Use Cases for Flash Loans in DeFi: Arbitrage, Liquidations, and More

Flash Loan Profit Calculator

Calculate your potential profit after fees when executing flash loan arbitrage. Based on real-world data from the article.

Profit = (Price Difference × Loan Amount) - Protocol Fee - Gas Fee

Estimated Profit:

$0.00

Gas fee may vary during network congestion

Important Notes:

- Real-world gas fees can fluctuate significantly - check current Ethereum gas prices

- Profitability decreases with higher gas costs (e.g., $50 gas fee reduces $2,500 profit to $2,450)

- Article shows successful trades require at least $1,000 profit after fees

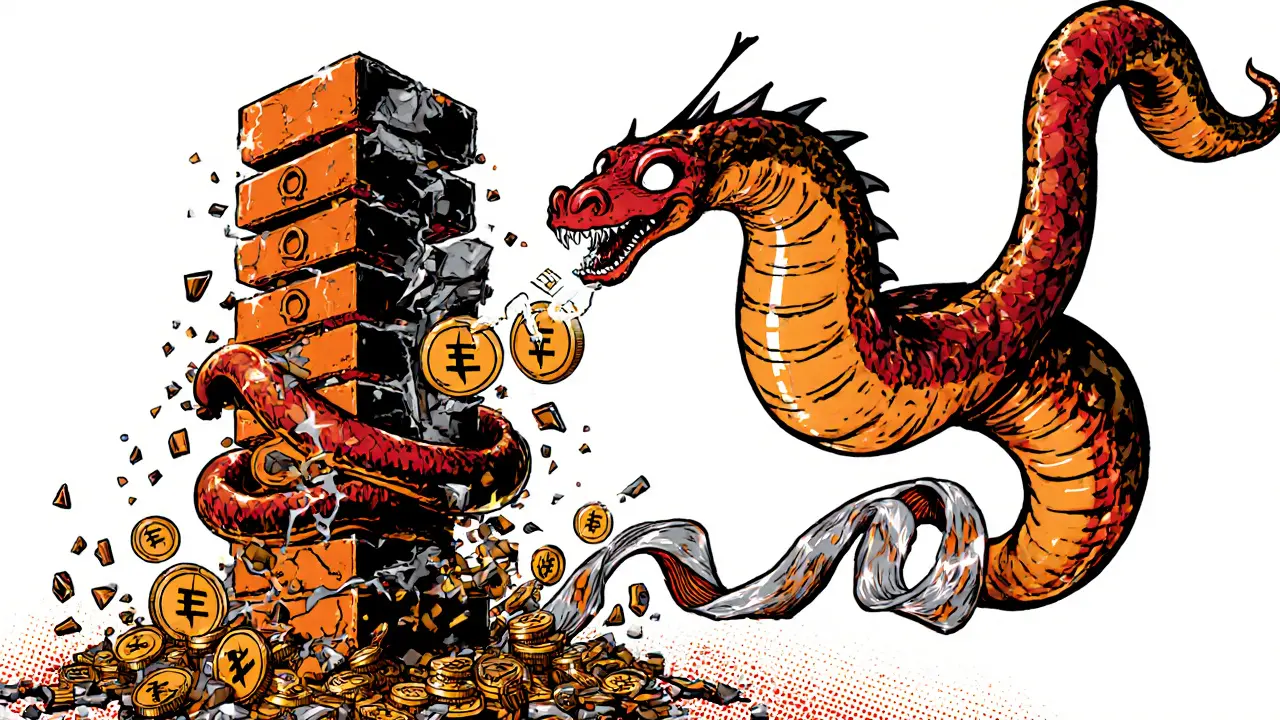

Flash loans don’t need collateral. They don’t require credit checks. And they’re gone in seconds. That’s not magic-it’s blockchain. Introduced by Aave in early 2020, flash loans let you borrow millions of dollars in a single transaction, as long as you pay it back before the block closes. If you fail? The whole thing vanishes-like it never happened. No debt. No penalties. Just a failed transaction.

This isn’t theoretical. Over $18.7 billion in flash loans have been processed since 2020, with Aave handling nearly two-thirds of all volume. Most of these aren’t scams. They’re smart, high-speed financial moves only possible on blockchain. Here’s how real users are using them today.

Arbitrage: Buying Low, Selling High-In One Transaction

Price differences between exchanges happen all the time. On Uniswap, ETH might trade at $3,200. On SushiSwap, it’s $3,215. In traditional markets, you’d need to buy on one, wait for settlement, then sell on the other. That takes hours. And you’d need thousands in capital upfront.

With a flash loan, you borrow $500,000 in DAI. You swap it for ETH on Uniswap at $3,200. Then you immediately sell that ETH on SushiSwap for $3,215. You repay the loan plus 0.09% fee (about $450). You pocket $2,500. All in under 15 seconds. No personal money risked. No waiting.

Professional traders like Alex Svanevik have executed over 140 of these in Q1 2024, netting $187,000 in profit-zero personal capital involved. These aren’t rare. They happen dozens of times daily across Ethereum, Polygon, and Avalanche. The market stays efficient because of them.

Liquidations: Saving DeFi from Collateral Crashes

DeFi lending platforms like Aave and Compound let users borrow crypto by locking up collateral. If the value of that collateral drops too far, the loan becomes undercollateralized. It needs to be liquidated.

Here’s where flash loans shine. Imagine someone borrowed 100 ETH against 200 ETH worth of collateral. The price of ETH crashes 30%. Their loan is now unsafe. A liquidator steps in: they borrow 100 ETH via flash loan, use it to repay the undercollateralized loan, claim the 200 ETH collateral as a reward (minus a 5% fee), and sell the 200 ETH to repay the flash loan.

The liquidator walks away with 95 ETH profit. The borrower’s position is saved from total loss. The protocol stays solvent. And the whole thing happens in one transaction-no upfront cash needed. Aave’s data shows 26.1% of all flash loans are used for liquidations. That’s not a bug. It’s a feature.

Collateral Swaps: Moving Assets Without Selling

What if you want to switch collateral? Say you borrowed using WBTC but now want to use ETH instead. Normally, you’d sell WBTC, wait for settlement, then deposit ETH. That takes time and fees.

With a flash loan, you borrow 100 DAI. You sell your WBTC for ETH on Uniswap. You deposit the ETH as new collateral. You repay the DAI. Done. No need to sell your WBTC outright. No exposure to price swings during settlement. You just swapped your collateral type in seconds.

This is especially useful during volatile markets. You can protect your position without triggering capital gains or locking in losses. It’s like swapping your house’s mortgage from one bank to another-except you never actually sell the house.

Self-Liquidation: Avoiding Total Loss

Some users use flash loans to save themselves. If your collateral is about to be liquidated and you can’t add more funds, you can use a flash loan to repay part of your loan. Borrow 50 ETH via flash loan. Use it to pay down your debt. Your loan is no longer undercollateralized. The liquidation is canceled. You repay the flash loan. You keep your position.

This isn’t cheating. It’s risk management. Users who do this are often already underwater but have the means to recover if given a temporary boost. Flash loans give them that window. Aave’s internal logs show this use case accounts for about 6% of all flash loan activity.

Exchange Listing Arbitrage: Getting Ahead of the Curve

When a new token launches on a decentralized exchange, prices can be wildly off for hours. Say a new meme coin, $DOGE2, lists on Uniswap at $0.0001. But on a smaller DEX like Balancer, it’s $0.00015. The difference is small-but with volume, it adds up.

A trader borrows 1 million DAI via flash loan. Buys $DOGE2 on Uniswap. Sells it on Balancer. Repays the loan. Makes $5,000 profit. All before the price normalizes. This happens dozens of times a week during new token launches. It keeps prices fair across platforms.

These trades are so fast, centralized exchanges can’t compete. By the time their order books update, the arbitrage is already done. Flash loans are the reason decentralized markets stay accurate.

What Flash Loans Can’t Do

Flash loans aren’t magic bullets. They can’t be used for long-term investing. You can’t hold ETH for a month and repay later. The loan must be repaid in the same transaction. If you’re not a developer, you can’t even start.

Gas fees can kill profitability. One trader in Raleigh lost $1,200 in gas during 12 failed attempts before learning to optimize his contract. During Ethereum congestion, gas spikes to 150 gwei-and a $50,000 arbitrage can turn into a $63 profit after fees.

Security is another hurdle. The Harvest Finance exploit in 2020 lost $30 million because of a reentrancy bug. Flash loans amplify that risk. If your smart contract has a flaw, attackers can drain your funds. That’s why 78% of professional users test on Goerli or Sepolia first. And why most successful operators use Tenderly to simulate transactions before going live.

Who’s Using Flash Loans-and Why

Most users are developers or professional traders. Only 3.2% of volume comes from known institutional wallets. But that’s changing. Goldman Sachs filed a patent in February 2024 for a flash loan risk management system. The EU’s MiCA regulations now classify flash loans as crypto-asset services. The SEC settled a $2.1 million case against a flash loan arbitrage platform in early 2024.

Legitimate use cases dominate: 78% of flash loans are for arbitrage or liquidations, according to Aave’s 2023 report. Malicious use-like price manipulation or money laundering-makes up about 22%. That’s still too high, but it’s dropping as protocols add filters. Aave’s version 3.1 lets projects whitelist approved contracts. Uniswap’s upcoming v4 will cut gas costs by 15-20%.

Flash loans aren’t going away. They’re becoming more efficient. More regulated. More integrated. The future isn’t about banning them-it’s about making them safer.

Getting Started (If You’re Ready)

If you’re a developer, start here:

- Learn Solidity. Flash loans require writing smart contracts.

- Use Aave’s

IFlashLoanReceiverinterface. - Deploy on a testnet first. Don’t risk real money.

- Use Tenderly to simulate transactions.

- Monitor gas prices. Wait for low congestion.

- Test with small amounts. $1,000, not $100,000.

Most people spend 3-6 months learning before their first successful flash loan. Reddit user u/DeFiArbMaster spent three months studying before netting $8,350 on a $250,000 loan. Don’t rush it. The cost of failure is high.

Can anyone use flash loans, or do you need to be a developer?

You need to be a developer. Flash loans require writing and deploying a smart contract that interacts directly with DeFi protocols like Aave or Uniswap. There are no user-friendly apps that let you click a button to take a flash loan. You need to understand Solidity, transaction structure, and DeFi mechanics.

Are flash loans legal?

Flash loans themselves aren’t illegal, but how they’re used can be. The EU’s MiCA regulations classify them as crypto-asset services, requiring licensing. The U.S. SEC has taken action against platforms using flash loans for market manipulation. Using them for arbitrage or liquidations is generally accepted. Using them to pump-and-dump or launder money is not.

How much do flash loans cost?

There’s a fee, usually 0.09% on Aave and 0.3% on Balancer. But the bigger cost is gas. On Ethereum, a typical flash loan costs 0.005-0.015 ETH ($10-$30 at current prices). During congestion, gas can spike to $50 or more. Many profitable trades become unprofitable when gas rises.

What happens if I can’t repay the flash loan?

The entire transaction is reverted. It’s as if it never happened. Your wallet isn’t charged. No debt is created. But you lose the gas you paid to initiate the transaction. That’s the only cost of failure.

Can flash loans be used for long-term borrowing?

No. Flash loans must be repaid within the same blockchain transaction-usually within 12-15 seconds. They’re designed for instant, atomic operations, not holding positions. For long-term borrowing, use collateralized loans from Aave, Compound, or MakerDAO.

Which blockchains support flash loans?

Flash loans are supported on Ethereum, Polygon, Avalanche, BSC, and Arbitrum. Ethereum still leads in volume, but Layer 2s like Polygon and Arbitrum are growing fast due to lower gas fees. Aave and Uniswap are the most popular protocols offering them.

Are flash loans risky for the DeFi ecosystem?

They can be. Flash loan attacks were responsible for 34% of all DeFi losses in 2023, totaling $247 million. But they also make markets more efficient. Most flash loans (78%) are used for legitimate arbitrage and liquidations. Protocols are responding with filters, whitelists, and improved security standards. The net effect is still positive when safeguards are in place.

Brett Benton

November 2, 2025 AT 02:38Flash loans are wild but honestly they’re just high-speed arbitrage with extra steps. I’ve seen guys make $5k in 10 seconds then lose it all on gas 3 days later. The real win is learning how to read the chain like a book.

Mehak Sharma

November 2, 2025 AT 07:22What fascinates me most is how flash loans turn liquidity into a living organism-breathing price gaps, digesting inefficiencies, and excreting profit without ever needing a bank account. It’s finance as a self-correcting ecosystem. No middlemen. No bureaucracy. Just code executing truth.

This isn’t gambling. It’s algorithmic justice.

When you think about it, every market inefficiency is a silent scream for balance. Flash loans are the ears of the system.

And yes, gas fees hurt-but that’s the price of decentralization. We’re not just trading tokens. We’re rewriting how value moves.

I’ve watched new devs burn $2000 trying to arbitrage on Ethereum Mainnet. Then they switch to Polygon. Suddenly, they’re profitable. The lesson? Speed isn’t everything. Cost efficiency is king.

Also, the fact that 78% of use cases are legitimate? That’s a quiet revolution. People think DeFi is all rug pulls and pump-and-dumps. But this? This is the quiet backbone.

And liquidations? That’s the unsung hero. Without flash loans, undercollateralized positions would collapse like dominoes. Flash loans don’t just make money-they save systems.

Don’t romanticize it. Don’t fear it. Understand it.

The future isn’t about banning flash loans. It’s about building better contracts.

Ron Cassel

November 3, 2025 AT 10:14SEC settled a case? That’s not regulation-that’s control. They’re scared because flash loans can’t be taxed. Can’t be tracked. Can’t be stopped. This is the real crypto revolution and they know it.

They’ll label it ‘market manipulation’ until they can’t. Then they’ll try to license it. Like they licensed the internet.

Wait till they try to force KYC on flash loan contracts. That’s when the real war starts.

bob marley

November 4, 2025 AT 20:06Oh wow. So the guy who lost $1200 on gas is now a ‘professional trader’? Congrats. You just paid $1200 to learn that you’re bad at math.

And you call this ‘smart finance’? It’s just gambling with a blockchain tattoo.

Jeremy Jaramillo

November 4, 2025 AT 21:18Actually, that guy who lost $1200? He’s the reason we have better tools now. He shared his failures. Others learned. That’s how innovation happens-not by avoiding failure, but by documenting it.

And yes, gas is brutal. But Layer 2s are cutting that cost in half. This isn’t the endgame. It’s the training wheels.

Flash loans aren’t for everyone. But they’re not just for devs either. They’re for anyone who believes in open finance. Even if you’re just watching, you’re part of the experiment.

Phil Higgins

November 6, 2025 AT 04:22There’s a quiet elegance here. Flash loans don’t create debt-they correct imbalance. They’re not borrowing money. They’re borrowing opportunity.

Think of them as temporary bridges over market gaps. No one owns the bridge. No one owns the gap. But for 15 seconds, someone makes it useful.

The real genius isn’t the code. It’s the fact that no central authority needed to approve it. No bank. No regulator. Just math and consensus.

That’s why they’ll survive. Not because they’re profitable. But because they’re inevitable.

ISAH Isah

November 6, 2025 AT 07:41Flash loans are a scam disguised as innovation

They are used by western elites to manipulate emerging markets

Africa has no access to these tools

And you call this decentralization

It is colonialism with smart contracts

Sammy Krigs

November 6, 2025 AT 18:38lol i tried a flash loan once and my wallet got hacked becuase i copy pasted a contract from some guy on twitter

now i just use aave app

its not that hard

Josh Serum

November 7, 2025 AT 06:37People who use flash loans for arbitrage are just digital day traders with fancy tools. They’re not innovators. They’re glorified scalpers.

And don’t act like this is ‘financial inclusion.’ Most of these traders are in the U.S. and Europe. The rest of the world is watching from the sidelines.

Real innovation is building tools for grandma to send money to her grandkids without fees. Not buying ETH on Uniswap and selling it on SushiSwap.

Vicki Fletcher

November 8, 2025 AT 07:11Wait-so if you fail to repay, you just lose gas? No debt? No penalties? That’s… actually kind of beautiful. It’s like the blockchain has a conscience. It doesn’t punish failure. It just says, ‘Try again.’

That’s more humane than any bank I’ve ever dealt with.

I’ve been in debt my whole life. This is the first time I’ve seen a system that doesn’t shame you for trying.

alvin Bachtiar

November 8, 2025 AT 10:45Let’s be real: 22% malicious use is a disaster waiting to explode. The Harvest exploit? That was a flash loan. The $247M in 2023 losses? Flash loans. And now you’re saying ‘it’s dropping’?

It’s dropping because the bad actors are getting smarter. Not because the protocols are safer.

They’re not ‘filtering’-they’re whitelisting. That’s centralization by another name.

And don’t tell me ‘it’s still 78% legit.’ When one bad actor can drain $30M, the whole system is at risk.

This isn’t finance. It’s a casino with open-source rules.

Elizabeth Melendez

November 9, 2025 AT 11:11I just want to say how much I admire the people who are building this. Not just the coders-but the ones who write the docs, who answer questions on Reddit, who make tutorials for beginners. I’m a nurse, I don’t code, but I’ve watched this space grow for 5 years and it’s the most inspiring thing I’ve ever seen.

Flash loans? Yeah, they’re complex. But the fact that someone in Lagos can learn how to use them from a blog post written in English? That’s power.

And yes, gas is expensive. And yes, people lose money. But every time someone tries and fails? They learn. And then they teach someone else.

This isn’t about making millions. It’s about building a world where money isn’t controlled by a few.

I don’t use flash loans. But I root for everyone who does.

David Roberts

November 11, 2025 AT 02:16Flash loans are a textbook example of over-engineered efficiency. You’re paying 15 gwei to save 0.09% fee? That’s like buying a Ferrari to commute to work.

And the ‘liquidation’ narrative? It’s just a euphemism for front-running. You’re not saving the system. You’re exploiting its fragility.

Also, ‘Aave handles two-thirds’? So what? Centralized control disguised as decentralization.

DeFi is a house of cards. Flash loans are just the wind.

Bhavna Suri

November 12, 2025 AT 01:43Too much jargon. Too many numbers. Who even cares?

It’s just crypto magic. It’ll crash.

Nadiya Edwards

November 13, 2025 AT 20:57They say flash loans are ‘not magic’-but they’re exactly that. They’re the magic trick Wall Street doesn’t want you to see. The moment they understand it, they’ll ban it. They already are.

Why do you think the SEC settled? Because they’re scared. Not because they care about fairness. Because they know they can’t control it.

And now they’re calling it a ‘crypto-asset service.’ That’s not regulation. That’s theft by bureaucracy.

Flash loans are the last free thing in finance. And they’re coming for it.

Malinda Black

November 15, 2025 AT 05:03I just want to say thank you to the people who wrote this. Not just the author-but the devs who built the contracts, the testers who ran simulations, the educators who made it understandable.

This isn’t just tech. It’s hope.

Even if I never use a flash loan, knowing it exists makes me feel less alone in this world.

Chris Strife

November 15, 2025 AT 05:49Flash loans? America built the internet. We built DeFi. You think Nigeria or India are inventing this? Wake up. This is Western innovation. Stop pretending it’s global.

Stop romanticizing code. This is capital. Capitalism with blockchain branding.

Monty Tran

November 17, 2025 AT 02:13They’re calling this ‘financial inclusion’? Please. The only people using this are rich devs with $10k gas budgets. The rest of us are just watching the show.

And don’t even get me started on the ‘self-liquidation’ hype. That’s just borrowing money to pay off debt. That’s not innovation. That’s desperation with a whitepaper.

This isn’t the future. It’s the same old game. Just with more gas fees.

Ron Cassel

November 17, 2025 AT 14:23And now they’re patenting it. Goldman Sachs. Of course. They don’t want to stop flash loans. They want to own them.

Next thing you know, you’ll need a license to take a flash loan.

They’ll call it ‘compliance.’

We call it death.