Consumer Protection for Crypto in Australia: What You Need to Know in 2025

Buying crypto in Australia used to feel like stepping into a dark room with no map. One day you’re told it’s legal, the next you hear about a platform collapsing and people losing everything. That changed in 2025. After years of patchwork rules and high-profile failures like FTX, Australia finally put real consumer protection in place for cryptocurrency. This isn’t just another update-it’s the first time the government has forced crypto platforms to play by the same rules as banks and stockbrokers.

What’s Actually Changing in 2025?

The new rules, part of the Treasury Laws Amendment Bill 2025, don’t create a whole new system. Instead, they plug crypto into the existing financial laws that already protect people buying shares, superannuation, or insurance. Two new categories of regulated platforms are now defined: digital asset platforms (DAP) and tokenised custody platforms (TCP). Together, they’re called crypto platforms.

Any company running a crypto exchange, wallet service, or trading platform in Australia now needs an Australian Financial Services Licence (AFSL). That means they must follow the same rules as any financial services provider:

- Be honest and clear in how they market crypto

- Manage conflicts of interest (like when a platform trades against its own users)

- Have trained staff who understand the risks

- Set up proper systems to handle complaints

- Offer compensation if something goes wrong

Break these rules? You’re looking at fines of $16.5 million or more. That’s not a slap on the wrist-it’s a business-ending penalty.

What Crypto Is Covered?

The rules apply to almost anything you can trade or hold on a platform:

- Bitcoin and Ethereum - treated like commodities

- Stablecoins - even if they’re pegged to the Australian dollar

- Tokenised securities - like shares or bonds on a blockchain

- NFTs - if they’re being traded as investments, not just digital art

But there are exceptions. If you’re buying an NFT for a game, like a skin or a character, and you can’t trade it on a public exchange, it’s not covered. The government isn’t trying to regulate your video game purchases. They’re targeting platforms where people are speculating, investing, or storing value.

Who Gets a Pass?

Not every small crypto service has to get an AFSL. If a platform only handles under $5,000 per customer and under $10 million in annual transactions, it’s exempt. This is meant to let small, local businesses or peer-to-peer tools keep running without drowning in paperwork.

But here’s the catch: even if they’re exempt, they still can’t lie to you. Australian Consumer Law still applies. If a small platform claims your crypto is “100% safe” or “guaranteed to double in a month,” they’re breaking the law. The new rules don’t give them a free pass to mislead-they just remove the licensing burden.

What About AML and KYC?

Long before these new rules, crypto businesses had to register with AUSTRAC and follow anti-money laundering (AML) rules. Since 2018, every exchange had to verify your identity and report suspicious activity. That hasn’t gone away. In fact, it’s now layered on top of the new AFSL requirements.

That means:

- You’ll still need to upload ID to trade

- Platforms must track every transaction

- They must report anything that looks like fraud or money laundering

This isn’t just bureaucracy. It’s what keeps criminals out of the system. And it’s why you’re seeing fewer anonymous crypto wallets in Australia now.

How Are Companies Reacting?

Big exchanges like Independent Reserve and BTC Markets are welcoming the changes. Why? Because they’ve been playing by the rules while shady operators got away with scams. Kate Cooper from OKX Australia said the new laws are “the clearest signal yet that crypto is no longer operating on the fringes.”

But they’re also worried. If the government doesn’t enforce these rules tightly, unlicensed platforms could still pop up and lure in unsuspecting users. “We need to make sure licensed operators aren’t undercut by unregulated players,” Cooper warned. That’s the real test: will ASIC and AUSTRAC have the staff and tools to chase down rogue operators?

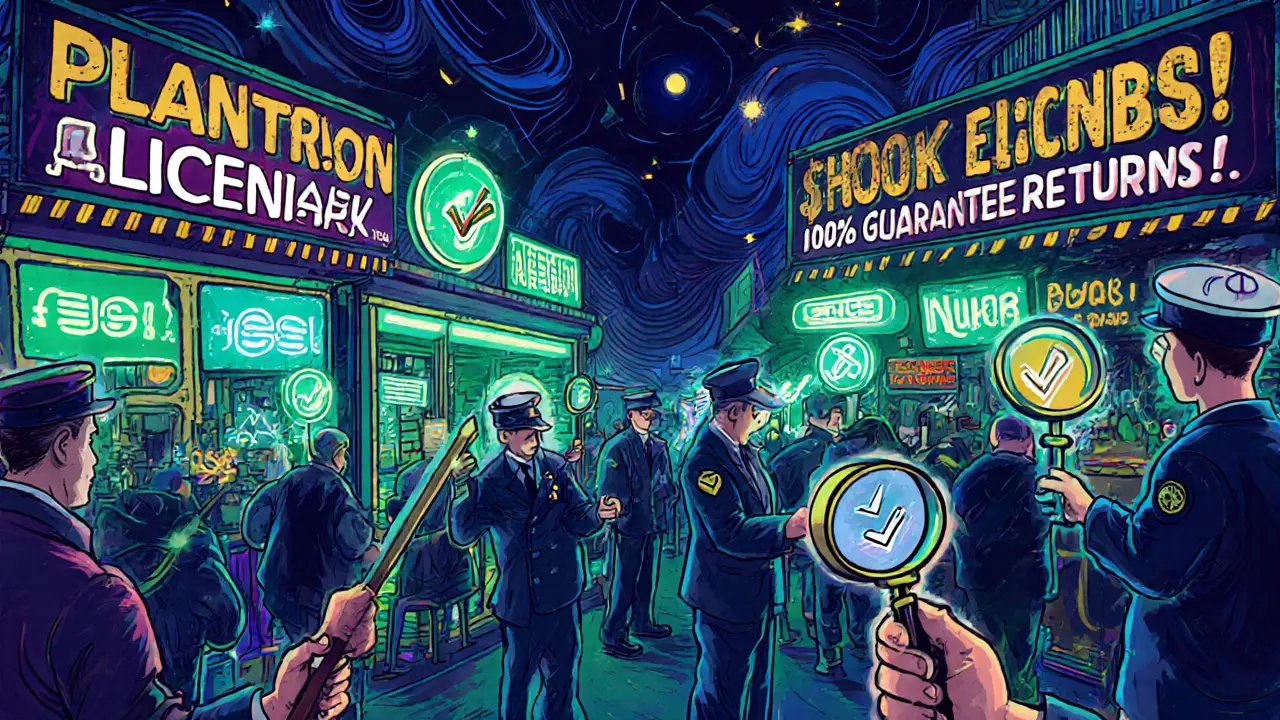

What About Marketing and Ads?

Remember those flashy TikTok ads promising “get rich quick” with crypto? Those are now high-risk under Australian law. Even if the token isn’t classified as a financial product, you can’t use misleading claims.

ASIC has already taken action against companies that used fake testimonials, exaggerated returns, or implied government backing. One firm was fined for saying their token was “backed by the Australian Reserve Bank.” It wasn’t. Another was caught using actors pretending to be real investors.

Under the new rules, any platform promoting crypto must:

- Clearly state the risks

- Avoid using emotional language like “guaranteed” or “risk-free”

- Not suggest the government endorses any specific coin or platform

That’s a big shift. It’s no longer enough to say “invest at your own risk.” You have to show people exactly what they’re getting into.

Why Did This Happen Now?

The FTX collapse in 2022 was the wake-up call. Thousands of Australians lost their savings. Many didn’t even know their crypto was held on a platform that wasn’t regulated. The government launched a “token mapping exercise” in 2023 to figure out what kinds of digital assets were out there and how they were being used.

Before this, regulation was split. AUSTRAC handled money laundering. ASIC handled financial products. But if a token wasn’t clearly a security, it fell through the cracks. Consumers had no idea who to trust. Now, there’s one clear path: if you’re running a platform where people trade or store crypto, you need a license-and you’re accountable.

What Does This Mean for You?

If you’re buying crypto in Australia today, here’s what you should do:

- Check if the platform has an AFSL - Look for it on their website or search the ASIC register.

- Never trust hype - If it sounds too good to be true, it is. No one can guarantee returns in crypto.

- Know your rights - If a platform lies to you, misleads you, or disappears, you can complain to ASIC or take legal action under the Australian Consumer Law.

- Use only licensed platforms - Even if an unlicensed one offers lower fees, the risk isn’t worth it.

The goal isn’t to stop crypto. It’s to make sure you’re not the one paying the price for someone else’s recklessness.

What’s Next?

The law is drafted and public consultation closed in October 2025. The next step is parliamentary approval. It’s expected to pass, but the real work begins after that: enforcement.

ASIC will need more staff, better tools, and clearer guidelines to monitor hundreds of platforms. If they fail, the whole system collapses. But if they get it right, Australia could become a global model for how to regulate crypto without killing innovation.

For consumers, this is the first time the system is designed to protect them-not just punish bad actors after the fact. That’s progress.

Are all crypto platforms in Australia now licensed?

No. Only platforms that trade or custody digital assets for customers and meet the transaction thresholds must hold an AFSL. Smaller platforms under $5,000 per customer and $10 million annually are exempt. But all platforms, licensed or not, must still follow Australian Consumer Law and cannot mislead customers.

Can I still buy Bitcoin without using a licensed exchange?

Yes, you can buy Bitcoin through peer-to-peer trades or non-platform methods like ATMs or direct transfers. But if you’re using a platform-like a website or app that matches buyers and sellers-it must be licensed if it meets the size thresholds. Unlicensed platforms that operate at scale are breaking the law.

What happens if a licensed crypto platform goes bankrupt?

Licensed platforms must have compensation arrangements in place. This means if they fail and customer funds are lost, there’s a formal process to recover at least part of your assets. This is a major change-before, users had no recourse. Now, platforms must prove they can cover losses before they’re allowed to operate.

Are NFTs regulated in Australia?

Only NFTs traded as investment assets are regulated. If you’re buying an NFT as digital art or a game item and can’t resell it on a public exchange, it’s not covered. But if a platform lets you buy, sell, or trade NFTs for profit, it falls under the new licensing rules.

Is crypto mining regulated in Australia?

No. Mining, staking, and developing blockchain technology aren’t covered by these rules. The regulations only apply to platforms that provide services to consumers-like trading, custody, or exchange. Individual miners and developers aren’t affected.

How do I check if a crypto platform is licensed?

Go to the ASIC Register of Licensed Entities at asic.gov.au and search for the platform’s name. Licensed platforms must display their AFSL number on their website. If you can’t find it, don’t use the service. You can also call ASIC’s hotline for confirmation.

What should I do if I’ve been scammed by a crypto platform?

Report it immediately to ASIC and AUSTRAC. Even if the platform isn’t licensed, you may still have rights under the Australian Consumer Law. Keep all records-screenshots, transaction IDs, messages. ASIC can investigate misleading conduct, even if the platform is offshore. Don’t wait-time matters in fraud cases.

Final Thought

Australia didn’t ban crypto. It didn’t try to control every coin. Instead, it made the system safer by forcing platforms to be transparent, accountable, and fair. That’s not overreach-it’s common sense. If you’re going to let people risk their money, you owe them real protection. Now, they have it.