Supreme Court Crypto Ruling in India: What the Landmark Decision Means for Traders

India Crypto Tax Calculator

Calculate Your Crypto Tax Liability

India imposes 30% tax on profits + 1% TDS on transactions above ₹10,000

Transaction Value: ₹0

Gains: ₹0

30% Tax: ₹0

1% TDS: ₹0

Total Tax: ₹0

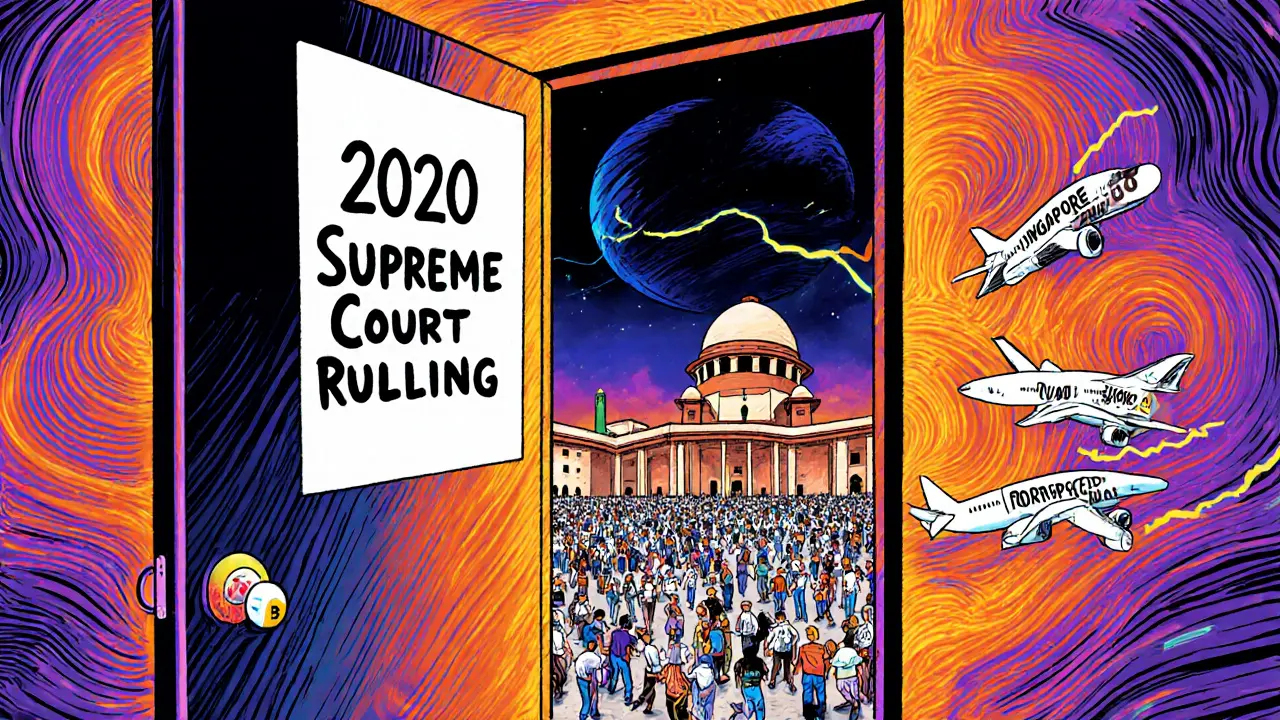

Before March 2020, if you wanted to buy Bitcoin in India, you had to find someone willing to trade cash in person. Banks had been ordered to cut off all services to cryptocurrency exchanges. No deposits. No withdrawals. No trading. It wasn’t illegal to own crypto - but it was practically impossible to use it. Then the Supreme Court crypto ruling in India changed everything.

The Ban That Didn’t Add Up

In April 2018, the Reserve Bank of India (RBI) issued a circular banning all banks and financial institutions from providing services to crypto businesses. The move was meant to protect consumers from volatility and fraud. But it didn’t stop people from trading. It just forced them underground. Exchanges like WazirX and CoinDCX lost access to bank accounts. Users couldn’t cash out. The entire ecosystem froze. The Supreme Court didn’t agree. In March 2020, after a legal challenge from the Internet and Mobile Association of India, the court ruled the RBI’s ban was unconstitutional. The judges said the central bank had no right to impose a blanket ban without evidence of harm to the financial system. The ruling didn’t legalize crypto - it just removed the government’s main tool to shut it down. This wasn’t a green light. It was a stop sign pulled down. For the first time, Indians could legally use banks to trade Bitcoin, Ethereum, and other digital assets. Within months, user numbers on Indian exchanges jumped by 300-400%. By 2025, an estimated 15 to 20 million Indians owned cryptocurrency - making India one of the top five countries in global adoption.What the Court Actually Said

The Supreme Court’s decision was built on two key legal principles: proportionality and constitutional rights. The court found that the RBI’s ban was too broad. It punished every crypto user because a few might be involved in fraud or money laundering. That’s like banning all cars because some are used in robberies. The judges pointed out that no law in India made cryptocurrency illegal. The RBI, as a regulator, couldn’t create its own criminal law. Only Parliament could do that. And Parliament hadn’t acted. So the court stepped in to prevent regulatory overreach. Justice B.R. Gavai and Justice N. Kotiswar Singh emphasized that innovation shouldn’t be crushed by fear. They warned that shutting down an entire technology sector without clear evidence of harm could hurt India’s digital economy and push talent abroad.But There’s a Catch - Taxes and Uncertainty

Just because you can trade crypto doesn’t mean it’s easy. The government responded to the court’s ruling not with regulation, but with taxes. In 2022, India introduced two harsh rules:- 30% tax on all profits from crypto trades - no deductions, no losses offset, no matter how long you held the asset.

- 1% Tax Deducted at Source (TDS) on every crypto transaction above ₹10,000.

What About DeFi, NFTs, and Cross-Border Trades?

The 2020 ruling only cleared the way for basic buying and selling. It didn’t address the newer parts of crypto: decentralized finance (DeFi), non-fungible tokens (NFTs), or crypto-to-crypto swaps. These are now huge in India, but there’s no official guidance on how to report them for taxes. If you use a DeFi protocol like Uniswap to swap Ethereum for Solana, do you owe tax? If you buy an NFT from a foreign creator, is that a capital gain? The Income Tax Department hasn’t said. Many traders are guessing - and risking penalties. Legal experts say the lack of clarity is the biggest threat. The Supreme Court removed a ban, but the government hasn’t replaced it with rules. That leaves investors in legal limbo.What the Court Is Saying Now - 2025

The Supreme Court hasn’t stayed quiet since 2020. In October 2025, the court questioned the government directly about why it hasn’t passed a crypto law after five years. Justice Surya Kant called unregulated Bitcoin trading “nothing but a more polished form of Hawala” - referring to India’s traditional underground money transfer system. That might sound like a warning. But the court also made it clear: outright bans won’t work. Global finance is changing. Digital assets are here to stay. India can’t afford to ignore them. The court is now pushing the government to act. It’s not asking for a ban. It’s asking for a framework - one that protects users, prevents fraud, and keeps innovation alive.

Why This Matters for You

If you’re an Indian crypto trader, the 2020 ruling gave you freedom. But freedom without rules is risky. You can trade legally. But you must:- Keep records of every transaction - buys, sells, swaps, and transfers.

- Calculate your gains and losses accurately - even if you trade between coins.

- Pay 30% tax on profits, plus 1% TDS on every trade above ₹10,000.

- File your taxes under the “Income from Capital Gains” section.

What’s Next?

The government has a draft bill - the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 - that proposes banning private cryptocurrencies and launching a digital rupee. But it’s been stuck for four years. The Supreme Court is running out of patience. If the government still doesn’t act by early 2026, the court might step in again - this time to set basic rules itself. For now, the legal status of crypto in India is clear: it’s allowed. But the rules around it are messy, expensive, and uncertain. The Supreme Court didn’t give you a free pass. It gave you a chance - to trade, to grow, to innovate. Now it’s up to the government to make sure that chance doesn’t turn into a trap.What You Should Do Today

1. Track every transaction - use a crypto tax tool like Koinly or CoinTracker to log buys, sells, and swaps. 2. Save receipts - keep screenshots of trade confirmations and wallet addresses. 3. Know your tax liability - 30% on gains, 1% TDS on every trade over ₹10,000. 4. Don’t ignore filings - even small trades need to be reported. 5. Stay updated - the government could change rules at any time. Follow the Supreme Court’s next hearings. The ruling in 2020 opened the door. Don’t let confusion close it.Is cryptocurrency legal in India after the Supreme Court ruling?

Yes, cryptocurrency is legal in India. The Supreme Court’s 2020 ruling struck down the Reserve Bank of India’s ban on banks serving crypto businesses. You can buy, sell, and hold Bitcoin, Ethereum, and other digital assets without breaking the law. However, the government has not passed a formal regulatory law, so the legal environment remains uncertain.

What is the crypto tax rate in India?

India imposes a flat 30% tax on all profits from cryptocurrency trades, regardless of how long you held the asset. There are no deductions for losses or expenses. Additionally, a 1% Tax Deducted at Source (TDS) applies to every crypto transaction above ₹10,000, whether you’re buying, selling, or swapping coins. These are among the highest crypto tax rates in the world.

Does the Supreme Court ruling apply to DeFi and NFTs?

The 2020 Supreme Court ruling only addressed the RBI’s banking ban on cryptocurrency exchanges. It did not clarify the legal status of DeFi protocols, NFT trading, or cross-border crypto transfers. These activities are not banned, but there are no official guidelines on how to report them for tax or legal purposes. Traders are operating in a gray area.

Why hasn’t the Indian government passed a crypto law yet?

The government introduced the Cryptocurrency and Regulation of Official Digital Currency Bill in 2021, which proposed banning private cryptocurrencies and launching a central bank digital currency (CBDC). But the bill has been delayed for over four years. The Supreme Court has repeatedly criticized this inaction, calling it a “blind eye” to regulatory needs. Political uncertainty and conflicting interests within the government are the main reasons for the delay.

Can Indian banks still refuse to work with crypto exchanges?

No, not legally. After the Supreme Court’s 2020 ruling, banks can no longer refuse services to crypto businesses solely because they deal in digital assets. However, some banks still impose unofficial restrictions by closing accounts under vague reasons like “high-risk activity.” This creates friction, but it’s not a legal ban - it’s a workaround that’s being challenged in courts.

Is the Supreme Court pro-crypto or anti-crypto?

The Supreme Court is neither pro- nor anti-crypto. It’s pro-rule-of-law. The court blocked the RBI’s ban because it was disproportionate and lacked legal authority. It has consistently said that crypto is not illegal, but it also recognizes risks like fraud and money laundering. The court’s message is clear: regulate properly, don’t ban blindly.

DeeDee Kallam

November 2, 2025 AT 12:29Helen Hardman

November 2, 2025 AT 20:43Nadiya Edwards

November 3, 2025 AT 13:19Ron Cassel

November 3, 2025 AT 14:34Malinda Black

November 5, 2025 AT 01:22ISAH Isah

November 5, 2025 AT 23:11Chris Strife

November 6, 2025 AT 08:17Mehak Sharma

November 8, 2025 AT 03:13bob marley

November 8, 2025 AT 14:21Jeremy Jaramillo

November 10, 2025 AT 00:41Sammy Krigs

November 11, 2025 AT 16:09naveen kumar

November 13, 2025 AT 04:47Bruce Bynum

November 14, 2025 AT 01:18Wesley Grimm

November 14, 2025 AT 07:38Masechaba Setona

November 14, 2025 AT 21:12Kymberley Sant

November 15, 2025 AT 17:56Edgerton Trowbridge

November 17, 2025 AT 07:56