What Is Composability in DeFi? The Money Legos Revolution

DeFi Composability Yield Calculator

Your Composable Strategy

Results

Estimated yield based on your strategy:

$0.00

0.00% APY

How Composability Works

Your yield grows as protocols work together: protocol 1 → protocol 2 → protocol 3. The more connected protocols you use, the higher potential yield—but also higher risk.

Risk Level

LowEstimated Risk

0.5% dailyImportant Risk Note

As shown in the article, composability amplifies risks. When more protocols are connected, a single vulnerability can compromise your entire strategy. Always monitor connected protocols and limit exposure to no more than 3 protocols.

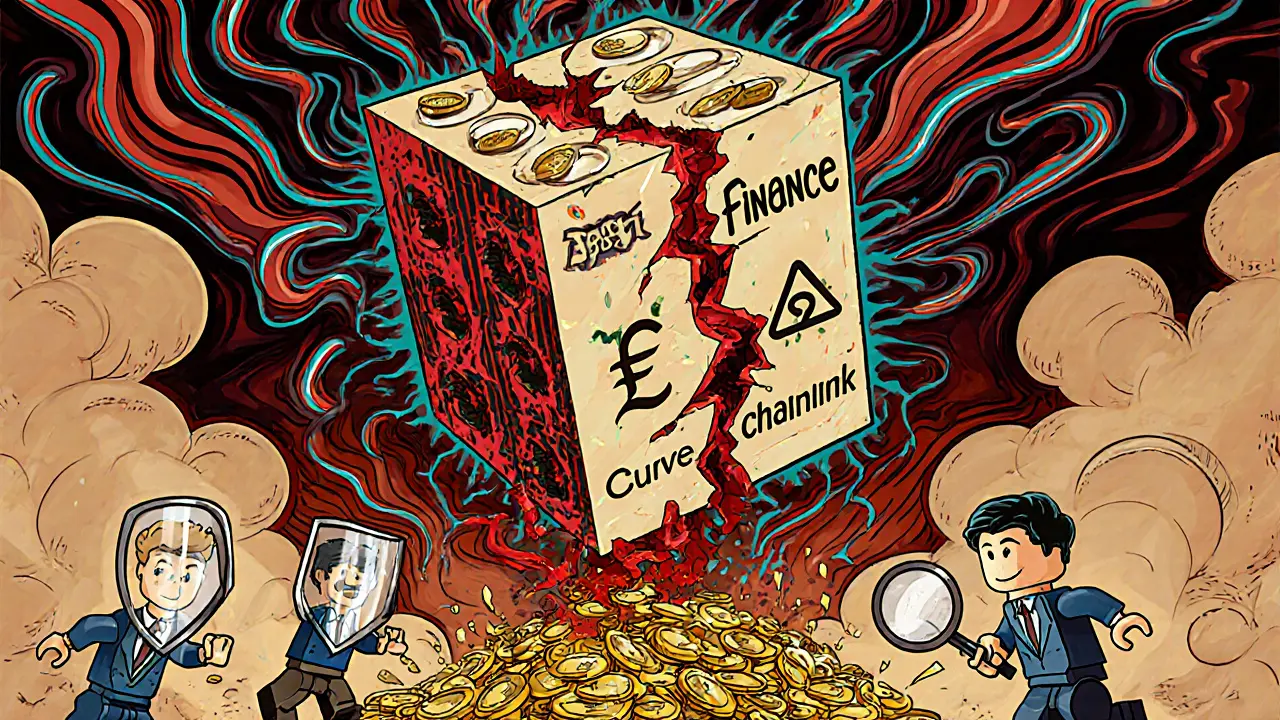

Imagine building a house using only pre-made LEGO blocks-no nails, no saws, no permits. You grab a foundation from one set, walls from another, a roof from a third, and suddenly you’ve built something no kit ever intended. That’s composability in DeFi. It’s not just a buzzword. It’s the reason DeFi moves faster than any financial system in history.

What Exactly Is Composability?

Composability means DeFi protocols can plug into each other like building blocks. Each one-lending, trading, insurance, derivatives-works independently but can also connect with others without asking permission. This isn’t like traditional banking, where you need contracts, legal teams, and weeks of back-and-forth just to link two services. In DeFi, if a smart contract follows the right rules, it just works.This is why people call DeFi components "Money Legos." You’ve got Aave for lending, Uniswap for trading, Chainlink for price data, and Curve for stablecoin swaps. A developer can take a loan from Aave, use those funds as collateral on dYdX to trade leveraged positions, then automatically repay the loan using profits from a flash loan arbitrage-all in one transaction, no middlemen.

How Does It Actually Work?

At the core, it’s all about smart contracts and standards. Every DeFi app runs on code that lives on the blockchain. If two contracts speak the same language-like ERC-20 for tokens or ERC-721 for NFTs-they can talk to each other automatically. No APIs to sign up for. No approval forms. Just code calling code.Here’s a real example: You deposit ETH into Compound to earn interest. Instead of leaving it there, you use that same deposited ETH as collateral on MakerDAO to mint DAI stablecoins. Then you take those DAI and stake them on Yearn Finance to earn even more yield. All of this happens on-chain, in sequence, without you ever leaving your wallet. Each step is a separate protocol, but together, they form a custom financial product you built yourself.

That’s composability in action: one protocol’s output becomes another’s input. It’s not just convenient-it’s revolutionary. In traditional finance, you’d need separate accounts, separate approvals, and separate fees for each step. In DeFi, it’s all automated, transparent, and open to anyone with an internet connection.

Why It’s Better Than Traditional Finance

Traditional finance is like a locked cabinet. To use a service, you need to be approved, verified, and often pay middlemen. Integration between banks, brokerages, and insurers takes years. DeFi flips that. Anyone can build on top of existing protocols. No gatekeepers. No licensing. Just code.Take yield farming. In traditional markets, chasing high interest rates means juggling multiple banks, dealing with minimum balances, and waiting days for transfers. In DeFi, a simple bot can move your funds between Aave, Compound, and Curve every hour to chase the highest APY. It’s not magic-it’s composability. The protocols were designed to work together, so the tools that use them don’t need to reinvent the wheel.

And it’s not just about making more money. It’s about creating entirely new financial tools. Synthetic assets like those on Synthetix combine price oracles, collateral systems, and token minting to let you trade gold, Tesla stock, or even the S&P 500-without owning any of it. All built from existing DeFi pieces.

The Risks: When One Block Falls, Others Follow

Composability isn’t risk-free. The same openness that makes it powerful also makes it fragile. If one smart contract has a bug, it can ripple through everything connected to it.Remember the 2022 Euler Finance exploit? A flaw in its lending protocol let attackers borrow huge amounts using manipulated collateral. Because Euler was connected to multiple lending and trading platforms, the attack spread fast. Over $200 million was drained in minutes. That’s the dark side of composability: interconnectedness amplifies both innovation and risk.

Another issue? Complexity. When you stack five protocols together, you’re trusting five different codebases. One tiny error in one contract can break the whole chain. That’s why experienced DeFi users always check for audits, use trusted interfaces like Zapper or DeFiSaver, and never put all their funds into a single multi-protocol strategy.

What’s New in 2025?

Composability is evolving fast. Cross-chain bridges now let you use Aave on Ethereum while borrowing on Polygon-something that was nearly impossible just two years ago. Layer 2s like Arbitrum and Base are making multi-protocol transactions cheaper and faster, so complex strategies don’t cost $50 in gas fees.Security tools are catching up too. Formal verification systems now test how smart contracts interact before they go live. Tools like Slither and MythX scan for vulnerabilities in multi-contract flows. Some protocols even require automated audits before allowing integration.

And the biggest shift? Institutional interest. Firms like JPMorgan and BlackRock aren’t just watching-they’re building on DeFi infrastructure. Why? Because composability lets them deploy financial products faster, cheaper, and with more flexibility than legacy systems allow.

What You Can Do With It Today

You don’t need to be a coder to use composability. Here are three real ways regular users benefit:- Auto-compounding yields: Platforms like Yearn or Beefy automatically move your crypto between lending pools to maximize returns. You deposit once. They handle the rest.

- Flash loan arbitrage: You can borrow thousands in a single transaction, exploit a price gap between exchanges, repay the loan-all in one block. No collateral needed. Just code.

- Protected lending: Deposit into Aave, then buy insurance from Nexus Mutual. If Aave gets hacked, you get paid. Two protocols. One click.

These aren’t theoretical. They’re live, working, and used by tens of thousands every day.

Where Is This All Going?

The next frontier? Real-world assets. Imagine tokenized U.S. Treasury bonds that automatically pay interest into a DeFi lending pool, which then funds a microloan on a blockchain-based lending app in Kenya. All connected. All automated. All permissionless.Decentralized identity is next. Your on-chain reputation-your loan history, your trading patterns-could one day act as your credit score, unlocking better rates across dozens of DeFi apps without a single background check.

Composability is turning finance into a sandbox. Not a walled garden. Not a bureaucracy. A living, growing system where anyone can build, remix, and improve.

Final Thought: It’s Not About the Tech-It’s About the Freedom

Composability isn’t just a technical feature. It’s a philosophy. It says: you don’t need permission to create value. You don’t need a bank to lend. You don’t need a broker to trade. You don’t need a lawyer to combine services.That’s why DeFi isn’t just competing with traditional finance. It’s rewriting the rules. And composability? It’s the engine behind the change.

Is composability only possible on Ethereum?

No. While Ethereum started the trend, composability now works across multiple chains. Tools like LayerZero, Wormhole, and Axelar let protocols on Solana, Polygon, Arbitrum, and others interact. Cross-chain bridges enable assets and data to move between chains, making DeFi truly multi-chain. You can now use a lending protocol on Avalanche to collateralize a trade on SushiSwap on BNB Chain.

Do I need to code to use composability?

No. Most users interact with composability through user-friendly interfaces like DeFiSaver, Zapper, or CowSwap. These platforms handle the complex multi-protocol interactions behind the scenes. You just pick your strategy-like "maximize yield on ETH"-and the app does the rest. Coding is only needed if you’re building new protocols, not using them.

What’s the biggest risk when using composable DeFi?

The biggest risk is smart contract failure across multiple layers. When you stack protocols, you inherit each one’s vulnerabilities. A bug in a price oracle, a flawed collateral ratio, or a missing reentrancy guard can cascade. Always check for audits from reputable firms like CertiK or OpenZeppelin, and avoid strategies that involve more than three interconnected protocols until you fully understand how they work.

Can I lose money even if I don’t trade?

Yes. If you deposit crypto into a lending protocol that’s connected to others, a hack or collapse in one part of the chain can affect your funds-even if you didn’t actively trade. For example, if a protocol you’re using as collateral gets liquidated due to a price oracle error, your position might be wiped. Always monitor your positions and understand which protocols your funds are connected to.

How do I know if a DeFi protocol is composable?

Look for three things: 1) Does it use standard tokens (ERC-20/ERC-721)? 2) Is its code open-source on Etherscan? 3) Does it list integrations with other protocols like Uniswap, Aave, or Chainlink? If yes, it’s designed to be composable. You can also check platforms like DeFi Llama, which show which protocols are connected to others.