NFT Market Crash: What Happened and Why It Collapsed So Fast

NFT Value Collapse Calculator

Your NFT Investment

Market Impact Analysis

Based on article data: 60%+ value decline from peak

Gas Fee Impact

High gas fees made selling many NFTs impossible. If your gas fee is $35 and your NFT was worth $50, you'd lose $85 ($50 value + $35 fee).

Estimated Value at Collapse

Total Loss:

Percentage Loss:

Gas Fee Impact:

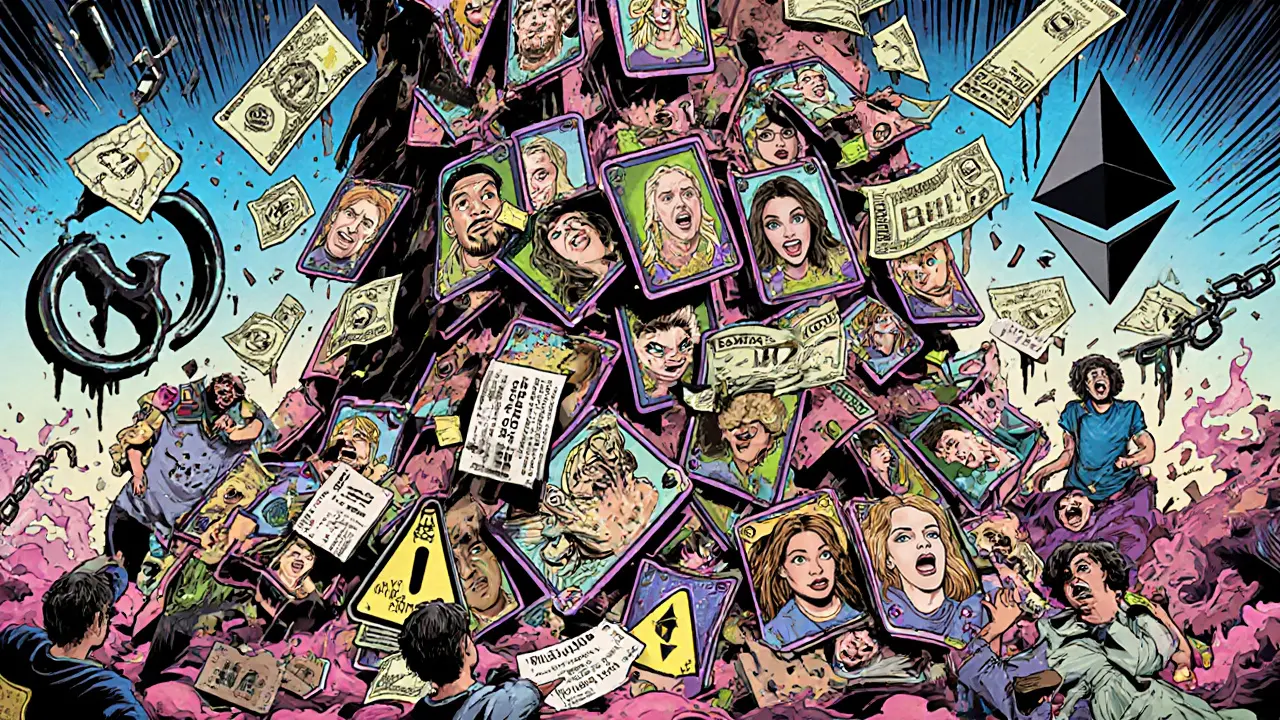

The NFT market didn’t just slow down in 2022-it imploded. What was once a $3 billion monthly trading frenzy shrank to a fraction of that by mid-year. In November 2021, people were paying millions for pixelated apes and digital sneakers. By June 2022, many of those same NFTs couldn’t give away for $10. This wasn’t a gentle correction. It was a full-blown crash, and the reasons behind it go deeper than just "it was a bubble."

How High Did NFTs Really Go?

In early 2021, NFTs were a niche curiosity. By late 2021, they were everywhere. Christie’s sold Beeple’s digital artwork for $69 million. NBA Top Shot sold highlight clips like rare trading cards, with some packs hitting $200,000. Gucci and Dolce & Gabbana dropped NFT-only fashion lines. Celebrities like Snoop Dogg and Paris Hilton jumped in, promoting their own collections. The hype wasn’t just online-it was on TV, in magazines, even in corporate boardrooms. The numbers tell the story. Monthly trading volume peaked at $2.8 billion in January 2022. Bored Ape Yacht Club NFTs traded for over $3 million each. CryptoPunks, once considered odd digital collectibles, were selling for tens of millions. Investors thought they were getting in on the next internet revolution. But that surge wasn’t built on real demand-it was built on speculation, FOMO, and easy money.The Crash Started Before the News Broke

Most people think the crash began in early 2022. It didn’t. The signs were already there in late 2021. Sales volume started slipping in October. By December, the number of buyers was already dropping. The real collapse hit in February 2022, when daily NFT sales plunged 92% from their peak, according to the Wall Street Journal. That’s not a dip. That’s a cliff. By June 2022, the market had lost over 60% of its value since January. Total sales volume fell from $2.8 billion to under $1 billion. The number of active sellers dropped by 36%. Buyers? Down 25%. Even more telling: the average profit from reselling NFTs collapsed by 46%. People who bought at the top were stuck. They couldn’t sell without taking huge losses. And many just didn’t want to face the truth.

Why Did It Collapse? It Wasn’t Just One Thing

The crash didn’t happen because one thing went wrong. It happened because everything went wrong at once. First, the economy turned. Inflation hit 9.1% in June 2022-the highest in 40 years. Interest rates started rising. The S&P 500 lost 23% of its value from the end of 2021 to mid-2022. People lost money in stocks. Their savings shrank. Suddenly, buying a $100,000 digital ape looked like a luxury they couldn’t afford. Investors started pulling money out of risky assets first-and NFTs were at the top of that list. Second, wash trading ruined trust. A huge chunk of NFT sales were fake. Sellers would buy their own NFTs using different wallets to make it look like demand was high. This tricked new buyers into thinking a collection was hot. When the truth came out, people realized the numbers were lies. Trust vanished overnight. Third, gas fees made selling impossible. Most NFTs lived on Ethereum. To sell a $50 NFT, you’d pay $30-$50 in gas fees. For many owners, it cost more to sell than the NFT was worth. So they just held on. That created a frozen market. No one was buying. No one could afford to sell. The liquidity vanished. Fourth, the environmental backlash hit hard. Younger buyers-who helped drive early adoption-began asking: "Why am I spending money on something that uses more energy than a small country?" The criticism wasn’t just noise. It changed public perception. Brands started backing away. Investors got nervous. And then there was regulation. Governments started asking: Are NFTs securities? Should they be taxed like stocks? Who owns the copyright? No one had answers. Without clear rules, banks and institutional investors stayed away. The money that could’ve saved the market never showed up.Who Got Hurt the Most?

Artists who built their entire income on NFTs were crushed. One digital creator told me she made $20,000 in a single month in late 2021. By June 2022, she hadn’t sold a single piece in four months. Her followers were gone. The market had moved on. Collectors who bought at the peak lost 80-95% of their portfolio value. Reddit threads from r/NFT and r/CryptoCurrency were full of people asking, "How do I get out?" The answer? You don’t. Most NFTs from 2021 are now worth less than the cost of the gas fee to list them. Investment funds that bet big on NFTs had to write off millions. Some shut down. Others pivoted to other crypto projects.

What’s Left After the Crash?

The NFT market didn’t die. It shrank. And in that shrinkage, something else emerged. The hype-driven art collections? Mostly gone. But utility-based NFTs are still around. Gaming companies use them for in-game items you can trade across platforms. Some brands use NFTs as digital tickets or loyalty passes. Others use them for verified digital identity-think of it like a digital passport for your online presence. Projects that focused on real use cases survived. Those that just sold JPEGs? Dead. Gas fees are lower now. New blockchains like Polygon and Solana offer cheaper transactions. Some NFT platforms now let you mint without paying upfront fees. That’s helped small creators get back in.Will NFTs Ever Come Back Like They Did in 2021?

No. And that’s probably for the best. The 2021 boom wasn’t innovation-it was gambling. People weren’t buying NFTs because they believed in digital ownership. They were buying because they thought they could flip them for 10x profit. That’s not a market. That’s a casino. The crash cleared out the noise. What’s left is a smaller, quieter, more serious market. One where NFTs serve a purpose, not just a price tag. The next wave won’t be led by celebrities. It’ll be led by developers, game designers, and companies trying to solve real problems: proving ownership of digital goods, securing access, or linking physical and digital identities. The bubble burst. But the technology? It’s still here. And this time, it might actually last.What caused the NFT market crash in 2022?

The NFT market crash in 2022 was caused by a mix of factors: rising inflation and interest rates pushed investors to pull out of risky assets, wash trading created fake demand that collapsed when exposed, high Ethereum gas fees made selling low-value NFTs impossible, environmental concerns turned off younger buyers, and unclear regulations scared off institutional investors. All of this combined to kill the speculative frenzy that had driven prices up in 2021.

Did anyone make money from the NFT crash?

Yes-early adopters who bought NFTs in 2020 or early 2021 often still made profits, even after prices dropped. Some sold high before the crash, cashing out millions. Others held onto their best pieces and waited. Meanwhile, a few traders made money by buying undervalued NFTs during the crash and reselling them later when the market stabilized. But for the vast majority who bought at the peak, the answer is no.

Are NFTs still worth anything today?

Some are, but most aren’t. The NFTs that still have value are tied to real utility-like access to exclusive events, in-game items in popular games, or digital identity verification. Collections that were just JPEGs with no purpose are mostly worthless. A Bored Ape might still sell for thousands, but 95% of NFTs from 2021 are trading for under $10, if at all.

Can you still make money from NFTs now?

It’s possible, but it’s not easy. The days of flipping NFTs for quick profits are over. Today, success comes from building real value-like creating NFTs that unlock experiences, services, or community access. Artists and developers who focus on utility, not hype, are the ones seeing slow but steady growth. If you’re looking to get in, treat it like a business, not a lottery ticket.

Why did gas fees hurt the NFT market so much?

Ethereum gas fees were often $30-$50 per transaction. If you owned an NFT worth $50, selling it could cost you more than the asset itself. That meant most small NFTs couldn’t be traded profitably. Owners were stuck. Buyers saw the fees and walked away. This froze the market, killing liquidity and making it impossible for prices to recover naturally.

Is the NFT market dead?

No, but the speculative bubble is. The NFT market is quieter now, but it’s not gone. It’s evolving. Real use cases in gaming, digital identity, and verified ownership are growing. The hype is gone, and that’s actually a good thing. What remains is a more sustainable foundation for digital ownership.

What’s the difference between NFTs in 2021 and NFTs in 2025?

In 2021, NFTs were mostly JPEGs sold for speculation. In 2025, they’re tools. They grant access to private communities, verify ownership of digital assets in games, act as tickets to real-world events, or serve as digital IDs. The focus shifted from "what can I resell?" to "what can I use?" The value is no longer in the image-it’s in the function.

Bruce Bynum

November 1, 2025 AT 16:46NFTs were never about art. They were about who could scream the loudest in a casino dressed like a tech conference.

Masechaba Setona

November 3, 2025 AT 05:10They said it was decentralization... but it was just Wall Street with JPEGs. 😒

Kymberley Sant

November 3, 2025 AT 22:45gas fees were the real villain here… i mean come on, payin 50 bucks to sell a 20 buck ape? that’s not a market thats a scam

Wesley Grimm

November 4, 2025 AT 06:04The collapse wasn’t unexpected. The volume metrics were fabricated, the floor prices were manipulated, and the buyer base was entirely speculative. This was a textbook pump-and-dump disguised as innovation. The only surprise is how long it took for the masses to realize they were being played.

mark Hayes

November 5, 2025 AT 22:07people keep forgettin that crypto was built on hype and free money. when the fed started hikin rates, the whole house of cards just… poof. 😅 nothin personal, just econ 101

naveen kumar

November 6, 2025 AT 08:09Actually, the crash was orchestrated. The same institutions that hyped NFTs as "the future" quietly shorted them through private derivatives. The environmental backlash? A distraction. The gas fees? A feature, not a bug. They wanted the retail investors to bleed so they could buy the remaining utility NFTs at 5% of peak value. You think this was market forces? No. It was a controlled demolition.

Shaunn Graves

November 7, 2025 AT 12:19So you’re telling me the only people who didn’t get screwed were the ones who sold before the hype even peaked? That’s not a market-it’s a rigged game where the house always wins, and the players are too drunk on FOMO to notice they’re holding empty bottles.

Beth Devine

November 7, 2025 AT 14:00It’s sad how many artists got crushed. But the ones who stuck with it? They’re now building real things-digital passports, ticketing systems, game items that actually cross-platform. The noise is gone. The work remains.

Jessica Hulst

November 9, 2025 AT 00:45Let’s be honest: we didn’t crash because of inflation or gas fees. We crashed because we confused ownership with obsession. We thought owning a JPEG made us part of something revolutionary. But ownership without utility is just digital hoarding. And hoarding? That’s not innovation. That’s a very expensive form of loneliness.

Kaela Coren

November 9, 2025 AT 23:53While the speculative frenzy has subsided, the underlying technological framework of non-fungible tokens continues to demonstrate measurable utility in digital rights management, supply chain provenance, and decentralized identity systems. The market correction, therefore, represents not an endpoint, but a transition phase toward institutional-grade application.

Helen Hardman

November 11, 2025 AT 08:48Look, I know it’s easy to laugh at the Bored Apes now, but remember-some of us actually met our best friends through NFT communities. We had Discord calls, shared art, even started a small charity fund for digital creators. The hype died, but the people? They’re still here. And that’s worth more than any JPEG.

David James

November 12, 2025 AT 04:24the truth is nfts were always gonna be a gamble and most people treated them like lottery tickets. now that the odds are clear, the serious builders are finally getting space to work without the noise. thats progress.

Brian McElfresh

November 13, 2025 AT 21:35They’re hiding the real truth-the NFT market was a front for money laundering through crypto wallets. The celebrities? Paid shills. The "utility" now? A cover story. The government knew. The banks knew. You just didn’t want to see it

Nabil ben Salah Nasri

November 14, 2025 AT 23:12As someone who grew up in a culture where digital identity is sacred, I’ve always believed in ownership. NFTs were never about the art-they were about reclaiming control over our digital selves. The crash? It just cleared out the tourists. The locals? We’re still here, building quietly.

Edgerton Trowbridge

November 15, 2025 AT 00:09It is important to recognize that the NFT market's contraction was not indicative of technological failure, but rather a necessary recalibration of investor expectations and market fundamentals. The emergence of lower-cost blockchains, improved interoperability standards, and a shift toward utility-based applications suggests a maturation process that, while painful, is ultimately healthy for the ecosystem.

DeeDee Kallam

November 16, 2025 AT 23:57i just spent 3 hours scrolling through my nfts… they’re all worth less than my coffee. i miss when i could brag about being rich on twitter. now i just cry into my oat milk latte 😭

Hanna Kruizinga

November 17, 2025 AT 03:44So… what’s the point? If I can’t sell it, if it costs more to list than it’s worth, and no one cares anymore… why do I still have this JPEG on my wall? I’m not even mad. I’m just… tired.