How DeFi is Disrupting Traditional Finance

DeFi Yield Calculator

Calculate Your Potential Returns

Results

Traditional Bank

$0.00

DeFi

$0.00

Based on article data: Traditional savings rates average 0.5% APY (as of 2025), while DeFi lending protocols offer 5-15% APY.

Note: DeFi returns are subject to market volatility and smart contract risk.

DeFi isn’t just another buzzword in tech-it’s rewiring how money moves, who controls it, and who gets access to it. While banks still operate within rigid hours, behind closed doors and with layers of middlemen, DeFi runs nonstop on public blockchains, open to anyone with an internet connection. No branch visits. No credit checks. No paperwork. Just code executing financial tasks automatically. And it’s growing fast. As of early 2025, over $125 billion in assets are locked into DeFi protocols, up from just $10 billion in 2021. That’s not a blip. That’s a seismic shift.

What Exactly Is DeFi?

DeFi stands for Decentralized Finance. It’s a collection of financial services-lending, borrowing, trading, saving-that run on blockchain networks without banks or brokers. Instead of relying on institutions to verify your identity or approve your loan, DeFi uses smart contracts: self-executing code that follows rules written into the blockchain. If you deposit $1,000 worth of Ethereum into a DeFi lending platform like Aave, the contract automatically locks it, lets others borrow against it, and pays you interest-all without a human touching the process.

Unlike traditional finance, where your money sits in a bank account controlled by the institution, DeFi gives you full control through non-custodial wallets like MetaMask or Ledger. You hold the keys. No one else can freeze your funds or decide you’re not creditworthy. This isn’t theoretical-it’s how a farmer in rural Bihar can now lend crypto and earn yield without ever stepping into a bank. That’s the power of permissionless access.

How DeFi Breaks the Mold of Traditional Finance

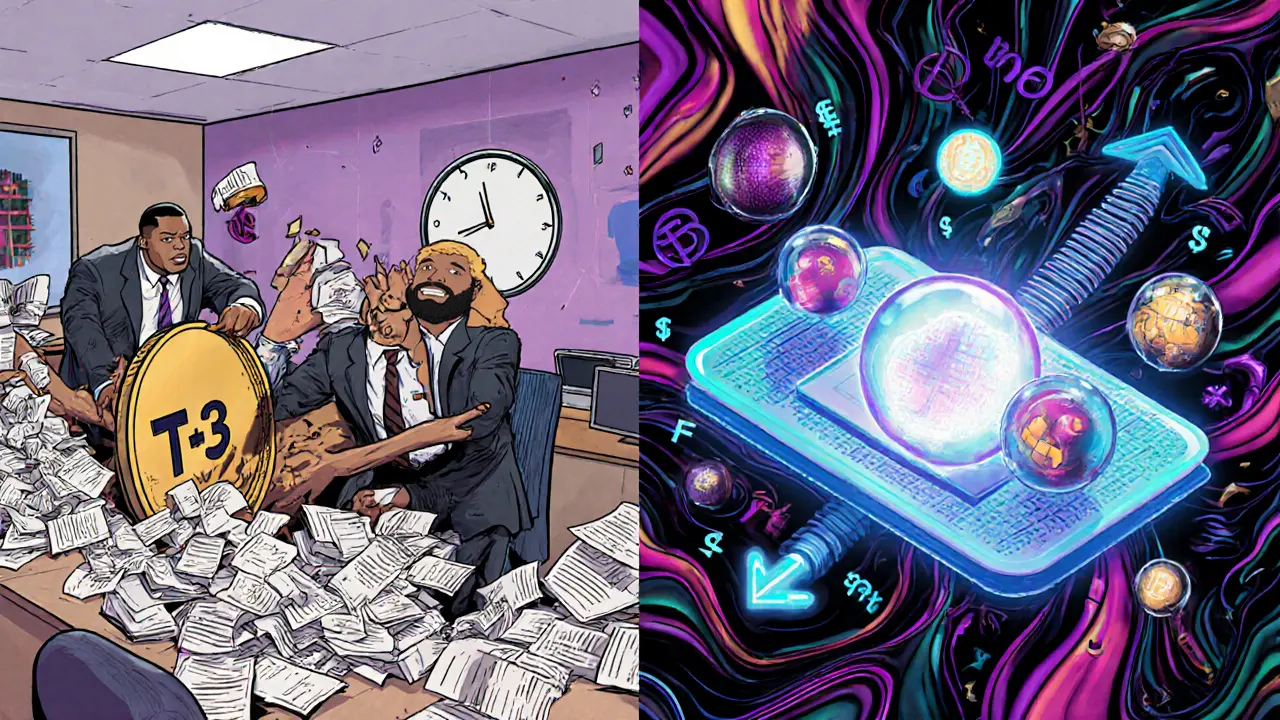

Traditional finance runs on slow, manual systems. When you buy stocks, it takes two to three days for the trade to settle. DeFi settles in seconds. When you apply for a loan, banks demand pay stubs, tax returns, and credit scores. DeFi asks for collateral-usually over 150% of the loan amount-and locks it in a smart contract. No income verification. No credit history. Just crypto.

Here’s how the two systems stack up:

| Feature | DeFi | Traditional Finance |

|---|---|---|

| Access | Anyone with internet and a wallet | Requires ID, KYC, bank approval |

| Custody | Self-custody (you hold keys) | Third-party custody (bank holds your money) |

| Operating Hours | 24/7, global | 9-5, weekdays, region-dependent |

| Settlement Time | Seconds to minutes | T+2 or T+3 days |

| Transaction Fees | $0.01-$0.10 on Layer 2 chains | $5-$50+ in commissions and hidden fees |

| Innovation Speed | New protocols launch weekly | Years to roll out new products |

| Regulation | Evolving, patchy enforcement | Strict, standardized global rules |

DeFi doesn’t just compete with traditional finance-it bypasses it entirely. Why wait weeks for a business loan when you can get one in minutes by locking up your crypto? Why pay 2% in wire transfer fees when you can send $10,000 across borders for under $1? These aren’t hypothetical savings. They’re real numbers people are seeing every day.

The Real-World Impact: Who Benefits?

DeFi’s biggest win isn’t speed or low fees-it’s inclusion. The World Bank estimates 1.7 billion adults globally are unbanked. They don’t have access to savings accounts, loans, or insurance. Traditional finance doesn’t serve them because they’re seen as too risky or too expensive to onboard.

DeFi changes that. In Nigeria, people use DeFi platforms to hedge against inflation by holding stablecoins like USDC instead of the naira. In Argentina, users bypass capital controls to move money out of the country. In India, despite a 30% tax on crypto gains and 1% TDS, over 8 million users still trade on decentralized exchanges like PancakeSwap. Why? Because the alternative-losing value to currency devaluation or being locked out of credit-is worse.

It’s not just developing nations. Even in the U.S., people are turning to DeFi for better yields. Savings accounts pay 0.5% interest. DeFi lending pools pay 5-10%. That’s not gambling-it’s rational finance. People aren’t chasing moonshots. They’re chasing returns that make sense.

Where DeFi Still Falls Short

Let’s be clear: DeFi isn’t perfect. It’s still young. And it’s dangerous if you don’t know what you’re doing.

Security is the biggest concern. The Poly Network hack in 2021 stole $600 million. While that was a one-time event, it exposed a truth: smart contracts are code, and code can have bugs. Since then, audits have improved. The Immunefi 2024 report shows critical vulnerabilities dropped by 37% year-over-year. But the risk remains. If you send funds to the wrong address? Gone forever. No customer service. No refund.

Then there’s complexity. Setting up a wallet, buying crypto, switching networks, managing gas fees-it’s overwhelming for beginners. A 2025 survey found 28% of user errors came from misconfigured gas settings. Another 19% lost funds due to phishing or poor wallet security. Platforms like MetaMask have a 3.8/5 rating on Trustpilot, mostly because they’re powerful but not intuitive.

Regulation is another wall. In the U.S., 32% of DeFi protocols block American users outright because of unclear rules. The SEC hasn’t decided whether most tokens are securities or not. That uncertainty keeps big banks and pension funds on the sidelines. Meanwhile, places like Singapore and Switzerland are building clear frameworks, attracting institutional players.

The Future: DeFi + AI and the Rise of Convergence

DeFi’s next phase isn’t about replacing banks-it’s about blending with them. We’re already seeing signs of this. JPMorgan’s Onyx blockchain processes $1 billion in daily wholesale payments using private blockchain tech. That’s not DeFi. But it’s the same underlying tech.

Tokenization is the bridge. Real estate, stocks, bonds-they’re being turned into digital tokens that can trade on DeFi platforms. A $5 million apartment in Miami can be split into 1,000 tokens. Anyone can buy one. Liquidity jumps. Ownership becomes fractional. Pilot programs show this can increase market liquidity by 40-60%.

Then there’s DeFAI-DeFi + Artificial Intelligence. New AI agents are popping up that act like personal finance assistants. Instead of manually checking yield rates across 10 different protocols, an AI agent scans them all, picks the safest option, and executes the trade. It warns you about high slippage. It reminds you to claim rewards. It explains gas fees in plain English. Crypto.com’s May 2025 report calls this the “next frontier” for mass adoption.

These aren’t sci-fi dreams. They’re already in beta. And they’re solving the biggest barrier to DeFi: the learning curve.

Can DeFi Fully Replace Traditional Finance?

Unlikely. Not anytime soon.

Traditional finance has trust built over centuries. Insurance. Regulation. Legal recourse. DeFi has none of that. If you lose your private key, you’re out of luck. If a protocol gets hacked, you don’t get FDIC protection. That’s why Gartner predicts only 20% of traditional financial services will integrate DeFi components by 2028-not replace them.

But that’s not the point. DeFi isn’t trying to kill banks. It’s showing them they can do better. It’s forcing them to lower fees, speed up transfers, and open access. It’s giving billions of people a financial lifeline they never had. And it’s proving that money doesn’t need gatekeepers to work.

The future isn’t DeFi or traditional finance. It’s DeFi and traditional finance-working together, each fixing the other’s flaws.

How to Get Started (Safely)

If you’re curious, here’s how to dip your toes in without risking everything:

- Get a wallet: Install MetaMask (free, browser extension). Never share your seed phrase.

- Buy crypto: Use Coinbase or Binance to buy ETH or USDC. Transfer it to your wallet.

- Start small: Try lending $20 on Aave or swapping $10 on Uniswap. Learn how gas fees work.

- Use Layer 2: Switch to Polygon or Arbitrum to avoid high Ethereum fees.

- Never invest more than you can afford to lose.

It takes 15-20 hours to get comfortable. But once you do, you’ll see finance differently. Not as something controlled by institutions-but as something you can control yourself.

Is DeFi safe to use?

DeFi is safe if you understand the risks. Smart contracts can have bugs, and you’re responsible for your own funds. No bank will refund you if you send money to the wrong address. But security has improved dramatically-critical vulnerabilities dropped 37% in 2024 thanks to better audits. Start small, use trusted platforms like Aave or Uniswap, and never invest more than you can lose.

Can I make money with DeFi?

Yes, but not without risk. DeFi lending and liquidity pools often pay 5-15% annual yields, far higher than bank savings accounts. But these returns come from volatile crypto assets. If the price of ETH drops 30%, your collateral could be liquidated. This isn’t passive income-it’s active investing. Treat it like trading stocks, not putting money in a CD.

Do I need to be tech-savvy to use DeFi?

You don’t need to be a coder, but you do need to learn basics: how wallets work, what gas fees are, and how to spot phishing scams. Tools like AI-powered DeFi assistants (DeFAI) are making this easier. Still, if you’re uncomfortable with technology, start with centralized platforms like Coinbase or PayPal’s crypto features before moving to full DeFi.

Why is DeFi so popular in India?

India has over 8 million DeFi users because traditional finance doesn’t serve everyone. High inflation, currency controls, and limited access to credit push people toward crypto. Even with a 30% tax on gains and 1% TDS, users still find DeFi more profitable than keeping money in a savings account. Platforms like PancakeSwap let them trade without paperwork or bank approval.

Will banks disappear because of DeFi?

No. Banks won’t vanish. But they’re already adapting. JPMorgan uses blockchain for wholesale payments. Goldman Sachs is exploring tokenized assets. DeFi isn’t replacing them-it’s pushing them to innovate. The future is hybrid: banks using DeFi tech for faster settlements and lower costs, while DeFi gains legitimacy through regulation and institutional adoption.

Robin Hilton

November 7, 2025 AT 14:28DeFi? Yeah, right. Like I'm just gonna hand over my crypto to some anonymous smart contract written by a 19-year-old in a basement. Meanwhile, my bank gives me FDIC insurance, fraud protection, and a human to yell at when things go wrong. This 'permissionless' nonsense is just reckless gambling with other people's life savings.

Grace Huegel

November 9, 2025 AT 09:20It’s fascinating how DeFi reifies the neoliberal fantasy of radical individualism-where financial agency is conflated with moral virtue, and systemic risk is externalized onto the uninitiated. The aesthetics of decentralization mask a profound lack of institutional accountability. One wonders if this is liberation… or merely a more elegant form of exploitation.

Nitesh Bandgar

November 9, 2025 AT 22:29Brooooooo!!! Did you SEE that guy in Bihar who got a loan in 47 seconds??!!! That’s not finance-that’s MAGIC!!! 🤯🔥 And then some rich dude in Silicon Valley says ‘it’s risky’-RISKY?? My cousin in Jaipur lost 12 lakhs to a rug pull last month and he’s STILL smiling because now he’s ‘in the game’!!! This isn’t about money-it’s about FREEDOM!!! No more bank managers looking down their noses at us!!!

Jessica Arnold

November 10, 2025 AT 22:25The ontological shift here is profound: DeFi doesn’t merely disrupt financial intermediation-it dissolves the epistemic authority of centralized institutions. The smart contract becomes the new juridical subject, enforcing trustless reciprocity through algorithmic determinism. The real innovation isn’t yield farming-it’s the reconstitution of social trust as cryptographic consensus. We’re witnessing the birth of a post-institutional economic ontology.

Chloe Walsh

November 11, 2025 AT 03:46So you're telling me I should risk everything because some guy coded a contract that says 'you get 12% APY'?? And if I mess up? Oh well, bye bye life savings. Meanwhile my bank charges me $5 for an ATM but at least I can call them and they'll say 'sorry' and give me a coupon for free coffee. This isn't finance. This is a casino run by people who think 'gas fees' are a type of coffee

Stephanie Tolson

November 12, 2025 AT 14:57DeFi isn’t about replacing banks-it’s about giving people who’ve been shut out for generations a seat at the table. I’ve seen grandmas in rural Ohio earn more on Aave than their savings accounts. I’ve seen students in Kenya pay for school with stablecoin interest. This isn’t speculation. It’s dignity. Start small. Learn. Don’t fear it-embrace it. The future isn’t waiting for permission.

Anthony Allen

November 12, 2025 AT 21:47Honestly I think this is the most balanced take I’ve read. The part about tokenized real estate? Mind blown. I never thought I’d see a $5M Miami condo split into 1000 tokens. That’s wild. And the AI agents? I tried one last week-it literally explained gas fees in plain English. I finally get it. DeFi isn’t for everyone, but it’s definitely for more people than banks ever were.

Megan Peeples

November 13, 2025 AT 22:51Oh please. 'Anyone with internet'-right. Like I’m supposed to believe that someone in rural India has the technical literacy to navigate MetaMask, gas fees, slippage settings, and phishing scams? This isn’t inclusion-it’s predatory. You’re not helping them-you’re turning them into collateral for DeFi’s next VC-funded rug pull. And you call this 'empowerment'? It’s exploitation dressed up as innovation.

Sarah Scheerlinck

November 14, 2025 AT 06:01I’ve watched my sister try to use DeFi. She sent $300 to the wrong address. No refund. No help. No apology. Just silence. And now you want to tell me this is better than a bank that at least has a customer service line? I’m not against innovation-but if the price of access is financial ruin for the vulnerable, then we’re not building a better system-we’re just making it prettier.

karan thakur

November 14, 2025 AT 06:59DeFi is a CIA operation disguised as finance. They want you to think you're free but you're just feeding data to quantum algorithms that predict your spending habits. The 30% tax in India? That's just the tip of the iceberg. Soon your crypto wallet will be linked to your Aadhaar and your movements tracked. The 'unbanked' are being turned into digital serfs. Don't be fooled. This isn't liberation-it's surveillance capitalism with a blockchain logo.

Evan Koehne

November 14, 2025 AT 21:39So let me get this straight: you’re telling me that instead of trusting a 200-year-old institution with regulators, auditors, and lawyers, I should trust code written by a guy who got paid in ETH to fix a bug in a contract named 'BunnyYieldV3'? And this is the future? I’m not anti-tech. I’m pro-not-being-an-idiot.

Vipul dhingra

November 16, 2025 AT 10:37DeFi is dead. You think those numbers are real? Most of that $125B is just people moving money between their own wallets to inflate TVL. And the 'farmers in Bihar'? They’re using it to buy iPhones on EMI. No one’s actually using DeFi for finance. It’s all just gambling with fake money. Banks are still winning because they’re the only ones who know how to make money without losing it

Jacque Hustead

November 16, 2025 AT 20:32Everyone’s so focused on the tech or the risk or the hype-but the real win is how this is changing conversations. My uncle, who used to say 'crypto is a scam,' now asks me how to set up a wallet so he can earn interest on his pension. That’s the quiet revolution. It’s not about replacing banks. It’s about giving people the power to ask better questions. And that’s worth more than any APY.