Crypto ATMs and the $246 Million Scam Epidemic: How Scammers Are Exploiting Unregulated Machines

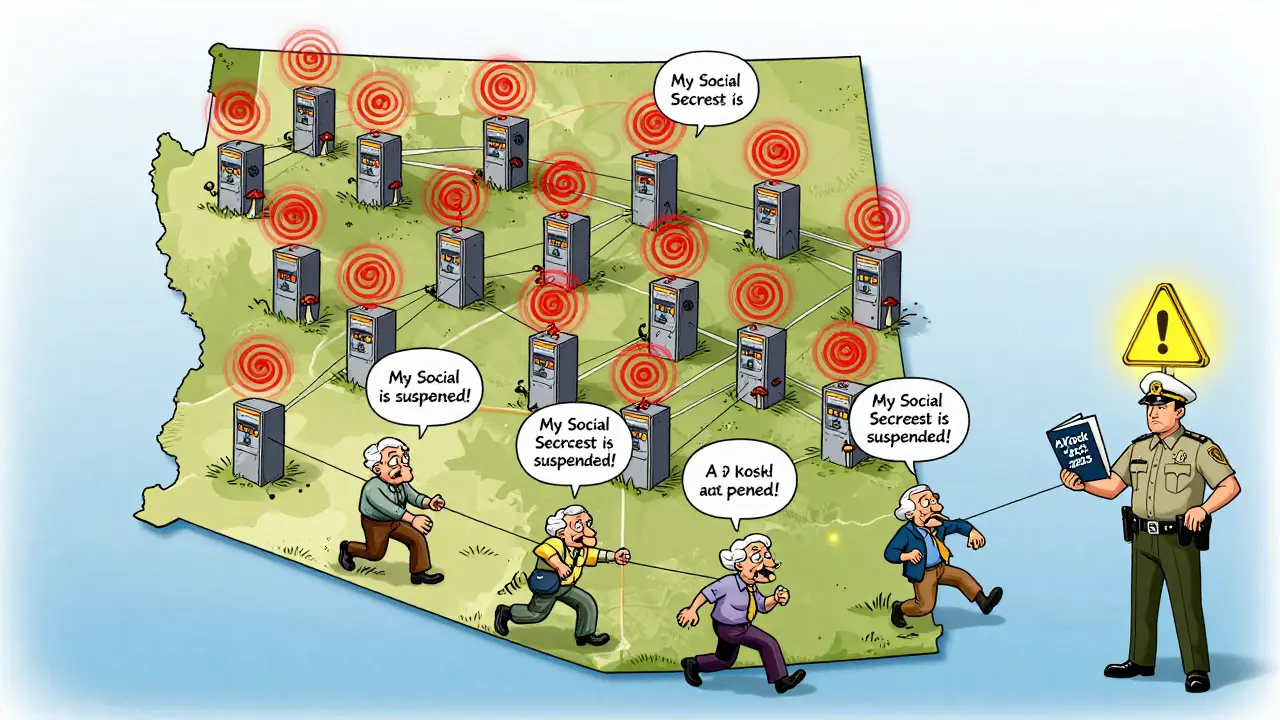

Every day, people walk up to shiny machines in gas stations, convenience stores, and shopping centers, insert cash, and walk away with Bitcoin or Ethereum. It seems simple. Fast. Convenient. But for thousands of Americans, especially seniors, this convenience has turned into a financial nightmare. In 2024 alone, victims lost $246.7 million through cryptocurrency ATMs - and most of it is gone for good.

How Crypto ATMs Work (And Why They’re So Dangerous)

Crypto ATMs, or convertible virtual currency (CVC) kiosks, let you trade cash for cryptocurrency in minutes. You scan a QR code linked to your digital wallet, put in bills, and the machine sends Bitcoin, Ethereum, or another coin to your phone. No bank account. No waiting. No questions asked - at least, not by the machine. That’s the problem. Unlike traditional ATMs, which are locked down by federal rules, crypto ATMs operate in a legal gray zone. Most aren’t required to verify your identity, track your transactions, or report suspicious behavior. The FBI says over 10,956 fraud complaints were filed in 2024. That’s not a typo. Over ten thousand people reported being scammed through these machines. And those are just the ones who came forward. Scammers don’t need hacking skills to pull this off. They just need a phone call. A common scam? Someone pretends to be from the IRS, a tech support team, or even a grandchild in trouble. They tell you to go to a crypto ATM, buy Bitcoin, and send it to a wallet they control. Once the transaction is done, it’s irreversible. No chargeback. No refund. No way to undo it.Who’s Getting Hit the Hardest?

It’s not just tech-savvy people falling for this. The FBI found that more than two-thirds of crypto ATM fraud victims in 2024 were over 60. That’s a 99% increase from the year before. Why seniors? Many are unfamiliar with how crypto works. They trust authority figures. They’re polite. They don’t want to seem confused. And when someone says, “Your Social Security number is suspended,” or “Your grandson is in jail,” they act fast - often heading straight to the nearest crypto ATM. In Arizona, where there are around 600 crypto ATMs, residents lost $177 million in 2024. In Scottsdale alone, police recorded $5 million in losses just this year. In Peoria, one neighborhood lost nearly $1 million in a single year. These aren’t random numbers. These are families who lost retirement savings. People who can’t afford to replace what was taken. And because crypto transactions are anonymous and irreversible, most of this money will never be recovered.The Tech Behind the Scams

It’s not just social engineering. Some scammers are hacking the machines themselves. In March 2024, security researchers at IOActive found critical flaws in the Lamassu Douro Bitcoin ATM model. One vulnerability, CVE-2024-0674, lets a stranger with physical access to the machine gain full control - just by dropping a single malicious file into the system and triggering an update. Once inside, they can steal cash, redirect transactions, or install spyware to capture PINs and wallet keys. These aren’t theoretical risks. They’re real, exploitable holes in machines sitting in public places. And because many operators don’t update their software, these flaws remain open for months - even years. Worse, most crypto ATM operators don’t follow basic financial safety rules. Under the Bank Secrecy Act, businesses that handle money - like money transfer services - must verify customers, log transactions, and report suspicious activity. But many crypto ATM operators skip all of this. They’re not registered as money services businesses. They don’t have compliance officers. They don’t train their staff. And they don’t care if you’re being scammed - as long as you’re buying crypto.

Arizona’s Law: The First Real Defense

Arizona is the only state that’s taken real action. In early 2025, Attorney General Kris Mayes signed the Cryptocurrency Kiosk License Fraud Prevention law. It’s not perfect, but it’s a start. Here’s what it requires:- New customers can only withdraw $2,000 per day

- Existing customers are capped at $10,500 per day

- Every machine must show a warning screen - you must click "I understand" before proceeding

- If you report fraud within 30 days, the operator must refund your money - including fees

- Operators must provide a printed receipt with the recipient wallet address

Why This Keeps Getting Worse

The system is designed to fail. Cryptocurrency was built on decentralization. No banks. No regulators. No middlemen. That’s great for freedom. Terrible for fraud prevention. Once money leaves your wallet and hits a blockchain, it’s gone. No one can freeze it. No one can trace it back to the thief. Even if law enforcement knows the wallet address, they can’t touch it unless the thief makes a mistake. Scammers know this. That’s why they love crypto ATMs. They’re faster than bank wire fraud. Easier than phishing. And harder to stop than any other scam. FinCEN, the Treasury’s financial crimes unit, issued a formal notice in August 2025 warning banks and payment processors to watch for crypto ATM red flags: large cash deposits from new customers, frequent small transactions, and transfers to wallets linked to known fraud cases. But banks can’t stop what happens at a kiosk in a 7-Eleven. That’s the gap.

What You Can Do to Stay Safe

If you’re thinking of using a crypto ATM, stop. First, ask yourself: Why am I doing this?- If someone told you to go to one - don’t. Walk away. Call someone you trust.

- If you’re buying crypto for investment - use a regulated exchange like Coinbase or Kraken. They verify your identity. They have fraud protection. They can freeze accounts if something looks wrong.

- If you must use a crypto ATM - only use it for small amounts. Never send more than $500 at once.

- Always check the machine’s operator. Look for a name and contact info. Avoid machines with no brand or unclear ownership.

- Read the warning screen. If it doesn’t appear, leave.

- Keep a receipt. Write down the wallet address you sent to. If you’re scammed, that’s your only evidence.

roxanne nott

December 19, 2025 AT 21:11crypto atms are just cash machines for criminals. no id? no limits? no refund? wow. what a brilliant business model. lol.

Dan Dellechiaie

December 20, 2025 AT 22:26Let’s be real-this isn’t about crypto. It’s about deregulation dressed up as innovation. These machines are unregulated money transmitters with zero accountability. The FBI’s data is just the tip of the iceberg. We’re not talking about ‘tech illiteracy’-we’re talking about predatory infrastructure. And yes, seniors are targeted because they’re vulnerable, but the real crime is letting these machines exist in the first place.

Every time a state passes a weak law like Arizona’s, it’s just window dressing. Operators still bypass warnings. Machines still don’t log wallets. Refunds? Ha. Good luck getting a dime back from some guy in a garage in Ohio who registered as ‘CryptoKiosk LLC’ with a PO box.

FinCEN’s red flags? Meaningless without enforcement. Banks can’t police 7-Elevens. The only solution is federal licensing, mandatory KYC, daily caps, and mandatory 72-hour holds on all transactions. Anything less is complicity.

Janet Combs

December 21, 2025 AT 04:51i just saw one of these in the gas station near my mom’s house. she asked me if it was like an atm for money. i didn’t know how to explain it without making her scared. now i’m gonna go with her next time she goes. just to watch.

Ellen Sales

December 21, 2025 AT 09:22so let me get this straight… you can’t send $20k through a bank without 17 forms and a notary, but you can walk into a 7-eleven, shove in cash, and send it to a random wallet? and the machine doesn’t even ask your name? lol. capitalism at its finest. 🤡

Sarah Glaser

December 21, 2025 AT 18:17There’s a deeper philosophical question here: When convenience outpaces caution, who bears the moral burden? The victim who trusts a voice on the phone? Or the system that built a machine designed to bypass all human safeguards? We celebrate decentralization as freedom-until it becomes a weapon. The blockchain doesn’t care if you’re old, scared, or alone. It only records. And that’s the tragedy.

We don’t need more laws. We need more humanity in the architecture of finance. A machine that doesn’t pause. Doesn’t warn. Doesn’t ask. That’s not innovation. That’s negligence with a QR code.

Radha Reddy

December 23, 2025 AT 09:57As someone from India, I find this deeply concerning. In our country, digital scams are rising rapidly, especially targeting elders. The same psychological manipulation-impersonating officials, family emergencies-is used everywhere. What’s alarming is how technology amplifies harm when regulation lags. Perhaps global standards for crypto kiosks are needed, not just patchwork state laws. Respect for the vulnerable must be built into the design, not added as an afterthought.

Sheila Ayu

December 24, 2025 AT 07:32Wait-so you’re saying people are being scammed… at ATMs… with CRYPTO… and no one’s doing anything? That’s not a scam-that’s a national emergency. And Arizona’s law? Pfft. ‘Click I understand’? That’s like putting a ‘Do Not Touch’ sign on a live wire. And the fact that operators don’t even have to report anything? Unbelievable. This is worse than the 2008 crisis. At least then, someone got punished.

Shubham Singh

December 25, 2025 AT 01:32It is evident that the absence of centralized oversight has engendered a pernicious ecosystem wherein predatory actors exploit systemic vacuums. The notion that ‘decentralization’ absolves entities of fiduciary responsibility is not only fallacious-it is morally indefensible. The victims are not merely ‘uneducated’; they are systematically abandoned by a regulatory regime that prioritizes capital mobility over human dignity. One must ask: if a machine can be engineered to facilitate irreversible financial harm, is it not, by definition, an instrument of malice?

Charles Freitas

December 26, 2025 AT 23:10Oh wow. People are dumb. And now we’re blaming the machines? Newsflash: you don’t send Bitcoin to someone who calls you saying your grandkid’s in jail. You hang up. You call the real grandkid. You don’t need a law. You need a brain. This isn’t a crypto problem. It’s a ‘people still believe everything they hear on the phone’ problem. Fix the people, not the machines.

Luke Steven

December 28, 2025 AT 07:34the thing no one talks about? the machines are often owned by people who don’t even live in the same state. some guy in Texas owns 200 ATMs in Arizona. he never visits them. never checks the software. never trains staff. he just collects a cut. and when someone loses $15k? he shrugs. ‘not my problem.’

the real villains aren’t the scammers. they’re the guys sitting at home with a spreadsheet, counting the cash while families cry.

and yeah, i know crypto’s supposed to be ‘free.’ but freedom without responsibility is just chaos. and chaos? it always hurts the people who can’t afford to lose.

Ashley Lewis

December 28, 2025 AT 16:38Let’s not pretend this is a new phenomenon. Fraud has always existed. The real issue is the media’s obsession with sensationalizing crypto as a vector rather than a symptom. This isn’t about technology-it’s about human gullibility amplified by poor financial literacy. Blaming ATMs is as productive as blaming hammers for murders.