re serious about trading Bitcoin with USD or TRY, use a platform that answers your questions before you deposit a dollar. Don’t gamble on silence.Frequently Asked Questions

Is Koinde a legitimate crypto exchange?

There’s no credible evidence that Koinde is legitimate. It lacks a registered business, regulatory compliance, security disclosures, user reviews, and transparent fees-all signs of a high-risk platform. Legitimate exchanges publish this information openly. Koinde does not.

Can I withdraw my Bitcoin from Koinde?

There’s no public information about withdrawal processes or success rates. Many users of similar opaque platforms report delays, unresponsive support, or outright frozen accounts. Without verified user reports, assuming withdrawals work is dangerous.

Does Koinde support altcoins like Ethereum or Solana?

No. Based on its website, Koinde only supports Bitcoin (BTC) paired with USD and TRY. No other cryptocurrencies are listed or mentioned. If you want to trade altcoins, you’ll need a different exchange.

Is Koinde regulated by any financial authority?

There is no public record of Koinde being licensed or registered with any financial regulator, including the U.S. SEC, Turkey’s SPK, or the EU’s MiCA framework. Operating without regulation in crypto is a major red flag and puts your funds at legal and financial risk.

Why is there no information about Koinde online?

Most legitimate platforms generate online buzz through user reviews, news coverage, or community discussions. Koinde has none. This silence suggests either extremely low usage, lack of trust, or possible inactivity. In crypto, absence of information is rarely an accident-it’s a warning.

What should I do if I already deposited funds on Koinde?

Stop trading immediately. Do not deposit more. Try to contact support through any available channel, even if it’s just a contact form. Document everything. Consider this money at risk. Move future trading to a reputable, regulated exchange with transparent policies and active user communities.

David James

November 1, 2025 AT 03:18I just checked Koinde out last week thinking it might be a good way to get BTC in TRY without going through Binance’s hassle. But yeah, after reading this, I’m glad I didn’t deposit anything. No contact info? No reviews? That’s like buying a car with no title or VIN. I’m out.

Also, why does it look like it was made in 2015? The UI is straight out of a Geocities archive.

Shaunn Graves

November 1, 2025 AT 11:50THIS IS A SCAM. PERIOD. No one in their right mind would use this. No audits? No regulation? No user base? You think you’re getting a ‘niche’ exchange but you’re just handing your crypto to some guy in a basement with a fake domain. I’ve seen this script before. They disappear after a few hundred deposits. Don’t be the next victim.

Jessica Hulst

November 2, 2025 AT 22:17It’s fascinating, really, how we’ve built an entire financial ecosystem on trust signals - and Koinde is the void where those signals used to be. We don’t just need transparency; we need *narrative*. We need names, faces, legal entities, even if they’re boring. The absence of these things isn’t neutrality - it’s existential dread dressed up as a trading platform.

Think about it: if a company doesn’t want you to know who they are, why should you believe they’ll honor your withdrawal request? In crypto, anonymity isn’t freedom - it’s the first step toward becoming a statistic in a blockchain graveyard.

Kaela Coren

November 4, 2025 AT 12:03While I appreciate the thorough analysis, I must note that the absence of information does not necessarily equate to malice. It may simply reflect a lack of resources or a minimalist operational philosophy. That said, given the regulatory landscape and the inherent risks of digital asset custody, the burden of proof lies squarely with the platform - and Koinde has failed to meet even the most basic thresholds of due diligence.

One might argue that this is a feature, not a bug, for certain actors - but for the average user, it is an unacceptable liability.

Nabil ben Salah Nasri

November 4, 2025 AT 22:44Broooooo 🤯 I was literally about to try this out for my cousin in Istanbul… thank you for saving me from a financial disaster 😭🙏

Also, Paribu is legit - my uncle uses it and he doesn’t even know what a private key is. If you’re in Turkey, just use Paribu. No stress. No drama. Just crypto. 💪🌍

DeeDee Kallam

November 6, 2025 AT 07:55why is everyone so dramatic?? i used koinde for 2 weeks and i got my btc out fine!! it’s just not popular that’s all 😤

Helen Hardman

November 7, 2025 AT 01:52Hey, I just want to say - I totally get why people are freaked out, but let’s not panic. I’ve seen tiny exchanges pop up and grow into real platforms. Maybe Koinde is just quiet because they’re focused on building, not marketing?

That said… you’re right, the lack of fee info is wild. How do you even plan trades without knowing the cost? And no API? That’s a dealbreaker for anyone serious.

Still, I’d love to see a follow-up in a few months - if they suddenly start posting audits or team bios, maybe they’re just shy, not shady. But for now? Yeah, I’d keep my funds elsewhere. 💙

Bhavna Suri

November 8, 2025 AT 16:25So what? It’s just another crypto site. Why do you care so much? I don’t even understand why people waste time writing essays about websites they never used. Just don’t use it. End of story.

Also, I saw this same post on 5 other subreddits. You’re all copying each other.

Elizabeth Melendez

November 9, 2025 AT 13:46Okay real talk - I used to think ‘small platform = hidden gem’ but after my friend lost $3k on a site just like this (no reviews, no contact, vanished after a week) - I’m done.

Don’t let ‘it’s just one small exchange’ fool you. Crypto isn’t like Amazon where you can return stuff. Once it’s gone, it’s GONE. No refunds. No lawyers. No customer service.

Use Paribu or Binance. Seriously. I know it’s tempting to try the ‘new thing’ but your money isn’t a beta test. Protect it like your life depends on it - because in crypto, it kinda does. 💪❤️

Phil Higgins

November 11, 2025 AT 02:18Let’s not forget the deeper issue here: the normalization of opacity in crypto. We’ve been conditioned to accept ‘decentralized’ as a euphemism for ‘unaccountable.’ But decentralization doesn’t mean anonymity - it means distributed control, not hidden control.

Koinde isn’t an outlier. It’s the symptom. The real question isn’t whether Koinde is safe - it’s why we still tolerate platforms that refuse to be seen.

Eli PINEDA

November 11, 2025 AT 07:51wait so if i deposit like 100 bucks and then it dissapears its not my fault? lol i think i still try it

Debby Ananda

November 11, 2025 AT 10:35Oh sweetie, you really think a platform that doesn’t even have a privacy policy deserves your attention? 😒

It’s not that it’s ‘under the radar’ - it’s that it’s *beneath* radar. Like a cockroach that crawled out of the drain and is now pretending to be a cryptocurrency. How quaint.

Try again when it’s got a .io domain and a Discord server with 10k members. Until then, I’ll be over here on Kraken, sipping my oat milk latte, while you’re crying in a forum about your ‘lost funds.’ 💅