What Is GMT (Green Metaverse Token) Crypto Coin? Explained in 2025

GMT Investment Calculator

StepN GMT Earnings Calculator

Estimate your potential GMT earnings based on daily activity, duration, and current market conditions. Note: This is not financial advice and GMT remains a high-risk investment.

Input Your Activity

Estimated Results

GMT, or Green Metaverse Token, isn’t just another crypto coin. It’s the backbone of StepN, a move-to-earn app that rewards you for walking, jogging, or running - but only if you’re willing to play by its rules. Launched in 2022 by Find Satoshi Lab, GMT was built to give users real control over the platform’s future. Unlike most tokens that just float in and out of wallets, GMT is tied to something tangible: your sneakers, your steps, and your ability to unlock features inside the StepN app.

How GMT Works Inside StepN

StepN runs on the Solana blockchain and uses a dual-token system: GMT and GST. Think of GST as the daily cash you earn from walking. Every time you move, you mint GST - the more you walk, the more you get. But GST alone doesn’t do much. To upgrade your sneakers, customize them, or get rare NFTs, you need GMT.

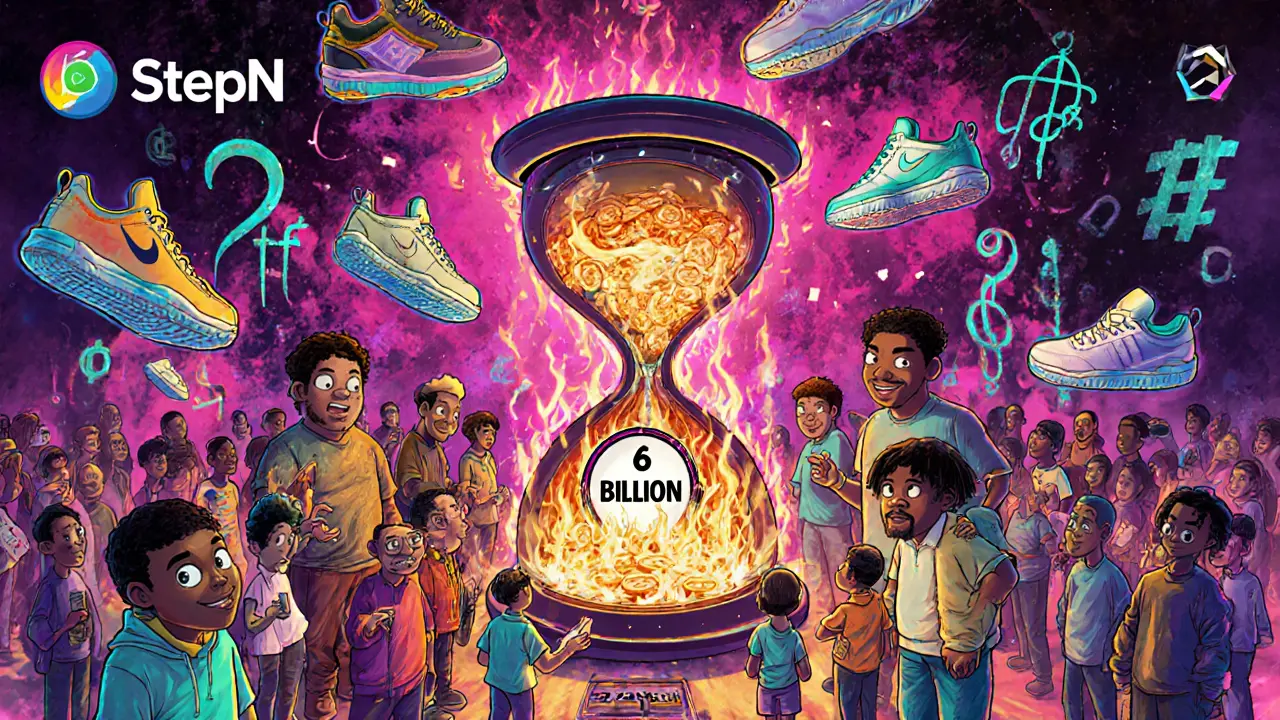

GMT is the governance token. It’s fixed at 6 billion total coins - no more will ever be created. That’s different from GST, which has no cap and floods the market as people move. Because GMT is limited, its value depends on how much demand there is inside StepN. If more people use the app, they spend more GST, and a portion of that GST gets used to buy and burn GMT. That’s the burn mechanism - it reduces supply and can push prices up.

But here’s the catch: you can’t earn GMT just by walking. You have to complete quests, hit milestones, or win special events inside the app. Some users report earning a few hundred GMT over months of consistent use. Others spent hundreds of dollars on NFT sneakers only to see their GMT holdings drop by 80% within a year.

What You Can Do With GMT

GMT isn’t just a store of value - it’s a key that unlocks features you can’t access with GST alone:

- Customize sneakers: Change names, colors, and designs - but it costs GMT.

- Upgrade gems: Improve the stats on your sneakers. After Level 4, your success rate goes up if you spend GMT.

- Unlock rare sneakers: Higher chances of getting legendary or epic NFTs when opening shoeboxes.

- Redistribute attribute points: Reset your sneaker’s speed, comfort, or energy stats - only with GMT.

- Vote on platform changes: Holders can propose and vote on updates like fee structures or new features.

- Stake GMT: Lock your tokens to earn more GMT, GST, or exclusive rewards.

These aren’t minor perks. For serious users, GMT turns StepN from a fitness tracker into a full-blown Web3 game. But it’s expensive to get in. As of November 2025, you need at least $500-$1,000 to buy a sneaker that’s even worth using. And even then, you’re not guaranteed to profit.

GMT Price History and Market Status

GMT’s story is a rollercoaster. In April 2022, it hit an all-time high of $4.03. By late 2022, it was under $0.10. Today, on November 5, 2025, it’s trading at $0.02194 with a market cap of $65 million - down from a peak of $2.4 billion.

That’s a 97.3% drop. What happened? User activity collapsed. StepN had 5 million users at its peak. Now, only 8,400 daily wallets interact with GMT. The app’s 24-hour trading volume has fallen from $1.2 billion to $27.97 million. The burn mechanism - the system meant to support GMT’s value - isn’t working because fewer people are spending GST.

Market analysts are split. Some predict GMT could hit $0.50 by 2027 if user numbers stabilize. Others warn it has a 68% chance of falling below $0.01 in the next 18 months. The truth? GMT’s price is tied to StepN’s survival. If the app dies, GMT becomes a digital ghost.

Why GMT Is Risky - And Why People Still Use It

Let’s be clear: GMT is not a safe investment. It’s a high-risk bet on a fading trend. The move-to-earn model exploded in 2022, then crashed as users burned out and regulators cracked down. China banned such apps in May 2022, calling them “gambling-like.” That alone tanked GMT’s price by 35% in a week.

But people still use it. Why?

- Early adopters made money: Those who bought cheap NFTs and held GMT before the crash still have value.

- It’s addictive: The gamification of fitness keeps people coming back - even if they’re losing money.

- Community belief: On Reddit and Telegram, users swear GMT will rebound. Some claim using GMT to customize sneakers improved their shoebox success rate by 22%.

- Future features: StepN’s September 2025 update introduced SocialFi tools - think community challenges and leaderboards. Early data shows only 12% of users are using them, but if they catch on, GMT could see renewed demand.

Still, the risks are real. Users report waiting 14-21 days for customer support. Withdrawals were restricted during the 2022 crash. One Reddit user lost 85% of their GMT in under a year. CoinGecko ratings average 3.2/5 - not terrible, but far from great.

How to Get Started With GMT

If you’re still interested, here’s what you need:

- A Solana wallet: Phantom or Solflare work best.

- StepN app: Download it on iOS or Android.

- An NFT sneaker: Start with a Level 1-3 sneaker. They cost $500-$1,000. No sneaker? No GMT earnings.

- Patience: It takes 2-3 weeks just to understand the system. To reach Level 30 sneakers (the only ones that let you swap GMT for USDC), you need 6-8 months of daily activity.

Don’t expect quick returns. GMT isn’t a pump-and-dump coin. It’s a long-term play on whether StepN can reinvent itself. Right now, the app is trying to pivot from fitness to social gaming. If it fails, GMT fades. If it succeeds, the fixed supply could create a supply shock - fewer tokens chasing more demand.

GMT vs. Other Move-to-Earn Tokens

StepN isn’t alone. Other apps like Sweat Economy (SWEAT) and Genopets (GENA) also reward movement. But GMT stands out because of its dual-token system and fixed supply.

| Token | Price | Market Cap | Supply | Key Feature |

|---|---|---|---|---|

| GMT | $0.02194 | $65.1M | 6 billion (fixed) | Governance + premium features |

| SWEAT | $0.0145 | $45.2M | Unlimited | Simple fitness rewards |

| GENA | $0.041 | $82.4M | Unlimited | Genome-based NFTs |

GMT’s fixed supply gives it a theoretical edge - but only if demand returns. SWEAT and GENA are simpler, cheaper to join, and less volatile. But they don’t offer governance or deep customization. GMT is more complex, more expensive, and more risky - but also more powerful if you’re in it for the long haul.

Is GMT Worth It in 2025?

Here’s the blunt truth: If you’re looking for a quick crypto win, walk away. GMT isn’t that.

If you’re a fitness enthusiast who loves Web3, enjoys gaming mechanics, and has $500+ to spend on sneakers - and you’re okay with losing money - then GMT might be worth exploring. The burn mechanism, the governance rights, and the potential for a future price surge if StepN revives make it interesting.

But if you’re hoping to earn passive income from walking? You’ll likely lose money. The cost of entry is too high, the rewards too slow, and the platform too unstable.

GMT’s future hinges on one thing: Can StepN become more than a fitness app? If it turns into a social fitness network with AR features, live events, and real community engagement - then GMT could rise. If not, it’ll keep sliding toward $0.01.

Right now, GMT is a gamble on a dying trend - but with a few sparks still glowing. Watch it. Don’t chase it. And never invest more than you’re willing to lose.

Can you earn GMT just by walking in StepN?

No. You earn GST by walking, but GMT can only be earned by completing quests, hitting milestones, or winning events in the StepN app. You can’t mine or stake your way to GMT through movement alone.

What is the total supply of GMT?

GMT has a fixed total supply of 6 billion tokens. No new GMT will ever be created, making it deflationary by design - unlike GST, which has an unlimited supply.

Is GMT a good investment in 2025?

It’s high-risk. GMT’s price has dropped 97% from its peak, and StepN’s user base has collapsed. While some analysts predict a rebound by 2027 if the app succeeds in its SocialFi pivot, most users are losing money. Only invest if you understand the risks and can afford to lose your capital.

How much does it cost to start using GMT?

You need at least one StepN NFT sneaker, which costs $500-$1,000 as of November 2025. Without a sneaker, you can’t earn GST or GMT. This high barrier makes it unviable for casual users.

What happens if StepN shuts down?

GMT would lose all its utility. Without the StepN app, there’s no way to use GMT for governance, customization, or staking. Its value would drop to near zero, as it has no independent use outside the platform.

Can GMT be staked?

Yes. You can lock your GMT in the StepN app to earn rewards like additional GMT, GST, or exclusive in-game perks. But staking doesn’t guarantee profits - it just gives you a chance to earn more while waiting for the market to recover.

Why did GMT’s price crash so hard?

GMT’s crash was caused by a collapse in user activity. StepN’s daily users dropped from 750,000 in early 2022 to just 8,400 in late 2025. With fewer people walking, less GST was spent, which meant fewer GMT tokens were burned. That broke the deflationary engine, and demand vanished.

Is GMT only on Solana?

Yes. GMT is built exclusively on the Solana blockchain. You need a Solana-compatible wallet like Phantom or Solflare to hold or trade it. It’s not available on Ethereum, Binance Chain, or other networks.

Sunidhi Arakere

November 5, 2025 AT 23:09GMT seems like a nice idea, but the cost to even start is insane. I walk every day, and I wouldn't spend $500 on digital sneakers. Not worth it.

Vivian Efthimiopoulou

November 7, 2025 AT 04:31The tragedy of GMT is not its tokenomics, but the human condition it exposes: we have traded the intrinsic joy of movement for algorithmic validation. StepN did not fail because of market forces-it failed because it turned breath into balance sheets, and sweat into speculative ledger entries. When fitness becomes a yield farm, we have already lost the soul of motion.

Angie Martin-Schwarze

November 7, 2025 AT 13:13i just wanna walk without paying for shoes that dont even exist?? like wtf is this?? gmt?? i think i lost my brain cells reading this lol

Fred Kärblane

November 9, 2025 AT 11:24GMT’s dual-token architecture is a brilliant example of tokenized behavioral economics on Solana. The burn mechanism creates controlled deflationary pressure while GST acts as a frictionless utility token-this is Web3 gamification at its most sophisticated. The real alpha is in the SocialFi pivot; if they integrate live leaderboards and DAO-governed event scheduling, we could see a 5x volume rebound by Q3 2026.

Janna Preston

November 10, 2025 AT 00:25I don’t get how you earn GMT. Is it only from quests? Can you buy it on exchanges? I’m confused because the article says you can’t earn it by walking, but then talks about people holding it. How do you even get started without spending a fortune?

Meagan Wristen

November 10, 2025 AT 23:35I used to walk with StepN back in 2022. I made a little money, but honestly? I missed the feeling of just walking for no reason. Now I walk without the app. It’s quieter. It’s mine. I don’t need a token to tell me I’m doing something good.

Becca Robins

November 11, 2025 AT 22:40so u pay $1k for shoes that only work if u walk... and then u still lose money?? 😭 i think i’d rather just go to the gym and not cry over my wallet

Alexa Huffman

November 12, 2025 AT 12:54It's fascinating how the design of GMT mirrors real-world economic principles-limited supply, usage-based demand, governance rights. But it’s also heartbreaking that so many people invested not just money, but hope, into something that was always going to be fragile. The tech isn’t broken. The human behavior around it is.

gerald buddiman

November 14, 2025 AT 02:05Wait-so you can’t earn GMT just by walking? Then what’s the point? I mean, I walk 8K steps a day, and I’m not rich. But now I have to buy NFT sneakers? This feels like a pyramid scheme dressed in blockchain glitter. I’m not even mad-I’m just confused.

Glen Meyer

November 15, 2025 AT 22:35Why are Americans so obsessed with paying for everything? In my country, we just walk. No app. No tokens. No $1000 sneakers. This is capitalism at its most ridiculous. You don’t need blockchain to be healthy.

Missy Simpson

November 17, 2025 AT 14:13I know it sounds crazy but I still believe in GMT! I’ve been walking every day since 2023 and I’ve gotten 120 GMT so far. It’s slow, but I’m in it for the long haul. The community is still alive, and I think the next update will bring everyone back 😊

Tara R

November 19, 2025 AT 09:48Anyone who bought GMT after the peak is either delusional or financially irresponsible. The market cap is 0.0027% of its peak. The user base is a ghost town. The only thing left is the echo of greed

Matthew Gonzalez

November 20, 2025 AT 15:33What’s the difference between GMT and a casino that rewards you for walking? The blockchain just makes the illusion feel more real. We’re not building a future-we’re just repackaging addiction with smart contracts.

Michelle Stockman

November 21, 2025 AT 15:36Wow. So you pay $1000 to walk? And you’re surprised it crashed? I’ve seen this movie before. It’s called ‘pump and dump with sneakers’.

Alexis Rivera

November 23, 2025 AT 15:14The real lesson here isn’t about crypto. It’s about how easily we trade autonomy for gamified rewards. StepN didn’t fail because of market conditions-it failed because it convinced people their worth was tied to their step count. That’s not innovation. That’s exploitation dressed as empowerment.

Eric von Stackelberg

November 25, 2025 AT 11:51Did you know that Find Satoshi Lab is linked to a shell company registered in the Caymans? The entire GMT ecosystem is a front for capital flight. The burn mechanism? A fiction. The real tokens are being siphoned into private wallets. The 8,400 daily users? Bot accounts. This isn’t a crypto project-it’s a laundering scheme with sneakers.

Emily Unter King

November 27, 2025 AT 08:12The burn mechanism is mathematically elegant, but it only works with high transaction velocity. With daily GST volume down 98%, the deflationary engine is idle. Without active users spending GST to buy GMT, the token becomes a static artifact. The real question: Can StepN reignite demand, or is this just digital archaeology now?

Michelle Sedita

November 28, 2025 AT 03:45I think people forget that StepN was never meant to be a fitness app. It was always a social experiment. And honestly? It worked. It showed us how far we’d go for a digital reward. We’re not losing money-we’re learning about ourselves.

John Doe

November 29, 2025 AT 13:37They’re not just shutting down StepN-they’re erasing our digital legacy. The blockchain doesn’t lie. The 6 billion GMT tokens are still there. But the people? The community? Gone. This isn’t a crash. It’s a funeral. And no one’s showing up to mourn.